Behind the Rise of Mass Timber Towers

With a flurry of high-profile projects, this building material is gaining traction.

Before concrete and steel’s arrival 150 years ago, wood represented the leading building staple. Today, with the advent of ultra-strong, safe mass timber, what’s past is prologue. The era of the ever-taller timber commercial building has arrived.

Mass timber’s acceptance is being propelled by multiple factors, with sustainability and decarbonization of the built environment among the most prominent. Many developers, owners and tenants are determined to cast their lot with sustainable structures.

“Many have climate commitments and climate pledges driving their sustainability interests,” Lauren Wingo, project lead on Washington, D.C.’s 80 M, designed by global sustainable development consultancy Arup, told Commercial Property Executive. At 10 stories, 80 M is the tallest mass timber office building developed to date in the U.S., she said.

READ ALSO: Will CRE Construction Hold Steady in 2023?

Quicker, safer construction projects are another upside, said Cody Armbrister, head of development, office, with real estate development and investment firm Crow Holdings. Components are prefabricated offsite. “There are fewer people onsite, so you’re able to move faster, move safer. That speed is a critical advantage of mass timber,” he said.

An improved user experience for tenants is still another positive, Armbrister said. Use of natural materials in biophilic design has been shown to hike productivity, reduce stress and absenteeism and promote healthier environments. This goes along with a flight to quality in post-COVID office space. Office tenants may now be leasing less space, but seeking more distinctive and attractive space, Wingo said.

Alan Kennedy, managing director of Hines, which created its proprietary mass timber product T3 more than a decade ago, agreed wood creates distinctive environments.

“Wood is a natural material, and it evokes a different emotion in people when they tour the building,” he commented. “Most visitors immediately walk to one of the mass timber columns to touch it. There is a scent and a quietness that embraces you in a mass timber building. People’s reactions to timber are very powerful.”

Vaulting hurdles

The 2021 International Building Code (IBC) permits up to 18-story timber buildings. But not every city is on board. “Depending on the municipality, you may get one that understands what mass timber is, or one operating on a 2015 IBC,” Armbrister said.

One municipality that appears onboard is the District of Columbia. Arup regarded D.C. as one of its project partners in developing 80 M, Wingo said. The district was engaged during the design process, and worked alongside Arup to address safety concerns.

READ ALSO: What’s Ahead for the Office Sector in 2023

While some municipalities remain concerned about fire, “there are no challenges from a fire standpoint,” Armbrister said. “It’s more fire-retardant than traditional steel. Fire is given fuel by the timber. But when the timber’s laminated, the outer layer snuffs out fire’s ability to continue. Steel just continues to burn until it returns to its original state.”

The grid layout of floorplates may be seen as a mass timber design challenge, Wingo said. A roughly 30-by-30-foot column grid is common in commercial offices. In mass timber buildings, columns are more closely spaced, at roughly 20 by 30. “That is harder to work with for tenants,” she said. “It changes how you lay out the space.”

Timber may also be saddled with costlier insurance premiums, Armbrister said. Because mass timber structures are limited in number, insurers don’t have a body of evidence to cite in determining how buildings perform over a 10- or 15-year period. “There’s some reticence on the part of insurance carriers,” he said. “With perceived risk can come inherent additional insurance premium costs.”

Availability of product may represent one more concern, said Danny Harrington, director of innovation for development consultant Project Management Advisors.

Mass timber has been used in Europe and Australia since the 1980s. “But there’s not a lot of production in the U.S.,” he said. “Where it’s been successful, there’s been cooperation between the development, construction and forestry industries.”

Design trends

Within T3 buildings, including seven-story T3 Minneapolis, the first major multistory U.S. office building built of wood in a century, Hines uses the timber structure as the finish. “Tenants do not feel the need to change the base condition,” Kennedy said. “A concrete building can be that way, but timber has a warmer feel and a different comfort level than concrete, which tends to feel sterile and cold. With tenants, just complementing the space with their own furniture, the condition requires less modification—and wasted materials going to a landfill—for the next tenant.”

In the case of high-rises, defined as higher than 85 feet, architects and developers are trying to find ways to use more contemporary skin, rather than a punched, masonry-like expression, Armbrister said. “Architects must ask, ‘Where do we accentuate the timber, and where do we wrap it in non-combustible material like sheetrock?’” he added.

“It has to do with the ability of municipalities to fight fire at higher heights.”

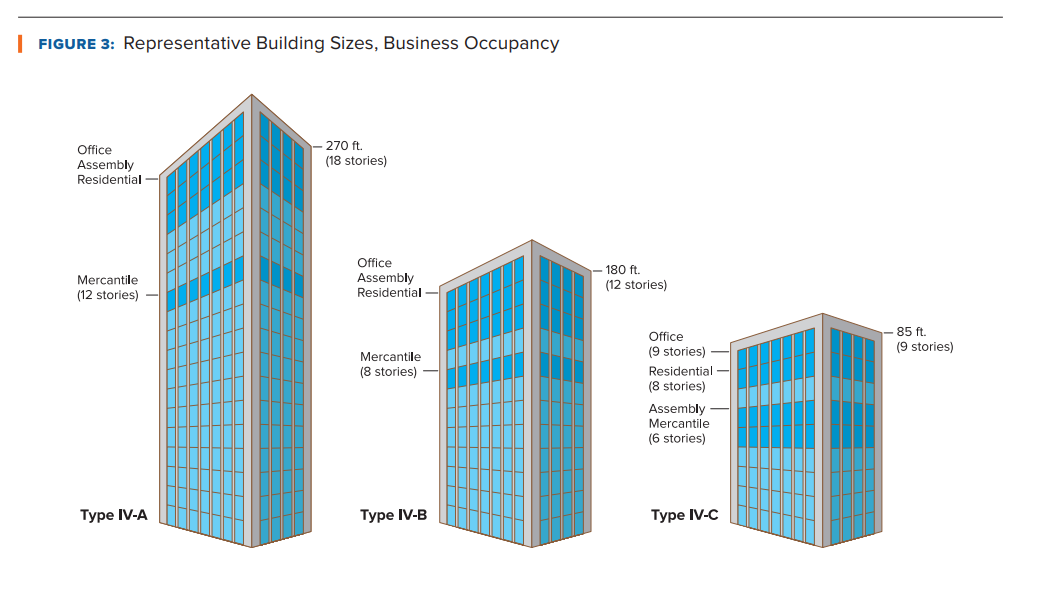

There are several exceptions to the 2021 IBC, Kennedy said. While Type IV-A calls for all mass timber elements fully encapsulated, and up to 18 stories, Type IV-B calls for protected exterior, partially exposed interior mass timber elements, and up to 12 stories. Type IV-C calls for protected exterior, exposed mass timber interior, and up to 9 stories. Some jurisdictions may impose not just height limits but restrictions like requiring percentages of the timber to be encapsulated, not exposed.

What’s ahead? Recognizing the urgency associated with the 39 percent of global CO2 emissions derived from developing and operating buildings, Hines is considering incorporating its T3 platform in industrial and residential platforms as well as office projects. Wingo envisions a future delivering more competitive markets for mass timber, reducing the material’s current cost premium.

“It’s a construction type here to stay,” Armbrister concluded. “Headwinds and challenges associated with a perceived new product type will dissipate. You’ll see mass timber in more buildings of all asset classes. The modularization of these buildings, and the idea so much of them can be built off-site, really has people excited.”

You must be logged in to post a comment.