Where to Find 2021’s Best Markets for CRE Development: CBRE

With an upswing in construction expected this year, the most promising metros show a definite geographic trend, according to the firm's latest report.

Atlanta skyline. Image by 12019 via Pixabay.com

Eight of the Top 10 markets for commercial real estate development opportunities in the U.S. this year are located in the Sun Belt, with Texas placing three metros on the list identified by CBRE.

READ ALSO: Alternative CRE Types to Attract More Funding: Nuveen

With construction activity expected to pick up this year after a pandemic-induced slowdown in 2020, CBRE created the Development Opportunity Index, which assesses the Top 50 markets in the U.S. based on development conditions, including property performance in the major commercial real estate sectors, construction costs, strength of supply, prior performance and forecast performance.

James Millon, a vice chairman in CBRE’s Debt & Structured Finance practice, said in prepared remarks that Southern states continue to rate well for development and construction costs as they tend to have the job growth, in-migration and cost advantages that drive high volumes of construction. However, Millon added, investors looking for development opportunities can find them in every market in the 101-page report that includes information and sector rankings for each of the 50 markets.

The Top 10 overall markets in CBRE’s inaugural Development Opportunity Index are: 1) Atlanta with a score of 83.81; 2) Dallas, 83.04; 3) Phoenix, 82.94; 4) Orlando, Fla., 82.06; 5) Seattle, 81.11; 6) Denver, 81.08; 7) Raleigh, N.C., 80.88; 8) Houston, 80.74; 9) Austin, Texas, 80.61; and 10) Charlotte, N.C., 79.49.

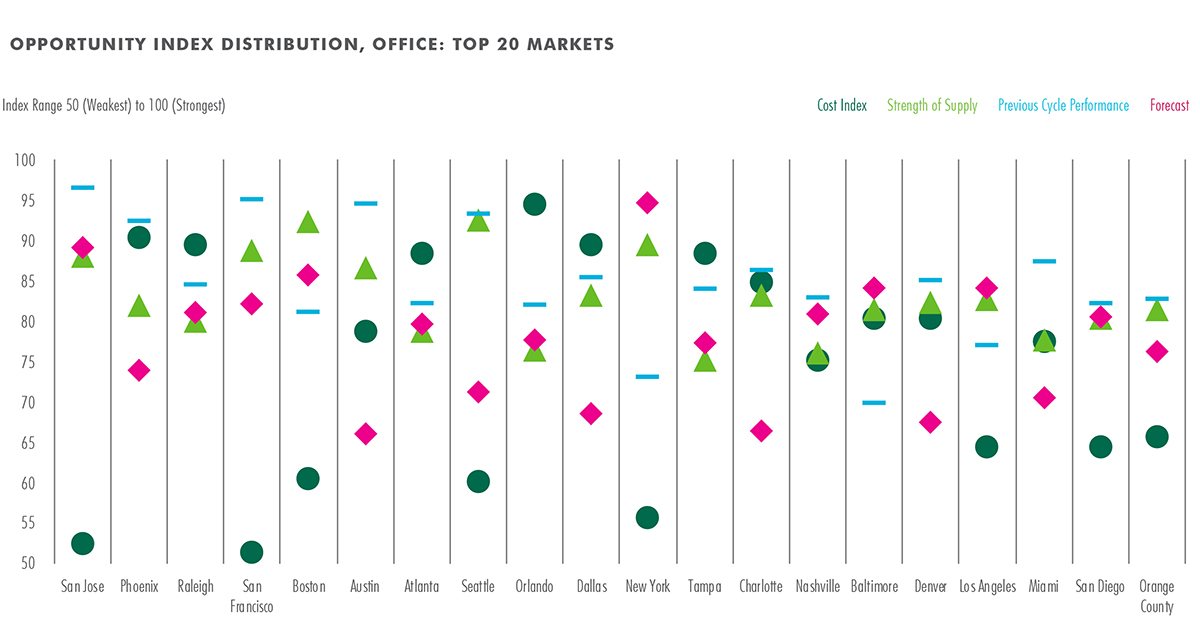

CBRE notes that an overall Top 10 ranking doesn’t necessarily mean certain markets are among the best for every sector. San Jose, Calif.,—which didn’t make the Top 10 overall list—is listed as the best market for office construction due to strong supply growth and supply absorption.

Phoenix places second on the office construction list due to its shrinking vacancy and strong absorption, while Raleigh, N.C. is third, partly because of its highly educated labor force.

San Francisco, which placed 22 on the overall Development Opportunity Index, was listed as the fourth-best market for office development opportunities because of its strong rent growth.

Opportunity Index Distribution, Office: Top 20 Markets. Chart courtesy of CBRE

Atlanta, the top overall pick for construction and development opportunities, also ranked first on the industrial and logistics list due to its balance of strong inventory growth and net absorption. Placing second on the industrial development opportunities list was Dallas, because of its relatively low costs and strong population growth, followed by Phoenix due to its affordable land and labor.

Lowest-Cost Markets

CBRE notes average costs, which have more than doubled over 20 years, are expected to remain volatile in the near term and eventually rise. The pandemic impacted development schedules and supplies, lengthening timelines and inflating costs. The index factors in demand and forecast development activity evenly. It also includes three main variables—average cost of land, current overall development costs and change in costs since 2016.

Orlando and San Antonio, tied at the top of the Cost Index Rankings, followed by Memphis, Tenn.; Kansas City, Mo.; and Jacksonville, Fla., in the Top 5 lowest-cost markets. Phoenix; Dallas; Raleigh, N.C.; Tucson, Ariz., and Atlanta filled out the list. CBRE cited Orlando’s land costs and its labor and materials costs to put it at number one. San Antonio has low land prices, as well as low materials and labor costs, and may provide greater pricing certainty, according to the report. CBRE notes Memphis and Kansas City have both seen increased demand for industrial and distribution space.

Other takeaways

- Office tenants are generally renewing leases rather than signing new ones, resulting in less demand for tenant fit-outs.

- New properties will be enhancing amenities, particularly relating to health and wellness, due to fallout from the pandemic, with focus on water and air quality, natural light and nonhazardous building materials. Enhanced air ventilation systems and touchless technology will be featured throughout interiors.

- Flexible office options will be part of occupiers’ long-term strategies as 86 percent of respondents to CBRE’s Global Occupier Sentiment Survey said they will be using flexible office space strategies. Some may be exploring satellite strategies and others like the idea of not being locked into a long-term lease if their space needs change.

- The importance of a physical office remains important, particularly for attracting talent and establishing and maintaining company branding.

Read the full report by CBRE.

You must be logged in to post a comment.