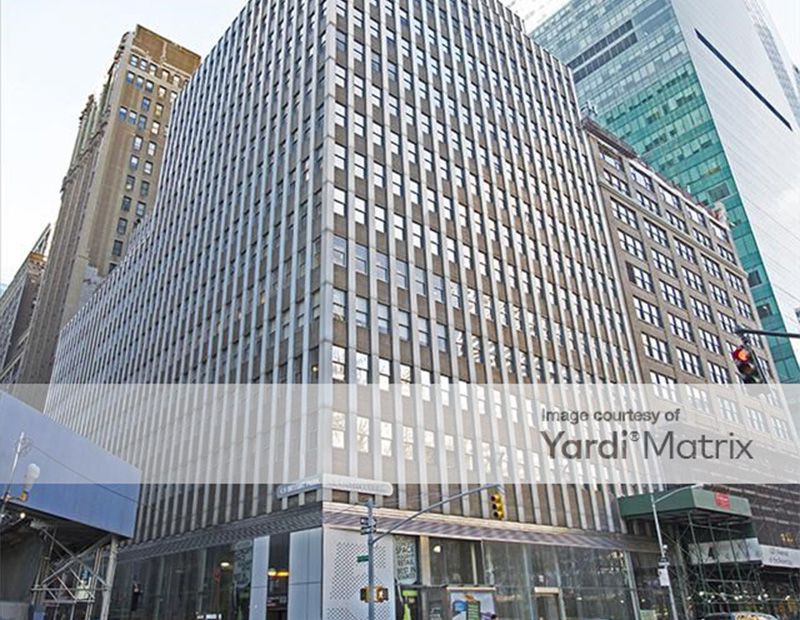

Blackstone Sells NYC Office Tower for $640M

The company found a buyer for the 683,000-square-foot 5 Bryant Park in Midtown Manhattan with the assistance of JLL and HFF. JLL also arranged $463 million in acquisition financing.

By Barbra Murray

Savanna is the new owner of 5 Bryant Park, a 683,000-square-foot office property in Midtown Manhattan. The real estate investment manager purchased the Class A tower from Blackstone in a $640 million deal.

Located at 1065 Ave. of the Americas (also known as 1065 Sixth Ave.), 5 Bryant Park last changed hands for $180 million in 2006 as part of a larger portfolio snapped up by Blackstone, which relied on commercial real estate services firms JLL and HFF to market the 34-story building and reel in a buyer. JLL worked on both sides of the table, arranging a $463 million acquisition loan on Savanna’s behalf. A bevy of lenders of different types were quite keen on the opportunity. Laurie Grasso of Hunton Andrews Kurth represented Savanna as legal counsel in the transaction.

“Ultimately, we secured a loan that enables Savanna to unlock the full value of the asset through extremely aggressive pricing, term, structure and prepayment flexibility,” Aaron Niedermayer, executive vice president with JLL, said in a prepared statement.

5 Bryant Park, which also features 38,300 square feet of retail space, first opened its doors in 1958 and underwent a $107 million renovation in 2007, followed by additional upgrades in 2015. Today, the tenant roster is approximately 97 percent accounted for by leases to a diverse set of business types. And it’s the tenancy that proved quite attractive to Savanna. “With in-place rents well below market, Savanna is poised to create significant value at 5 Bryant Park by rolling expiring leases to market,” Niedermayer added.

Savanna is accustomed to finding ways to add value to Manhattan office buildings. In 2017, the company paid $195 million to acquire the 304,000-square-foot property at 19 W. 44th St., and immediately announced plans to invest $25 million on repositioning.

In good company

Savanna’s purchase of 5 Bryant Park marks one of the top five largest single-asset commercial real estate deals completed in the first quarter of 2018, according to Preqin, data and intelligence provider for the alternative assets industry. Two other U.S. properties made the list: the mixed-use development at 701 Seventh Ave. in Times Square, acquired by Fortress Investment Group and Maefield Development for $1.5 billion; and the 776-key Grand Wailea hotel resort on Maui in Wailea, Hawaii, which is being purchased by Blackstone for $1.1 billion.

Image courtesy of Yardi Matrix

You must be logged in to post a comment.