Bracing for More Job Losses, Looking Toward Better Days

The unemployment rate is expected to reach 20 percent as layoffs appear to be slowing and experts predict industry-wide change on the road to recovery.

Economists and commercial real estate experts are expecting mixed news on Friday, when the Department of Labor will release preliminary jobs figures for May. Most observers expect the U.S. unemployment rate to hit at least 20 percent, up significantly from the April rate of 14.7 percent and the highest since the Great Depression, when unemployment reached 25 percent. At the same time, the pace of job losses finally appears to be slowing.

READ ALSO: Finding Durable Employment Sectors During a Pandemic

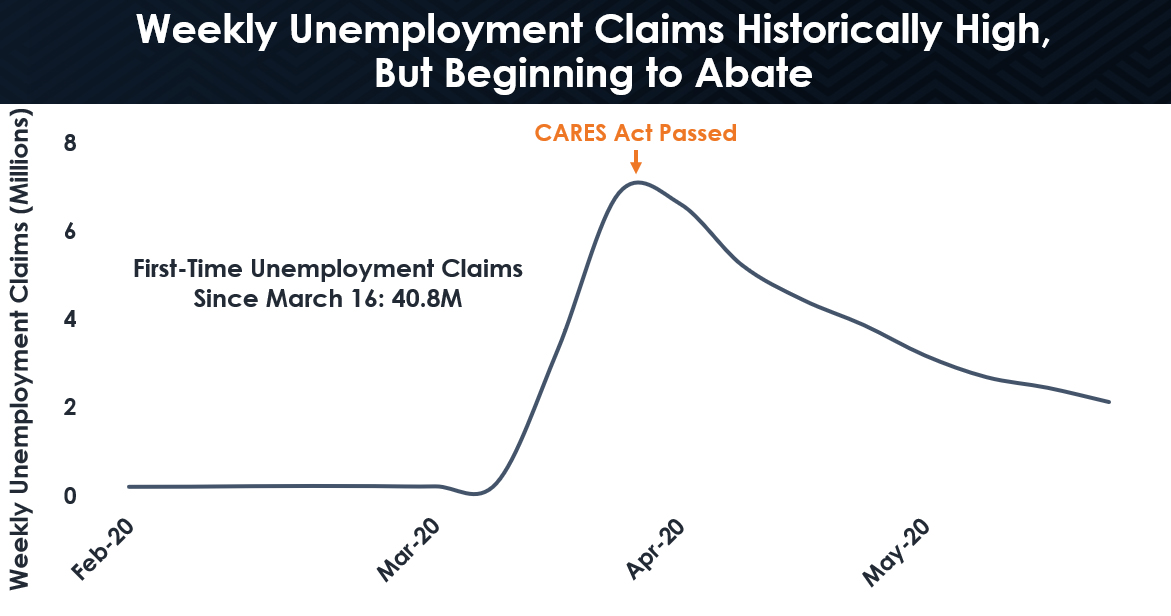

Nearly 41 million people have filed for unemployment benefits since the COVID-19 crisis hit the U.S. in mid-March, forcing most states to begin shutdowns. While there are some signs those numbers are starting to come down as more states begin reopening their economies, commercial real estate experts say it will be a slow climb back up, with some sectors and parts of the country doing better than others.

“I’d generally expect the downward trend to continue in both initial and continued claims,” Ryan Severino, JLL’s chief economist, told Commercial Property Executive.

John Chang, senior vice president & national director at Marcus & Millichap Research Services, agreed. “First-time unemployment claims have been easing steadily since the surge last March. With many states carefully navigating the reopening process, the pace of job losses should continue to abate, but they are still dramatically higher than at any point in the history of the country,” Chang said.

Private payroll numbers out Wednesday from ADP also pointed to a glimmer of hope that the worst was over on the jobs front. While ADP reported companies cut nearly 2.8 million jobs in May, it was much lower than the Wall Street predictions of 8.75 million, according to Mark Zandi, chief economist at Moody’s Analytics, which prepares the report with ADP. Zandi told CNBC he thinks that the “COVID-19 recession is over, barring a second wave, a major second wave, or real serious policy errors.” The bad news is that Zandi does expect tomorrow’s unemployment rate to top 20 percent and believes that economic recovery will be slow until a vaccine or widely accepted therapy is available.

Hugh Kelly, an economist and chair of the curriculum committee at Fordham University’s Real Estate Institute, was blunter. “The economy is in an induced coma. It’s going to be dead until we start to see the effects of the reopening that is occurring. It’s going to take 18 months to pick up the slack.”

Kelly said he does not think that’s a pessimistic view, because even before the pandemic, “the economy of the 2020s was going to be very much slower than the economy of the 2010s. We were ripe for a fall.” He expects more of a W-shaped recovery, similar to that of the early 1980s, rather than the V- or U-shaped recovery some predict.

CRE impacts

“The pandemic drove a ripple of job losses through the economy that started in the leisure and hospitality sector, but has since migrated through the retail businesses, the health-care sector and now into professional and business services,” Chang said. “With the exception of the hospitality sector, the short-term impact of the job losses on real estate have thus far been negligible, as leases on most properties are long-term.”

Severino noted that markets around the U.S. that have seen a less pronounced COVID-19 outbreak will open their economies faster and start growing again. “I’d expect a multi-speed recovery, which we are already seeing, with places that came through with the relatively minor outbreaks opening up sooner and places with more severe outbreaks taking longer,” he told CPE.

Marc Wieder and Robert Gilman, co-leaders of the real estate unit at Anchin, think the spike in unemployment has ended but that might be the only good news for awhile for commercial real estate.

“I think we’re going to be in a world that we’ve never seen before,” Wieder said, citing the office and retail sectors as two areas that will see major impacts.

Retail was struggling before the coronavirus hit, both noted, and now retailers will be cutting square footage drastically. People may avoid malls because of social distancing concerns and keep up the e-commerce shopping they relied on during the shutdown. Kelly said shopping centers that had turned to more experiential retail to replace vacant storefronts may regret that at least in the short-term. “Experience means being with people and that’s what you don’t want to do now,” Kelly said.

Wieder said some retail and restaurant tenants may shutter their doors for good in hopes of negotiating a better deal with their current landlords or getting cheaper rent at a new location.

Cities like New York, Boston and Chicago with high-rise towers that rely on mass transit to get workers to urban offices will likely face at least a temporary reduction in demand. Kelly said suburban markets and Sunbelt regions that low-rise office buildings where workers can drive rather than take mass transit will have a temporary advantage over CBDs.

Wieder and Gilman said office occupiers, who are seeing their employees work rather productively remotely, will reconsider their space needs as their leases expire. In the meantime, they may be looking to sublease space they are not using, as much of their staffs continue to work from home and only come into the office sporadically. “They’re creating their own WeWork, taking unused space and subleasing it out until their lease expires,” Wieder said.

Kelly said industrial, particularly any logistics properties, should be OK during and after the pandemic, but estimated hotels and industries that depend on discretionary travel are in for a bad patch for possibly five years. He also cited airlines and any economy that depends on high levels of transportation like Las Vegas, and major airport hubs like New York, Atlanta, Dallas, Los Angeles and San Francisco as facing a tough road back.

You must be logged in to post a comment.