Breaking the Cycle: Looking Ahead to Interest Rate Cuts

What will be the smart strategies after the Fed finally makes its move?

Despite stubbornly high inflation that remains above the Federal Reserve’s 2 percent target, interest rate cuts are on the horizon at last. The Fed’s Open Markets Committee left rates untouched at a range of 5.25 to 5.5 percent during its March meeting, and though the exact timing of the first rate cuts remains uncertain, Fed Chair Jerome Powell indicated at a March 20 press conference that the benchmark rate is expected to decline to 4.6 percent by the end of the year. For investors, rate cuts won’t come soon enough.

As Daniel Levitt, executive vice president of capital markets at Ryan Cos., put it, the key issue is “getting the uncertainty out of the system as much as it is the rates.” At the same time, other factors in the mix for investors are how supply, demand and secular trends will influence lenders’ willingness to provide capital as rates start declining.

“A lower rate environment will certainly help,” stated BentallGreenOak Managing Partner Steve Reents. “It will likely alleviate some of the immediate pressure on loan reserves, but the balance-sheet lenders we speak with indicate they will be more active when they start to receive payoffs of their existing loans.”

Capital quandaries

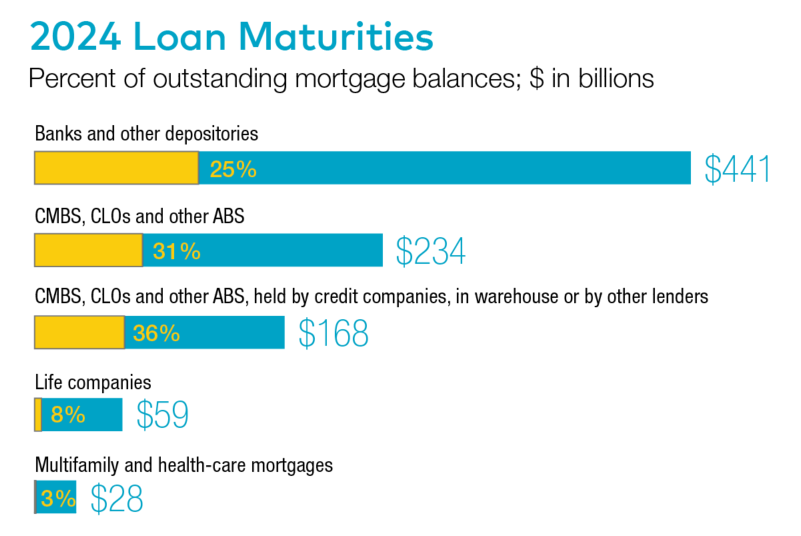

With interest rates likely to come down, how are lenders faring? Capital remains hard to come by, with the near-complete withdrawal of many traditional lenders and regional banks. Add the distress brought on by more than $929 billion in maturing loans this year and a considerable volume of assets under pressure, and investors face plenty of challenges, even as interest rates decline.

Nonetheless, lower rates will alleviate some of this stress, and drive up property values. “The bid-ask spread between buyers and sellers is going to narrow,” predicted Maria Stamolis, chief investment officer & head of investment management at Lincoln Property Co. “Sellers are going to be willing to transact and pay more, at levels that are less bad” than they expected, she added.

But in the near term, lower rates will have only limited impact. The 10-year Treasury rate, which was hovering around 4.2 percent by late March, remains at a years-long high—and that signals little short-term change in the debt markets.

With this scenario in mind, Canyon Partners Real Estate has shifted its focus to structuring with rescue capital, bridge and construction-focused lending, alongside opportunistic equity. “We view it as our job to facilitate liquidity to the market for good sponsorships for good real estate, particularly in times of dislocation like right now,” reported Frank Liu, a managing director at the firm.

The credit side is proving promising as well, with equity-like returns possible. “You can get higher spreads by lending at higher index rates, and you are ultimately driving returns similar to what you would get through investing in equity on as discounted basis,” recounted Peachtree Group CEO Gregory Friedman.

At the same time, for equity investors, select regional banks, life companies and other private lenders with access to large amounts of dry powder, a connecting thread is that these capital sources are prioritizing asset quality and predictability in a still-uncertain market.

For Franklin Street Managing Director Nathan Weyer, this will become more important as interest rates are cut. “We are getting things done, it just takes longer,” he said. “Our biggest concern is not looking at source term sheets and opportunities—our focus is picking the right groups that can execute.”

Short-term decisions, long-term investments

As lower rates approach, a near-universal sentiment is that the most attractive investments are in property types with strong short-term valuation, as well as supply-and-demand fundamentals with staying power through multiple cycles.

At AEW Capital Management, investment goals “shifted away from continued yield expansion driven by rising interest rates, (which is) now squarely on broader economic conditions, and its impact on property market fundamentals,” reported Michael Byrne, the firm’s chief investment officer & head of private equity and debt for North America.

The topline view of asset categories will remain largely unchanged by reduced capital costs that will follow interest rate cuts. Industrial, retail and data centers all boast robust supply and demand, and are experiencing positive situational, secular trends. On the flip side, high capital costs, poor liquidity, debt and distress driven by maturities will continue to make 2024 a tough year for office deals after last year’s overall 25 percent decrease in values.

Overperformers and underperformers

As the transition to lower rates approaches, the flight to quality typical of these transition periods will persist for the office sector. “We all expect the best office assets to perform quite well and to see solid, even expanding, tenant demand,” Byrne noted. But “for many reasons, (including) the capital intensity and lack of liquidity, it is a very challenging sector to invest in today.” The distress that’s likely to accompany $150 billion in office loan maturities will ratchet up pressure on owners, lenders and prospective investors.

Industrial is an entirely different story, and is likely to benefit further when cap rates increase. “While current supply is ahead of demand, we expect that to flip in the next year as new construction continues to face challenges in the financing market and starts continue to fall,” according to Michael Hyun, chief investment officer at Crow Holdings. CommercialEdge data shows industrial transactions totaled $2.6 billion this January, and the U.S. had roughly 425 million square feet of space under development, while average in-place rents of $7.74 per square foot marked a 7.6 percent increase year-over-year. This all takes place as the nation nearshores its manufacturing and logistics bases at a time of geopolitical uncertainty, high shipping costs and labor shortages.

Crow Holdings recently closed on a $3.1 billion value-add fund that focuses on industrial and multifamily. “There is significant pent-up investment capital. Where we will be investing is where we have focused nearly all of our investment in the past decade: in the industrial space and the residential sector,” Hyun explained.

Niche industrial markets, such as outdoor storage and cold storage, could offer increased potential as declining interest rates nudge cap rates upward, especially since warehouses occupy the bulk of most pipelines. If capital for acquisition is secured now, those assets will generate even better returns when persistent demand pushes cap rates upward.

But which industrial properties to invest in depends on who you ask. To Nathan Clayberg, a vice president at MLG Capital, a Midwest-focused investor, “The bias is toward smaller-bay, more flex-type product, where it is very hard to build at a price point similar to what rent justifies today.”

A similar strategy motivates investment in infill and last-mile logistics. Peter Weiss, a co-founder & managing partner at Alpaca Real Estate, sees them as having all the location advantages of large distribution centers but less capital-intensive to develop. That’s a bonus given short-term interest rates and construction costs. “(They are) driven by e-commerce revenue growth, have repriced, and as rates have gone up, you can stabilize them at a healthy spread, alongside the cost of financing and the stabilized yield,” he noted.

Vertically integrated investors have taken notice too, using the success of their industrial investments to drive other ventures across their portfolios. Lincoln Property’s Stamolis cites the value in necessity and community retail spaces, which have made a comeback since the pandemic. These are furthered by the growth of last-mile industrial development, another area of interest for the firm.

“(It’s) an asset class that for the last decade was not in favor and was painted with a single brush,” Stamolis observed. “Investors are seeing that maybe they missed an opportunity in the necessity and community space where that segment has outperformed.”

You must be logged in to post a comment.