British Land to Buy Paddington Central in London’s West End for $708M

European real estate investment trust British Land is investing around $708 million to buy into Paddington Central, a 1.2 million-square-foot, office-anchored mixed-use development in London’s West End.

By Eliza Theiss, Associate Editor

European real estate investment trust British Land is investing around $708 million (£470 million) to buy into Paddington Central, 1.2 million-square-foot, office-anchored mixed-use development in London’s West End.

European real estate investment trust British Land is investing around $708 million (£470 million) to buy into Paddington Central, 1.2 million-square-foot, office-anchored mixed-use development in London’s West End.

The buy-in brought several hundred thousand square feet of income generating commercial space under British Land’s ownership, as well as several hundred thousand square feet of space with development potential. The buyer arranged the complex transaction that included multiple separate ownerships, with majority owner Aviva Investors.

The 11-acre Paddington Central currently features 1.2 million square feet of income-generating commercial space comprised of seven separate buildings and a retail and entertainment center. The complex also has potential for further development, to be conducted by British Land. Upon completion of further developments, Paddington will feature more than 1.6 million square feet of commercial space, of which British Land will own one million square feet.

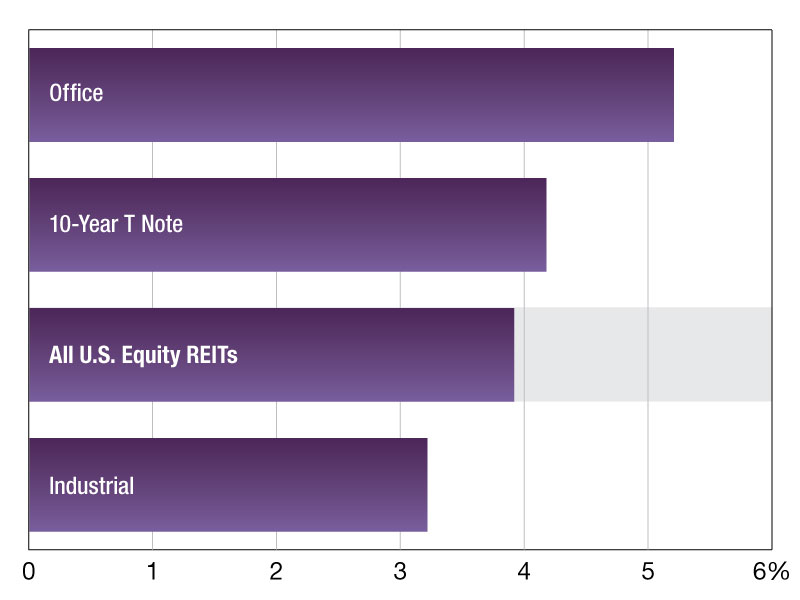

The income generating properties acquired by British Land holds 610,000 square feet of commercial space and comprises three office buildings and a retail and entertainment area. The assets, acquired for approximately $603 million (£400 million) are 91 percent leased with an average lease-term of 11 years. The properties generate a 5.3 percent initial net yield – which is expected to rise to 6.2 percent upon reaching zero vacancy.

Among the acquired commercial properties is 2 Kingdom St., the largest asset at Paddington Central with 268,000 square feet. The multi-let property is 84 percent occupied by tenants such as Nokia and Statoil with the average lease contract spanning 11.2 years generating a yearly $15.4 million (£10.2 million). 2 Kingdom Square was previously owned by an Aviva and Avestus Capital Partners joint venture. Next to the office building sits 3 Kingdom St., a 206-key Novotel hotel leased by Accor for 18 years for a yearly $3.3 million (£2.2 million). Both assets completed in 2010 and were designed by Kohn Pederson Fox.

3 Sheldon Square is also among British Land’s acquisitions at the site. Finished in 2002, the fully-leased office property features 143,000 square feet of office space. Tenants include Kingfisher and Prudential with a 7.8 years average leasehold. The property generates a yearly income of $11 million (£7.3 million). Sitting right next to the office property is Sheldon square, a retail and entertainment area, a grass amphitheater surrounded by cafés, restaurants and bars and a 9 percent vacancy rate and 12-year average leases. British Land also purchased a 200-unit residential component’s freehold, located above Sheldon Square .

The buyer also secured two development sites, 4, respectively 5 Kingdom St. at the price of $265 (£175) per square foot. The sites have been approved for 355,000 square feet of office space with designs in advanced stages. However the buyer has expressed its intents to partially modify and improve existing designs. Groundbreaking for these projects is set for 2014 and are expected to cost $272 million (£180 million). A further 80,000 square feet of land will revert to British Land in 2018. Currently occupied by Crossrail, the owner will develop a mixed-use project on it.

Paddington Central has efficient access to Heathrow airport via the Heathrow Express, is in close proximity to Paddington station, a major rail and subway interchange. Starting in 2014, the new Hammersmith & City Line station will also serve the area with Crossrail adding even more connectivity from 2018.

You must be logged in to post a comment.