Brookfield, Elion Form $1B Partnership

The companies aim to develop an additional 15 million square feet of industrial space in Wilmington, Ill.

Elion Partners and Brookfield Asset Management have formed a $1 billion strategic partnership, to increase Brookfield Real Estate Secondaries’ logistics footprint in several core infill markets. The investment included $80 million in equity commitments to Elion Real Estate Fund V, which closed earlier this year, reaching its hard cap of $500 million.

The partnership will enable Elion to fulfill the long-term development vision for its Chicago-area master-planned industrial park, Elion Logistics Park 55 in Wilmington, Ill. The project was recapitalized by Brookfield, and the consortium estimates some $1 billion of industrial real estate can be developed within the 2,500-acre site. Park Madison Partners acted as capital advisor for the recapitalization process.

Elion Partners hired CBRE to act as leasing manager at Elion Logistics Park 55 back in 2019. The master plan for the site calls for the development of up to 30 million square feet, and the partnership currently intends to develop some 15 million square feet of new product. Additionally, 140 acres have been set aside for retail services. The developer has access to $140 million in tax increment financing. In 2011, the Illinois Department of Commerce and Economic Opportunity chose to include ELP55 in its Enterprise Zone Program, providing tax benefits, regulatory relief and other benefits to the developer.

Elion Logistics Park 55 is situated at the intersection of Lorenzo Road with Interstate 55, and the site has 3 miles of frontage along the highway. The industrial park’s five existing Class A properties total 4 million square feet and are fully leased.

Site features and amenities

One of the most recently completed buildings is an 810,900-square-foot warehouse fully leased to Amazon. The building opened in 2018 and features a cross-dock configuration, 180 dock-high loading doors, ESFR sprinklers and a 200-foot truck court.

The existing structures range in size from 111,000 square feet to more than 1 million square feet. The park offers multiple amenities for its occupants, including rail service via BNSF’s Transcontinental Mainline, a dedicated 24-hour police and fire first responder station, a helipad and a travel plaza which features restaurants, a repair service, a truck wash and other services. Besides Amazon, tenants include Michelin, Lineage, Post, Batory Foods, General Mills and others.

The site’s location is within 12 miles of two four-way interchanges and a Union Pacific intermodal terminal. Major thoroughfares within this radius include interstates 55 and 80 and State Route 129.

Developers are currently working on the park’s second phase, which includes a speculative project of 1 million square feet, with the possibility of expandable by 300,000 additional square feet. The building will feature 40-foot clear heights, 50- by 56-foot column spacing, an ESFR system, 205 docks and two drive-in doors. Delivery is planned for the first quarter of 2022.

Long-term growth strategies

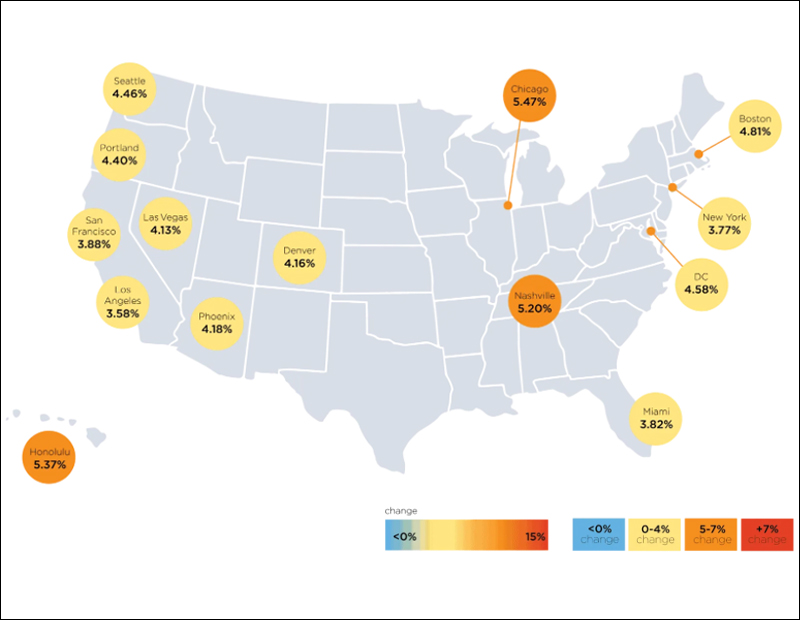

As of July, Chicago had more than 25 million square feet of industrial space under construction, a CommercialEdge report shows, surpassed only by Dallas. The metro is one of the nation’s most sought-after logistics and last-mile distribution markets, with rents increasing by 2.7 percent year-over-year through July.

Elion and Brookfield are poised to expand long term in core markets through their respective vehicles. Last year, Elion Partners received a strategic investment from Goldman Sachs Vintage Funds, enabling Elion to further its strategy of targeting infill locations in high-growth urban markets. The amount was undisclosed.

Earlier this month, Brookfield Asset Management joined forces with Boston-based King Street Partners. The partnership aims to invest $1.5 billion in equity capital in King Street’s life sciences real estate pipeline.

You must be logged in to post a comment.