Brookfield Scores $465M Downtown Los Angeles Office Refi

The loan on the 50-story Gas Company Tower marks the investor's second CMBS refinance in the city center in the past six months.

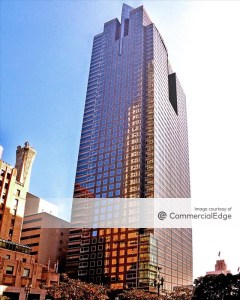

The Gas Company Tower

Brookfield Properties has secured a $465 million CMBS refinancing package for The Gas Company Tower, a 1.3 million-square-foot Class A office high-rise in downtown Los Angeles, The Real Deal reported, citing a Moody’s report.

The financing is structured in two parts. The first, a $350 million loan from Citi Real Estate Funding and Morgan Stanley, carries a variable interest rate over a two-year term. The second is a $115 million mezzanine note from Citi, Morgan Stanley and SBAF Mortgage fund. The transaction is anticipated to finalize on Feb. 5.

The new loans will replace two notes from 2016 totaling $450 million. The first is a $319 million loan originated by Deutsche Bank, CommercialEdge data shows. The mortgage has a fixed 3.47 percent interest rate and matures in August, according to public records. At the same time, a private lender provided a five-year, $131 million mezzanine loan with a 6.5 percent interest rate.

Located at 555 W. Fifth St., the LEED Gold-certified tower was completed in 1991. The property has a 14,373-square-foot showroom and 14,157 square feet of retail space. The 50-story building has 25 passenger elevators and a parking ratio of 1 space per 1,000 square feet. Amenities include a banking center, a car wash and concierge services. The tenant roster includes Deloitte, WeWork and Southern California Gas Co.

Refinancing spree

This will be the second property in downtown Los Angeles that Brookfield has refinanced with CMBS loans in the past six months. In September, the company took a $305 million debt package for its 910,610-square-foot Ernst & Young Plaza. The loan matures in October 2022.

Last June, Bank of America originated a $171 million loan for the company’s 386,180-square-foot 1100 Avenue of the Americas in Manhattan. The firm is executing a major capital improvement plan at the property.

Brookfield came to own The Gas Company Tower after its DTLA Holdings fund acquired MPG Office for $2 billion in 2013. The transaction included seven downtown Los Angeles office buildings encompassing 8.3 million square feet. The company holds a 47 percent stake in the DTLA fund, with several institutional investors owning the remaining 53 percent.

You must be logged in to post a comment.