Buoyant Industrial Sector Drove Irish Property while Retail Struggled

Retail property followed with an annual return of 3.0 percent, according to MSCI's Ireland Quarterly Property Index.

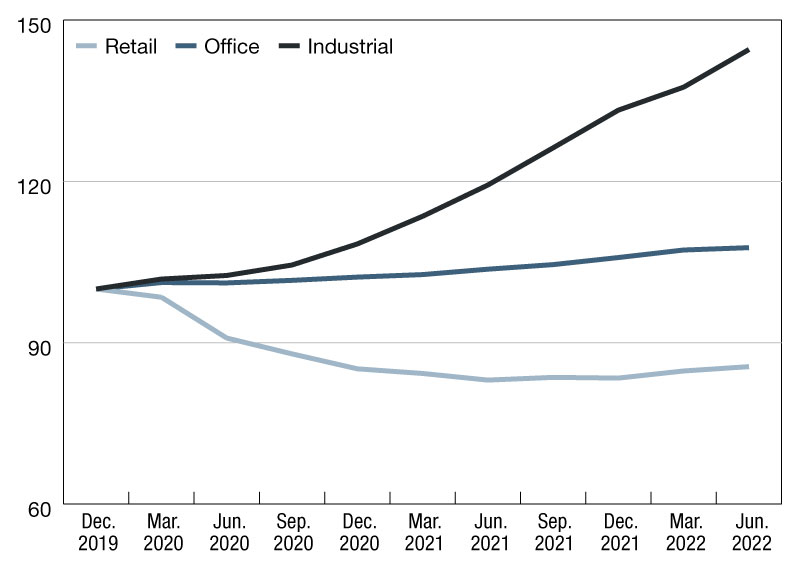

Total Return Index from Q4 2019

Irish real estate continued its recovery in the second quarter of 2022 and for the first time surpassed its pre-pandemic annual total return. This was as the return of the MSCI/SCSI Ireland Quarterly Property Index improved to 5.6 percent, on a rolling annual basis.

Industrial property was the top performing sector for the year to June 2022 with an annual return on standing investments of 21.1 percent. Industrial’s outperformance stood in contrast with that of the office and retail sector where the annual return across all subtypes remained in single digits. Office, the largest sector in the index by capital value delivered an annual return of 3.9 percent, driven by the Dublin 2 node where quarterly returns have remained positive throughout the pandemic. Retail property followed with an annual return of 3.0 percent but remained 14 percent off its pre-pandemic mark. While shopping centres and retail warehouses have shown signs of stabilisation, standard shops had yet to turn the corner as the annual total return for assets located along Grafton and Henry/Mary Streets remained negative at Q2 2022.

A 14-year low equivalent yield coupled with strong market rental growth confirmed the robust investor demand for industrial assets. While investment property deal activity in Ireland grew to EUR4.2bn during the first half of 2022 according to data from Real Capital Analytics, industrial’s share of the total has increased from 5 percent in 2019 to above 31 percent in the first half of 2022.

You must be logged in to post a comment.