Can Cold Storage Keep Its Cool This Summer?

Despite headwinds, this soaring niche continues to attract an increasing number of investors.

The cold storage segment, a small but growing niche within the broader industrial sector of commercial real estate, has seen substantial growth since the pandemic and industry experts expect that to continue, driven by increasing demand and need for temperature-controlled storage and transportation of food, pharmaceuticals and chemicals.

Commercial Property Executive took a closer look at this market, focusing mainly on food storage and transportation, and found investor interest in cold storage began climbing as e-commerce started surging, particularly during the COVID-19 crisis. Trends in the food supply business that began pre-pandemic, such as the rise of meal prep kits and grocery home delivery services, took off during the pandemic.

A June 2022 CBRE research report on the cold storage sector stated e-commerce’s share of total grocery sales in the U.S. was expected to rise from 13 percent in 2021 to 21.5 percent by 2025. According to CBRE, there was approximately 225 million square feet of U.S. cold storage real estate in 2022. Citing USDA figures, CBRE reported there was about 3.7 billion cubic feet of gross refrigerated storage capacity, up 2.2 percent from 2020.

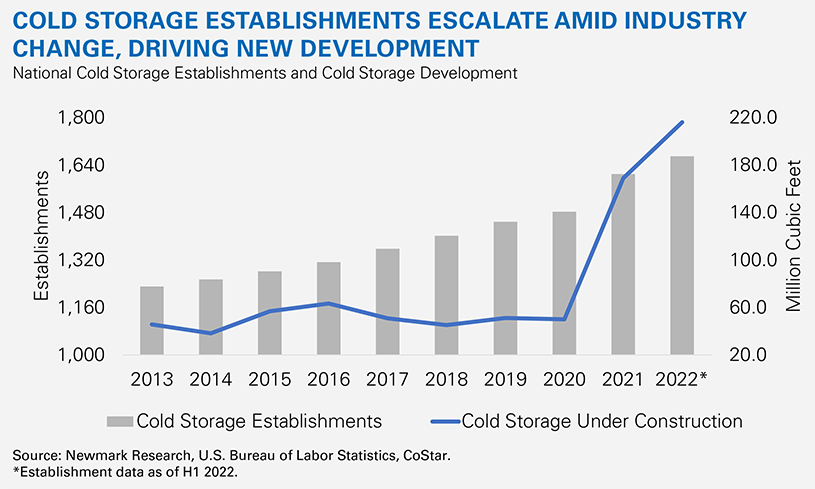

A March 2023 Newmark report stated national cold storage development hit an all-time high of 9.8 million square feet—an estimated 216.2 million cubic feet—by the end of 2022. Between 2013 and 2020, annual average growth had been 2.2 percent. By comparison, the overall number of cold storage facilities jumped 8.6 percent from 2020 to 2021 and an additional 7.5 percent from 2021 to the first half of 2022, according to Newmark.

David Sours, senior vice president of CBRE’s National Food Facilities Group, told CPE cold storage building deliveries soared during the pandemic, with a 46 percent increase in 2021 over 2020 and a 93 percent year-over-year increase in 2022.

“It certainly helped the growth trajectory pretty dramatically,” Stephen Levine, executive managing director, industrial & logistics at Newmark, said of the spike in e-commerce in recent years and how it’s boosted demand for more cold storage development and attracted more investors.

READ ALSO: Nearshoring Is Boosting Supply Chain Resilience

West Hutchison, president & CEO of Vertical Cold Storage, a growing company that develops and operates cold storage and logistics solutions across the U.S., agreed.

“Vertical Cold Storage was formed prior to the pandemic, but yes, COVID-19 accelerated some of the trends in the marketplace that we see demand for, like e-commerce, meal kits and pharmaceuticals,” Hutchison told CPE.

Sponsored by real estate investment firm Platform Ventures, Vertical Cold Storage operates seven distribution centers with a total of more than 2 million square feet of warehouse space. In late May, the company acquired MWCold, operator of two temperature-controlled warehouses totaling about 545,000 square feet in the Indianapolis area.

The largest of the two assets is a two-story, 390,000-square-foot cold storage facility built in 1956 on a 13.3-acre site that features blast freezing, export services and quick thaw. The multi-modal site has 33,000 pallet positions and 46 dock doors and is served by CSX and Norfolk Southern railroads. The 159,000-square-foot Pendleton, Ind., warehouse has 19,600 pallet positions and 15 dock doors and can handle multiple temperature zones down to -20°F. The locations of the two facilities enable two day or less service to 75 percent of U.S. and Canadian populations.

Noting the company is both acquiring and building greenfield cold storage facilities, Hutchison said, “We are in active negotiations for additional acquisitions and are in various stages of planning for several greenfield and expansion projects.”

Stephen Levine, Executive Managing Director, Industrial & Logistics, Newmark. Image courtesy of Newmark

He said plans for two ground-up facilities will be announced soon and both are expected to be operating within two years. Hutchison did not say where those assets would be built but the company has properties in Florida, North Carolina, Nebraska, Indiana and Texas. The January 2022 acquisition of Lone Star Cold Storage marked the firm’s entry into one of the nation’s key logistics markets, Dallas-Fort Worth. Lone Star Cold Storage owned one property in Richardson, Texas, a 227,331-square-foot warehouse with 5.6 million cubic feet of storage, 17,982 pallet positions and 40 dock doors. The facility has seven multi-temperature rooms from -20 to 45 degrees with services including blast freezing and case picking.

“We like the current markets we are in and are actively looking to continue growing in these markets as well as others throughout North America, whether that is in traditional major markets, growing markets that have been traditionally viewed as secondary, or even remote locations if a customer needs production support,” Hutchison told CPE.

Growing markets in cold storage

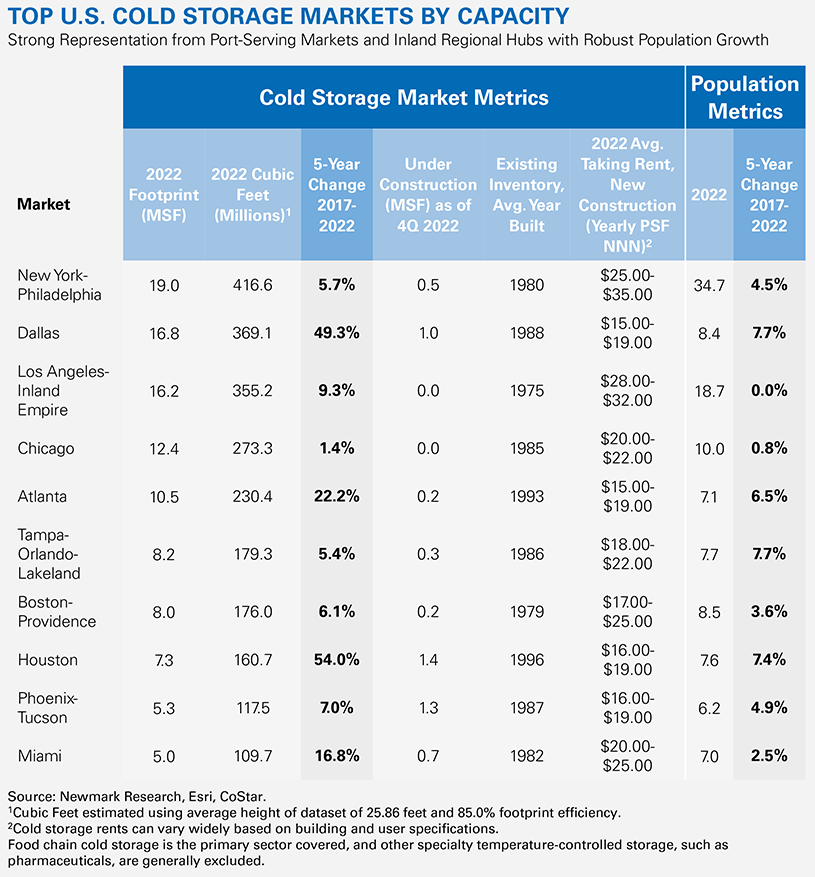

Lisa DeNight, national industrial research managing director at Newmark, said Dallas and Houston by far grew their cold storage inventories the most over the past five years.

“It surpassed the New Jersey/New York/ Philadelphia greater statistical area,” she noted, adding that the Dallas-Fort Worth metro “is poised to surpass that larger market in terms of cold storage inventory by year end.”

Amanda Ortiz, industrial & logistics research director at CBRE, agreed.

“Dallas-Fort Worth is the mecca for this kind of activity right now. They check a lot of those boxes [like land and labor availability] so that’s why there’s so much more development and cold storage happening there,” Ortiz said.

A list of the nation’s top 10 cold storage markets by capacity in Newmark’s March 2023 Industrial Insight report shows major increases in both Dallas and Houston, as well as Atlanta and Miami. In fact, seven of the top 10 cold storage markets are in Sun Belt states, six of which have seen the largest increases in cold storage inventory since 2017, with an average of 26.4 percent increase in inventory, according to Newmark.

These figures mirror broader warehouse/distribution trends in these states, which have seen an average 4.8 percent population growth over the same period, Newmark reports. For example, the New York-Philadelphia market, currently the top U.S. cold storage market with about 19 million square feet of space as of 2022, saw a 5.7 percent increase in capacity during the 2017 to 2022 period while number 2, Dallas, with 16.8 million square feet of space in 2022, had seen a jump of 49.3 percent during the same stretch. Atlanta, number 5 on the list with 10.5 million square feet, increased 22.2 percent; Houston, number 8 on the list with 7.3 million square feet, had a 54 percent increase and Miami, taking the number 10 spot with 5 million square feet, saw a 16.8 percent increase in capacity.

“DFW as a whole is one of the largest industrial markets in the country, ranking in the top three. They’ve got land everywhere and you can reach a tremendous amount of population in a very short amount of time. And its proximity to Mexico and other ports makes it a supremely important logistical hub,” said Levine.

DeNight noted that while the ambient warehouse market has seen a significant decline in new construction this year, down 30 percent in the first quarter of 2023, new cold storage development “has remained incredibly stable at maybe 9.6 million square feet.”

Looking ahead to future development, DeNight pointed to a late June announcement from Americold Realty Trust, a global operator of approximately 250 temperature-controlled warehouses, and Canadian Pacific Kansas City rail network that they were planning on locating cold storage facilities along the railway from the U.S. Midwest to Mexico as part of a larger plan to expand intermodal transportation options for cold storage products. The first facility will be built in Kansas City, Mo., and will link Chicago to stops in Mexico. The temperature-controlled service will focus on shipping U.S.-produced meat to Mexico and Mexican produce to the U.S. as well as streamlining border crossing procedures. CPKC has already increased its fleet of refrigerated containers ahead of the collaboration.

DeNight said this kind of cross-border direct rail link is an example of shifts in the amount of perishable goods that will be coming across the borders and will be a “demand driver for the next five to 10 to many years in the future.”

Even with the uptick the cold storage sector has seen in recent years, new deliveries are beginning to slow from those pandemic-year highs. At the end of the first half of 2023, Sours said there has been about a 7 percent increase in deliveries. With a few more projects expected before the year is over, he expects the overall increase will be about 10 to 12 percent year-over-year from 2022.

“It’s still growth but it is slowing,” Sours said.

Both Levine and Sours said economic conditions in the past year, particularly the rising interest rate environment, inflation and capital markets crunch, have played a role in deal slowdowns in this sector as well as in the broader commercial real estate market.

Investor interest in cold storage increases

But investors continue to be attracted to the cold sector niche. While it previously had been seen as very risky, it suddenly had a broader appeal.

“It’s become a bit of a darling within industrial,” Sours said.

CBRE’s “2022 U.S. Investors Intention Survey” found nearly 40 percent of respondents said they were pursuing cold storage assets in 2022, up from 22 percent in 2021 and 7 percent in 2019. The CBRE June 2022 research report, “Cold Storage Demand Grows Amid Tailwinds,” found investors were attracted to the market because of its growth prospects and higher yields compared to the traditional warehouse sector. At that time, robust demand had driven the cap rate spread between cold storage and dry warehouses to as low as 50 basis points, according to the CBRE report.

Levine said investment interest came from institutional investors, private equity, family office investors, food companies “and everybody in between.” Some, he said, have been more successful than others.

There has also been a lot of industry consolidation particularly with the large, global public refrigerated warehouse companies like Americold and Lineage Logistics, which account for approximately 70 percent of the North American total cold storage space. United States Cold Storage controls about 10 percent followed by other companies that are also looking to expand organically and via acquisitions.

But as both Sours and Levine noted, cold storage development is still considered a risky investment, particularly in the current interest rate environment. The Newmark report noted there are significant challenges, particularly when developing speculative cold storage facilities. Challenges include specialized costly construction, which are at least twice the cost per square foot of traditional warehouses; high operating costs; unique tenant requirements and inflexibility for potential future conversion because much of the demand is client specific.

Some of the spec properties that were most recently built are still sitting empty, possibly because the developers built larger assets than the market could handle or because tenants had specialized needs that weren’t met by the spec facilities.

Another challenge is aging inventory and the need for modernization, said DeNight. According to Newmark, the average age of cold storage facilities in the top U.S. markets is 37 years. In California, the stock is 49 years old on average, DeNight said.

You must be logged in to post a comment.