Interest Rates Are Still High. Now What?

Investors can wait around for more rate cuts from the Fed or they can adjust to the new rate environment, writes Adam Johnson of NAI Hiffman.

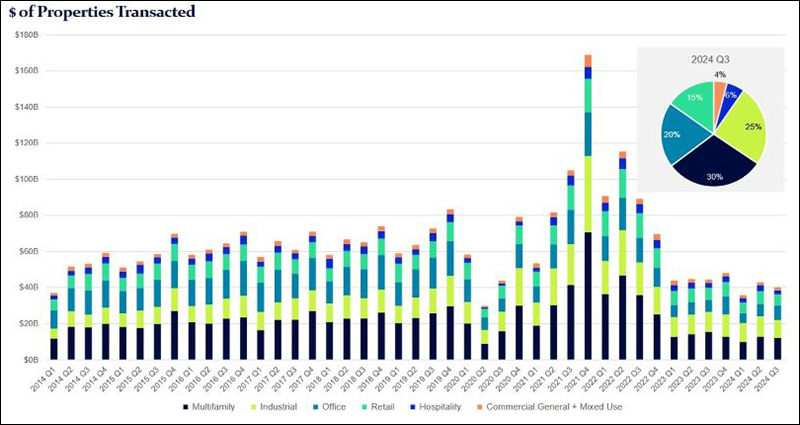

Any real estate broker or investor will tell you that debt drives deals. So, it’s no surprise that sales volume remains low as interest rates remain high.

While some market observers may have hoped the Federal Reserve’s decision to begin lowering its benchmark rate would lead to less expensive financing, it seems lenders had already priced in those cuts. Commercial property sales volume remains a fraction of what it was even a few years ago.

Significant interest rate drops are unlikely soon, so as we head into 2025, buyers and sellers will have to continue to adjust their expectations. Good opportunities do exist in this market, but success will depend on understanding capital markets, maintaining lender relationships and structuring deals carefully.

READ MORE: Why Big Data Centers Are Going Nuclear

Understanding debt markets

Since many lenders look to the 10-year and 5-year Treasuries when setting mortgage rates, the Fed’s action, while positive, hasn’t had an immediate impact on the commercial real estate market. In fact, Treasury yields have gone up nearly 80 basis points since the first rate cut in September.

As a result of lingering uncertainty over how future rate cuts will affect Treasury yields, debt remains the biggest unknown in real estate transactions. Nothing else in the market has changed from recent years. The properties are the same; the tenants are the same. But when the cost of money becomes unpredictable, it creates disruption. As a result, buyers have a difficult time underwriting debt, and the volatility of the interest rate market then stalls or potentially kills deals in the pipeline.

Leveraging lender alternatives

Normally, real estate buyers tour a property, determine a price they are willing to pay and then approach lenders for financing. But the script has flipped recently in this market, with buyers often having to approach lenders first to see if they’ll even be able to secure a loan. Likewise, listing brokers will often engage with lenders before going to the market to help source debt for the sale.

In some sectors, such as office, many traditional lenders have stepped back, leading to alternative options such as regional banks, credit unions and mortgage brokers filling the void.

Cash transactions have also become more prominent, particularly with distressed properties for which valuations have plummeted. Buyers who a few years ago were able to secure 70 percent loan-to-value now might have to put down 50 percent or even 60 percent in equity, along with higher reserve requirements.

Building resilient capital plans

Right now, I’m seeing a lot of tire-kickers in the market who are throwing out offers with little due diligence and seeing what sticks. Often, the quick offer is not the deal that transacts. You need to do due diligence on the buyer and confirm they can articulate their underwriting, show their understanding of the local market and have a clear path to fund the purchase.

That’s why the best buyers, or those who will capitalize on the best opportunities in the market, will go into these acquisitions with a plan. They know the market. They know their competition. They have their capital stack figured out, and they have a strategy for maximizing asset value post-acquisition.

Next year is set to be a year of change, but many people expect the Fed and lenders to react slowly to see how inflation and economic policies enacted by the new administration play out. Most experts expect interest rates to remain flat over the next 12 months. Flat may not get some investors excited based on today’s rates, but consistency should help buyers feel more comfortable in underwriting, leading to more offers and activity.

Adam Johnson is executive vice president, office services & capital markets group, NAI Hiffman.

You must be logged in to post a comment.