The Outlook for Capital Costs Amid Increasing Uncertainty

The current volatility will yield opportunities for those who are ready, writes Dekel Capital's Shlomi Ronen.

It’s been quite an eventful start to the year on every level of the economy and the commercial real estate sector.

At the national and international level, the unexpectedly frantic pace of the Trump administration’s changes are having an immediate impact on CRE. DOGE and its government workforce reduction efforts have impacted both the residential and commercial office markets. However, as the cost-cutting effort continues, expect a wide range of sectors—ranging from nonprofits and consulting firms to universities and defense firms—to feel the impact and adjust their use or need for commercial real estate space. In essence, any business that relies on nonlegislated government funding could be affected.

READ ALSO: Data Centers Boom for Debt and Equity Investors

The uncertainty around tariffs is having immediate impact on development costs. General contractors are adding language to their contracts that will allow for material cost escalations resulting from tariffs in GMAX contracts. This added uncertainty will ultimately result in equity investors (and developers) seeing a higher yield on cost to compensate for the added risk. Achieving the targeted, untrended yields on cost in the 6.25 percent to 6.5 percent range for multifamily already had been a challenge for developers prior to the tariff discussions. Now with the added tariffs premium, we will likely see development activity slow down even further.

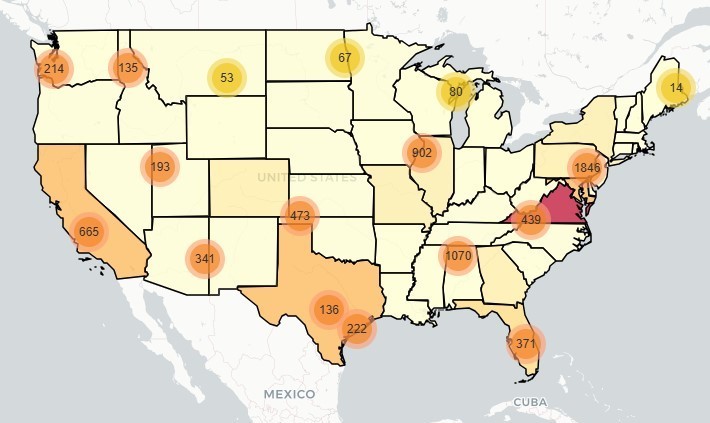

Source: Trepp Inc.

On a more positive note, as capital markets are trying to absorb the flurry of changes and assess the impact to the U.S. economy, there has been a flight to safety that has pushed down the yield on the five- and 10-year Treasuries by 31 and 54 basis points, respectively (as of March 12), since the beginning of the year. In addition, we have seen a tightening of credit spreads on fixed-rate financing as liquidity in the market remains high and deal volume continues its slow recovery. These are all good things for CRE as borrowers are again seeing fixed-rate interest rates as low as 5 percent.

Lastly, the banks are lending once again and having a positive impact on construction capital and bridge lending. Loan-to-cost on nonrecourse construction debt is back above 60 percent LTC and creeping toward 65 percent. Debt funds are sourcing more aggressive terms on their warehouse lines, enabling them to reduce credit spreads on bridge loans to the high 100s while maintaining underwriting discipline.

As we look forward, it’s safe to say we’ll see continued volatility and uncertainty that should present investors and developers alike with some interesting buying opportunities.

Shlomi Ronen is a managing principal and founder of Dekel Capital.

You must be logged in to post a comment.