Capital Growth

Could breaking capital growth into its components help tell a more detailed story of property portfolios’ performance?

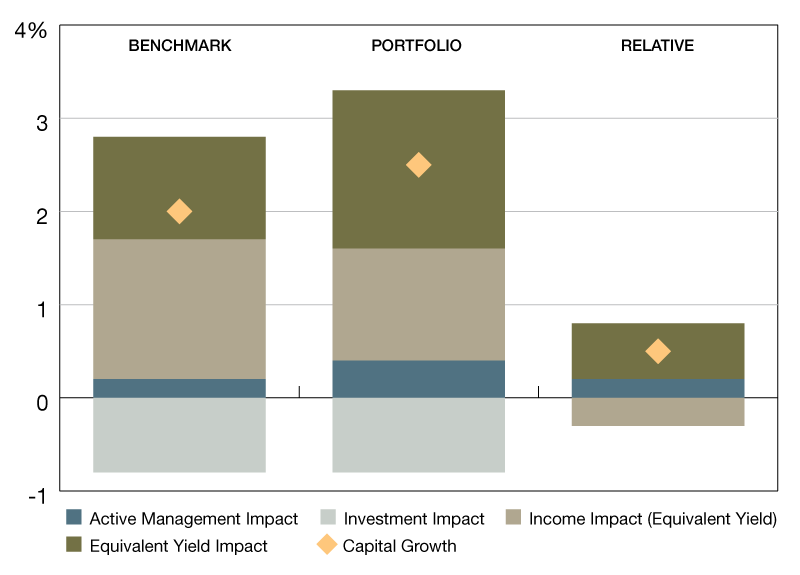

3-year annualized return/impact by component

In real estate investing, capital growth has historically been responsible for most of the observed volatility in total returns. Could breaking capital growth into its components help tell a more detailed story of property portfolios’ performance?

This chart uses a simulated portfolio of U.K. property assets and measures its performance against the MSCI UK Quarterly Property Index to demonstrate how the drivers of capital growth can be analyzed.

The first component, active-management impact, represents how much transactions and developments contributed to capital growth. Equivalent-yield impact shows how much the change in asset values was attributable to movements in equivalent yield. Income impact represents how much of the change in asset values came from growth in initial and expected rental income. (Added together, the equivalent-yield impact and income impact show the total change in asset values.) And the investment impact, the difference between asset-value growth and capital growth, equals the amount of capital expenditure reinvested.

Analyzing the components of capital growth like this can provide additional insights on what has driven market and/or portfolio performance.

Insights and data provided by MSCI Real Estate, a leading provider of real estate investment tools. A Vice President in MSCI’s global real estate research team, Reid focuses on performance measurement, portfolio management and risk related research for asset owners and investment managers. Based in Sydney, he covers APAC as well as global markets.

You must be logged in to post a comment.