Capital Ideas: Trump’s Gift to the Office Market

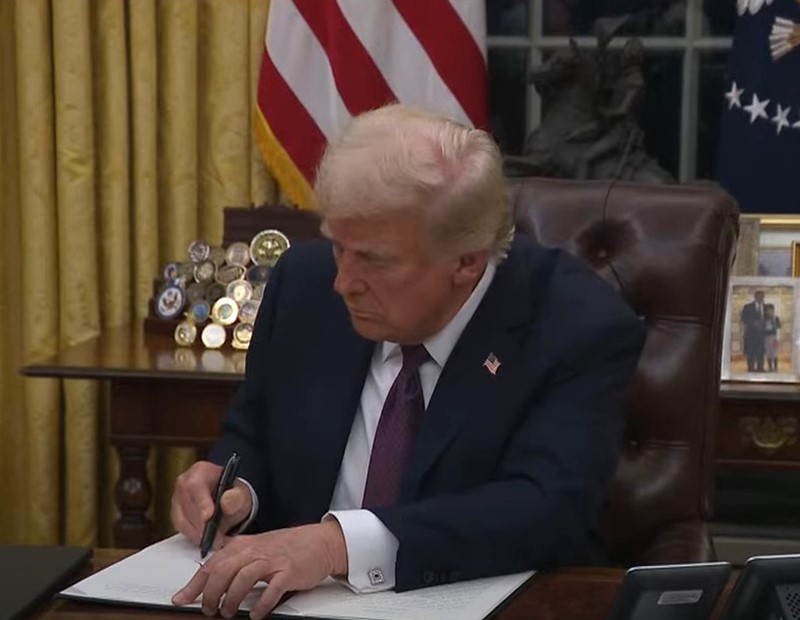

With the stroke of a Sharpie, our new president may have touched off a turnaround.

It was raining executive orders on President Donald Trump’s first day in office. It remains to be seen just how much many of these—like exiting the Paris Agreement, freezing pending regulations and creating an agency to collect tariffs—will impact commercial real estate investment and finance.

There is one directive from our returning leader, however, that should have a direct and powerful impact on CRE investment and finance. That is the “Return to In-Person Work” order for executive branch employees (understood to mean all federal workers).

At just 65 words, the order packs a positive punch for the Washington, D.C. and national office markets, which have been dismantled by remote and hybrid work following the pandemic.

READ ALSO: 5 Promising Opportunities in an Uncertain Market

By November, utilization in the District had recovered to 60 percent of pre-COVID levels, according to Placer AI. The average for the top 12 office markets is 62.9 percent. The office vacancy rate is 22.5 percent, according to CBRE, while the national average is 19 percent. So, there is definitely room for improvement.

Following the enactment of Trump’s order, District buildings—and the surrounding streets, stores and hotels—should be filled with more occupants and visitors, and some older buildings that seem destined for obsolescence could regain some of their potential as office space.

It should be noted Trump and Elon Musk, who leads the newly created Department of Government Efficiency, are actually eager to shrink and decentralize the Federal workforce. In fact, Musk has said he hopes the Return to In-Person Work executive order for government employees will set in motion a wave of voluntary resignations.

Meanwhile, during the past few years, the GSE has been “optimizing” and rightsizing” its footprint, in part, by selling about 5 million square feet of excess properties across the country—three of the 31 properties sold or for-sale are in Washington, D.C. It has also been reducing its lease commitments due to the increase in remote and telework post-pandemic.

A smaller, consolidated Federal workforce would hurt the Washington, D.C. office market. But the impact of Trump’s executive order can extend way beyond Washington and government offices. With the federal government requiring a complete return to work by its workers, private employers of all sizes—the big ones are already starting to fall in line—will likely be emboldened to require the same, thereby weakening if not reversing the work-from-home trend.

“That by itself is enough to start making office more viable,” Lonnie Hendry, chief product officer at Trepp Inc., told me in a conversation last year.

More bodies in the office means better fundamentals for office, more investment and financing and less distress.

Efficiencies in the office

According to the American Federation of Government Employees, the largest union for federal employees, 54 percent of federal employees work at completely in-person jobs and 10 percent are fully remote. Among the subset of federal workers who are telework but not remote work eligible, 61.2 percent of working hours are spent in-person.

How does that compare to the broader population? According to the Bureau of Labor Statistics, about 23 percent of American workers were teleworking or working from home in December of 2024.

But remote work and telework for Federal workers cannot be attributed to COVID alone. Following the executive order, AGFE issued a statement saying restricting telework would undermine the “effectiveness” of the federal workers since it was Congress in 2010 that required telework for the sake of efficiency.

It will be interesting to see how Trump’s return to the office executive order plays out for Federal employees and the buildings they occupy, but even more interesting to see the effect it has on the broader workforce. Stay tuned!

You must be logged in to post a comment.