CapRidge Partners Buys Houston Office Portfolio

HFF arranged the sale and $91.3 million in financing for three properties situated in an urban infill location adjacent to some of the city's most prominent neighborhoods.

CapRidge Partners has acquired a three-property, 544,291-square-foot office portfolio in Houston from a joint venture led by Unilev Capital. HFF facilitated the deal and also arranged a four-year, floating-rate acquisition loan for the buyer. New York Life Insurance Co. provided the $91.3 million financing set to mature in April 2023, according to public records.

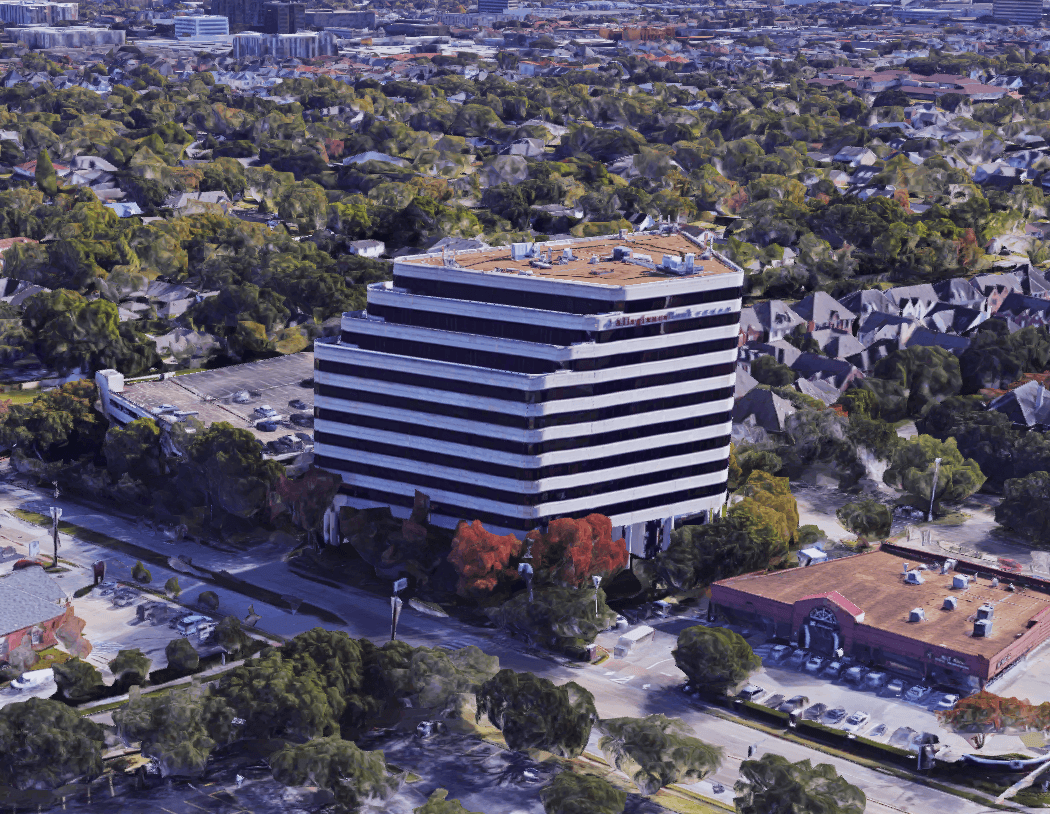

The three properties are located at 1616 S. Voss St., 7500 San Felipe St. and 6363 Woodway Drive, just west of Houston’s Galleria area. CapRidge Partners plans on utilizing about $15 million to renovate all three properties including upgrading building systems and adding new amenities for tenants.

The trio of properties is situated in urban infill locations in some of Houston’s most popular submarkets such as Tanglewood and Memorial Villages. The buildings are within walking distance of numerous retail establishments including Trader Joe’s, Whole Foods and a plethora of restaurants. All are also nearby the historic Houston Country Club.

Office market rebounding

According to Cushman & Wakefield’s most recent Houston office report, the fourth quarter of 2018 showed positive signs of office demand, with 1.7 million square feet of positive overall absorption, plus an increase in leasing activity, a decreased availability rate and a dip in total sublease space. However, the report notes that overall absorption for the entire year was in the red, posting negative 190,515 square feet, so projections are that recovery is going to be a long-term solution.

HFF Senior Managing Director Dan Miller, Senior Director Martin Hogan and Analyst Johnny Kight represented the seller in the deal. The firm’s debt placement team consisted of Managing Director Jim Curtin and Senior Managing Director Andy Scott. Stream Realty Partners’ Craig McKenna and Matthew Asvestas are handling leasing for properties.

In March, CapRidge Partners acquired Nashville City Center, a 477,261-square-foot Class A office tower in central Nashville, Tenn., for $105.3 million from The Shidler Group. CIT Real Estate Finance provided the buyer with a four-year floating-rate acquisition mortgage.

You must be logged in to post a comment.