CapRock Sells Greater Los Angeles Industrial Asset

The new owner will use the property as its corporate headquarters.

CapRock Partners has sold West Valley Logistics, a 270,000-square-foot industrial asset in Pomona, Calif. A Southern California-based alternative fashion company acquired the property. Stream Realty Partners and Colliers represented the seller and the buyer, respectively.

The new owner plans to establish its corporate headquarters at the building. CapRock will assist the buyer with interior design and the construction of tenant improvements.

West Valley Logistics came online last month. CapRock broke ground on the project in the second quarter of 2023, financing its construction with a $50 million loan issued by JPMorgan Chase, according to CommercialEdge information.

READ ALSO: SoCal Industrial Market’s Comeback Story

Located on nearly 13 acres at 4200 Valley Blvd., West Valley Logistics is some 30 miles east of downtown Los Angeles. State routes 57 and 60 are less than 4 miles away, while Interstate 10 is about 6 miles from the facility. The Ontario International Airport operates less than 17 miles away.

The LEED-certified, rear-load building features 40-foot clear heights, 28 dock-high doors and two grade-level doors, as well as 240-foot truck courts and 10,000 square feet of office space. There are 130 auto and 45 trailer parking spaces at the property.

Stream Executive Vice Presidents Matt Moore and Wes Hunnicutt, together with Associate Michael Torres, represented the seller. Colliers Senior Executive Vice President Mike Hartel and First Vice President Nick Velasquez brokered the deal on behalf of the buyer.

CapRock’s industrial dealings

CapRock’s industrial portfolio—including its development pipeline—encompasses roughly 19 million square feet across Western markets and Texas, where the company made its first purchase in April.

After a few months, CapRock announced its first ground-up development in the Lone Star State. The three-building campus totaling 518,000 square feet will also rise in the Metroplex.

In the West, the firm marked another premiere in July, with the $81.5 million purchase of a 707,010-square-foot industrial building in Sparks, Nev. This was CapRock’s first acquisition in northern Nevada.

Los Angeles’ sizeable industrial investment scene

Greater Los Angeles’ industrial sales volume totaled some $2.5 billion during the first 11 months of last year, according to a CommercialEdge report. The metro ranked second among the Western markets after the Bay Area ($3 billion), but equaled Phoenix ($2.5 billion) and surpassed the Inland Empire ($1.9 billion).

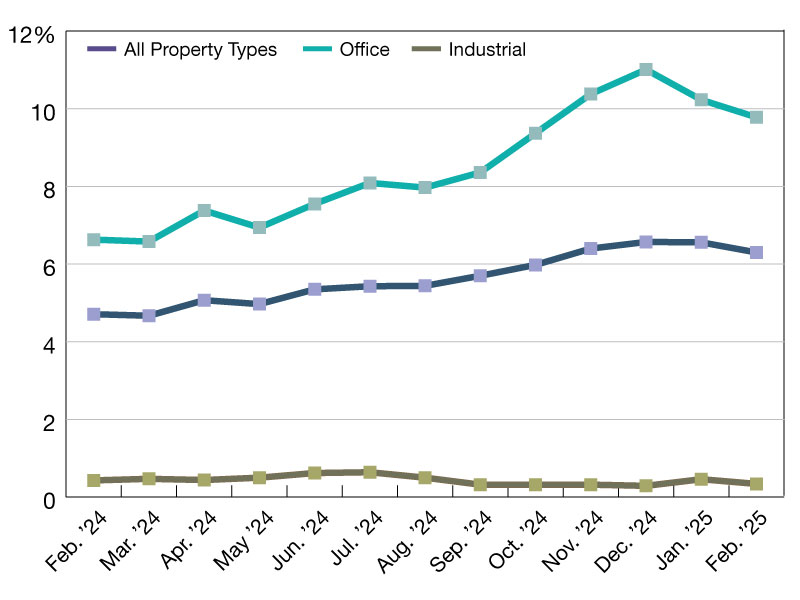

Although the City of Angels kicked off 2024 with a strong industrial rent growth—being one of the few markets that posted a double-digit increase—the rate in November was 8.1 percent, down from 11 percent in July, the same source shows.

The Southern California industrial real estate market witnessed a resurgence of the owner-user buyer profile, according to prepared remarks by Taylor Arnett, senior vice president at CapRock. One such example was Ardmore Home Design’s October acquisition of the 282,377-square-foot asset it had occupied since 2020. LBA Realty sold the City of Industry property.

You must be logged in to post a comment.