Premium/Discount to NAV

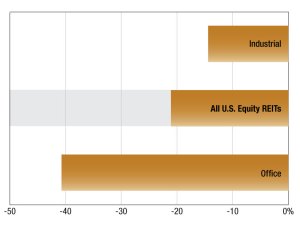

2020 REIT Trading Trends

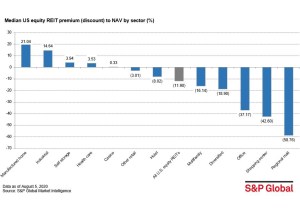

As of Oct. 30, 2020, publicly listed U.S. equity REITs traded at a 19.3 percent median discount to estimated net asset value.

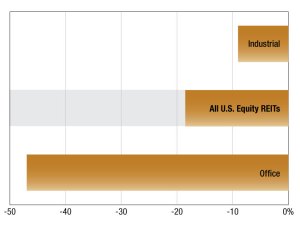

2019 REIT Trading Trends

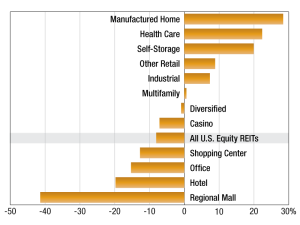

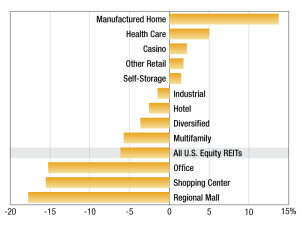

The Manufactured Home sector traded at the greatest median premium to NAV, at 28.4 percent.

Manufactured Home REITs Trade at Greatest Premium to NAV

At the other end of the spectrum, the regional mall REIT sector traded at the greatest median discount to NAV.

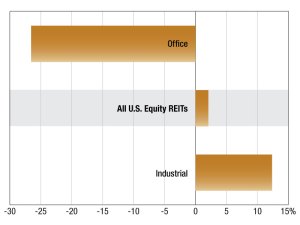

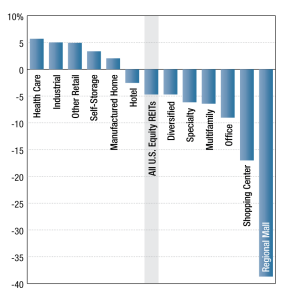

2018 REIT Trading Trends

As of Sept. 28, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value of 6.14 percent.

REITs

At the company level, Healthcare REIT Community Healthcare Trust Inc. traded at the greatest premium to NAV, at 38. percent.

Specialty REITs Raise Most Capital Year-to-Date

The specialty sector raised $25.9 billion in capital year-to-date through Sept. 29, with communications REITs raising more than 40 percent of that total, according to S&P Global Market Intelligence data.

Industrial, Self-Storage REITs Performing Well

The two sectors were among the leaders of all publicly traded U.S. equity REITs in terms of the last 12 months funds from operations, according to S&P Global Market Intelligence data.