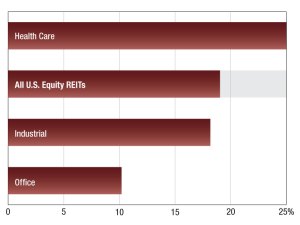

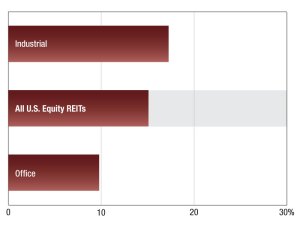

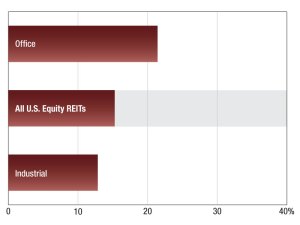

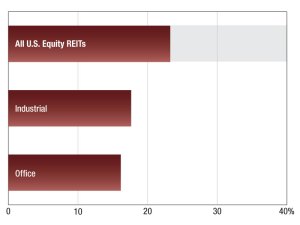

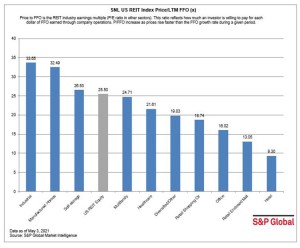

Price/LTM FFO

2024 Commercial REIT Values

S&P Global Intelligence’s latest snapshot of REIT performance. Read the report.

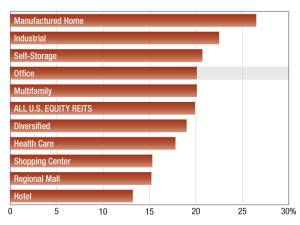

2020 REIT Values

As of Sept. 30, the manufactured homes sector led all publicly traded U.S. equity REIT sectors in terms of the funds from operations multiple for the last 12 months.

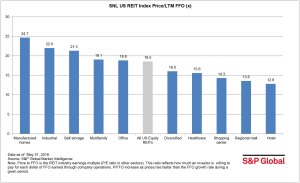

2019 REIT Values

The manufactured homes sector led all publicly traded U.S. equity REIT sectors in terms of the last 12 months.

2018 REIT Values

The multifamily sector had a 20.1x last 12 months funds from operations multiple as of Aug. 31, outperforming the broader US REIT index and six other REIT sectors.

Manufactured Home REITs Outperform Market

The sector had the largest last-12-months funds from operations multiple of all publicly traded U.S. equity REITs, at 24.7x, according to S&P Global Market Intelligence data.

Specialty REITs Raise Most Capital Year-to-Date

The specialty sector raised $25.9 billion in capital year-to-date through Sept. 29, with communications REITs raising more than 40 percent of that total, according to S&P Global Market Intelligence data.