CBL & Associates, PREIT Bankruptcies Show Coronavirus Toll

The retail property owners have filed for Chapter 11 protection after rent collections suffered during the pandemic.

As the U.S. gears up for the holiday shopping season, a pair of bankruptcies involving the operators of nearly 130 retail properties highlights the ongoing financial toll of coronavirus-related disruption of the nation’s malls.

CBL & Associates Properties Inc., one of the largest retail owners in the U.S., filed for Chapter 11 bankruptcy protection on Sunday, with a proposed restructuring that would slash debt by at least $1.5 billion. On the same day, Pennsylvania Real Estate Investment Trust, a smaller mall landlord focused primarily on the Mid-Atlantic region, filed a Chapter 11 petition to execute a prepackaged financial restructuring plan, after striking a tentative agreement with its bank lenders last month.

READ ALSO: Taubman Centers Sells 760 KSF Connecticut Mall

Both NYSE-listed REITs were forced to close their malls for months during the pandemic, squeezing rent collection and exacerbating financial concerns that existed prior to the crisis. CBL’s shares had already dropped below $1 in 2019, as the regional mall owner focused on secondary and tertiary markets faced familiar challenges from the rise of e-commerce, retailer bankruptcies and store closures. PREIT saw its stock fall by more than 20 percent in late February to a multi-year low, after posting weak performance for 2019.

Rent collection is rebounding after the companies have reopened their properties and customers are slowly returning to malls. CBL’s rent payments fully recovered by September, according to a regulatory filing cited by the Wall Street Journal, after plunging to 27 percent of the company’s billed monthly rent in April. The company also said that some tenants have begun to pay past due rents.

PREIT announced at the start of October that it had collected 67 percent of cash receipts due in the second and third quarters. Cash receipts to date represented about 99 percent of third-quarter rents, including payments on previous months.

Struggling tenants

Chattanooga, Tenn.-based CBL owns or manages 107 retail properties totaling 66.7 million square feet across 26 states, primarily in the South and Midwest, including open-air and outlet centers. The company’s bankruptcy filing includes a proposal to give unsecured bondholders a 90 percent stake in CBL in exchange for lightening its balance sheet. CBL said in a statement that the comprehensive restructuring plan offered the best way for the company to emerge stronger and more stable.

Rather than going out of business, CBL plans to “continue to own and operate a portfolio of market-dominant shopping centers with a vision to transform our properties from traditional enclosed malls to suburban town centers,” the company said in a statement.

More than 30 of CBL’s tenants have filed for bankruptcy this year, including J.C. Penney, Ascena Retail Group, GNC Holdings Inc. and Stage Stores Inc. J.C. Penney revealed in October that it would permanently close 144 stores across the U.S., while another tenant, Macy’s, announced in February that it would shutter 125 stores over the following three years.

Open for business

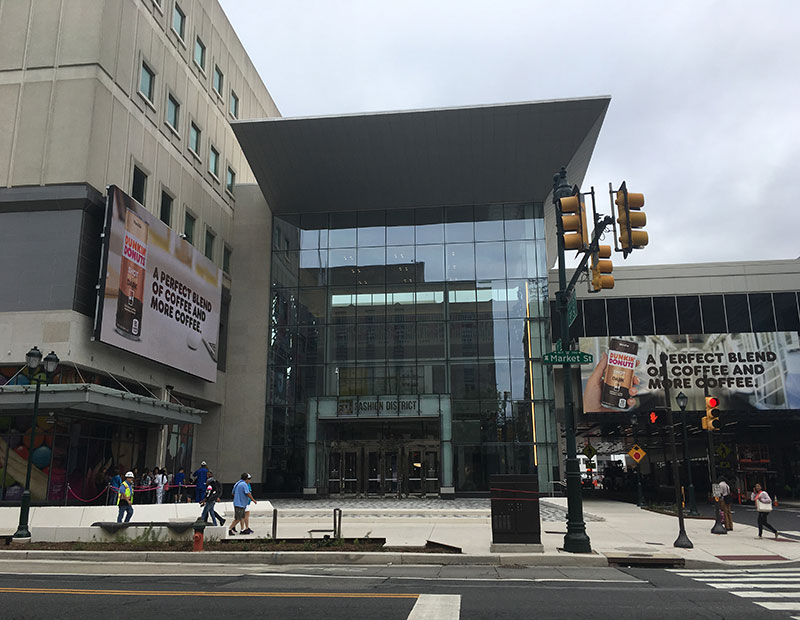

PREIT, the largest mall owner in Philadelphia and its surrounding counties, owns and operates more than 22.5 million square feet of retail space across 19 properties in eight states, according to its corporate website. The REIT’s reorganization plan, which has 95 percent lender support, includes the infusion of $150 million of new capital to support the business, with a strategy to continue to improve its properties and introduce new uses.

PREIT reopened all of its malls by July 3, including Fashion District Philadelphia, a landmark redevelopment spanning 900,000 square feet of space that a joint venture of the REIT and Macerich launched in September 2019. In its announcement of the reopening, the company touted its new health protocols and contactless delivery options, as well as its portfolio occupancy rate of more than 80 percent.

PREIT noted in a March presentation that it had replaced 13 department stores in two years and had disposed of 18 lower-quality mall properties, roughly 40 percent of its previous portfolio, in five years. The company also has plans to add some 5,000 to 7,000 multifamily units in order to densify its malls.

You must be logged in to post a comment.