CBRE 2020 CRE Outlook Is Optimistic

A growing economy and jobs market combined with low interest rates and solid consumer confidence point to another strong year, according to CBRE researchers.

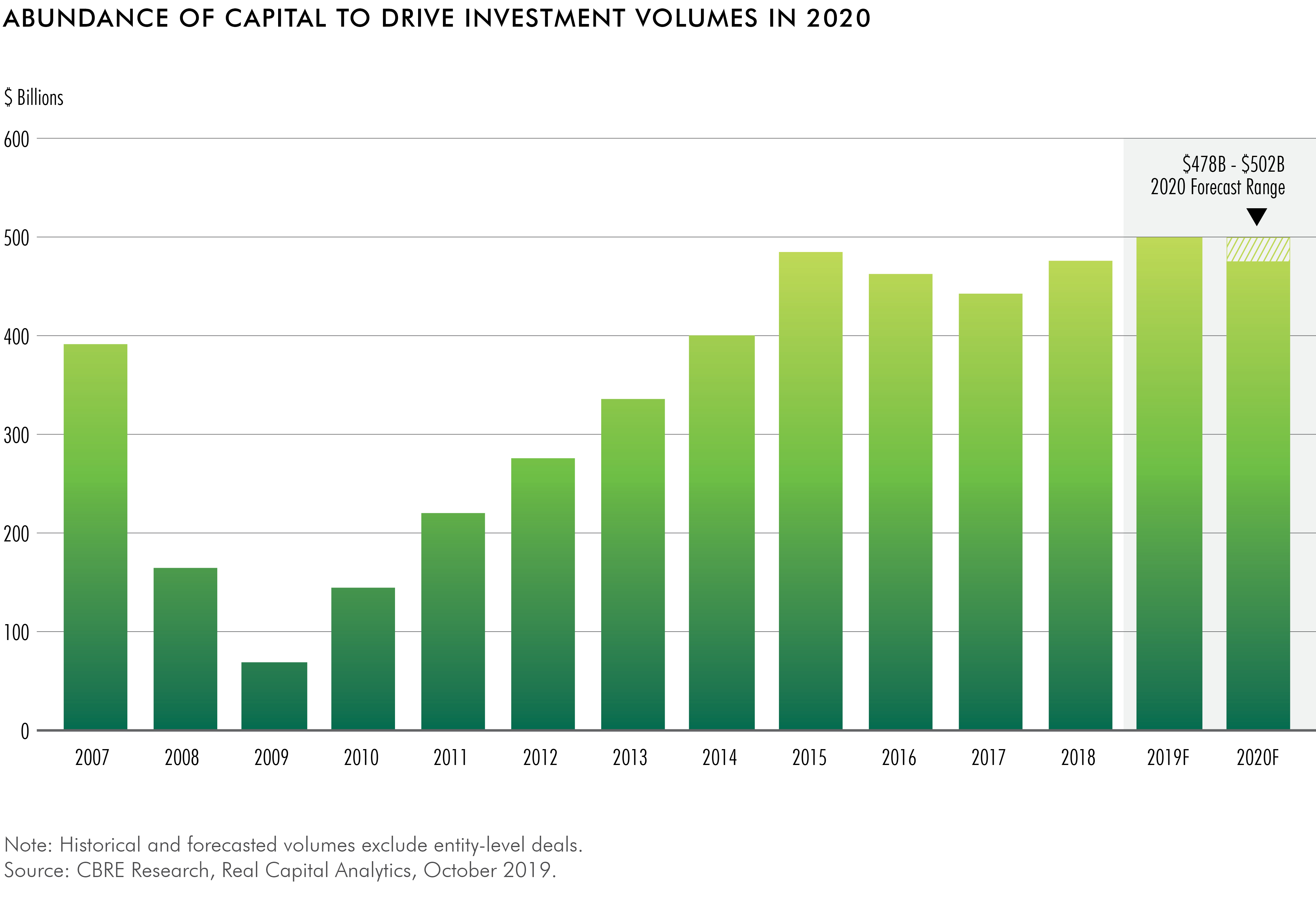

Abundance of capital to drive investment volumes in 2020. Chart courtesy of CBRE

Buoyed by an expanding economy, robust job market, low interest rates and solid consumer confidence, CBRE’s commercial real estate forecast for 2020 projects gains in office, retail, logistics and other sectors. The 2020 Real Estate Market Outlook notes there are still underlying uncertainties about trade negotiations and the upcoming presidential elections but not enough to have major impacts on most of the CRE industry in the coming year.

“Consumers are confident, the decline in the manufacturing sector seems to be bottoming, interest rates are down, governments around the world are spending more. The trade war and Brexit are headwinds, but even these have moderated recently. I am increasingly optimistic for 2020,” Richard Barkham, CBRE’s global chief economist and head of Americas research, told Commercial Property Executive.

READ ALSO: CRE Finds Clarity in the Long View

The forecast looks at the 2020 trajectories for capital markets and six real estate sectors—office and occupier, industrial and logistics, retail, multifamily, alternatives and data centers. Barkham said they expect to see resilience across asset classes like office, retail and multifamily based on demand. The report also predicts transaction volumes and capitalization rates will stay relatively stable in 2020.

Richard Barkham. Image courtesy of CBRE

Stable returns generated by U.S. commercial real estate will be even more attractive in 2020, when global bond yields are expected to remain extremely low and equity markets are likely to be more volatile, the report notes. CBRE expects investment volume to reach between $478 billion and $502 billion, down slightly between 5 percent and 10 percent from 2019 but still enough volume to make it one of the strongest years on record.

One aspect of capital markets that is expected to improve is foreign investment, which should rebound after a pullback in 2019. Much of that foreign capital will be looking for assets in “safe haven” core markets.

“The cost of hedging the U.S. dollar has fallen. Overseas investors like the resilience of the U.S. and continued growth in most of the main real estate sectors,” Barkham told CPE.

Sector-By-Sector Preview

Office and Occupier: CBRE expects a slight increase in the national vacancy rate and slowing of rent growth to 1.6 percent gain as growth of office-using jobs drops from about 1.5 percent to 0.3 percent. Markets that should see the most jobs growth are in Texas—with Austin expected to see a 2.4 percent increase—Dallas-Fort Worth a 1.9 percent increase and Houston a 1.6 percent increase. Tech jobs are driving much of the new office construction in markets like Austin; San Francisco; Salt Lake City; San Jose, Calif.; and Nashville, Tenn. Markets with high rates of net absorption include San Jose, Salt Lake City and Austin. Los Angeles is expected to see the most rent growth due to a low number of new office completions.

The flexible-office sector is projected to grow by 13 percent in 2020, down from about 23 percent in 2019. Part of the drop comes from WeWork tempering its growth after its botched IPO and ouster of its CEO. But CBRE expects flex office inventory should be about 87 million square feet by the end of 2020, led by flex operators with sound operating models. Landlords may get more control over flex operations in their buildings next year as they seek to hedge risk.

Industrial and logistics: CBRE expects net absorption to be lower in 2020 due to extremely low vacancy rates and limited space options in several markets. The vacancy rate is expected to remain near historic lows and CBRE is seeing higher-than-normal renewal rates particularly in markets with the lowest vacancy rates. The markets that are seeing new construction can expect to see higher rents. New Class A warehouses and smaller light-industrial warehouses are seeing rents rise. Markets to watch include secondary markets like Charlotte, N.C.; Cincinnati; Denver; Louisville, Ky.; Portland, Ore.; St. Louis; Orlando and Tampa, Fla.

Retail: Consumers may be more cautious next year but one group that is returning to the malls is teens and others who are part of Gen Z. They are combining online research and interaction with in-store experiences. They may find more focus on healthcare, beauty and fitness and increasing use of pop-ups to test new markets and brands. CBRE expects thousands of new stores to open nationwide in 2020, including brands that started online. Struggling malls are being transformed into mixed-use town centers offering multifamily residences, hotels, offices, co-working spaces, sports facilities, public event spaces, recreation and entertainment and educational uses. Rents and net absorption are expected to have small gains due to relatively little new construction.

Multifamily: Some cooling is expected in the sector as new supply outpaces demand leading to the vacancy rate rising by 20 bps to 4.5 percent and rent growth reaching 2.4 percent, down slightly from the long-term average of 2.6 percent. Developers will remain active. Completions are expected to be similar to 2019 at about 280,000 new units. Development is also occurring in suburban markets, which is expected to outperform urban next year with lower vacancy and higher rent growth. The top four markets expected for best performance in 2020 are Austin, Atlanta, Phoenix and Boston. Smaller markets are also expected to outperform with rent growth of 4 percent or higher, including Albuquerque, N.M.; Birmingham, Ala.; Colorado Springs, Colo.; Greensboro, N.C.; Memphis, Tenn.; Dayton, Ohio; and Tucson, Ariz.

CBRE notes new rent regulations enacted in New York, California and Oregon in 2019 are expected to spread to other places in 2020 like Illinois and Washington state. Some locations such as New York City and Los Angeles have seen investment drop due to new rent controls.

Alternatives: Investments in alternative assets like self storage, data centers, medical offices, life sciences facilities, senior housing and student housing have grown to 12.5 percent of all CRE investment in 2019 from 6 percent in 2007. Those investments are expected to continue with volume of about $59 billion expected in 2020. Healthy market fundamentals and impressive long-term growth are drawing more capital to the specialty sectors.

Data Centers: New data center capacity in primary markets is expected to increase by 17.3 percent in 2019. Those markets—Atlanta, Chicago, Dallas-Fort Worth, New York Tri-State, Northern Virginia, Phoenix and Silicon Valley—accounted for more than 56 percent of the record annual absorption in 2018. Competition is expected to increase in those markets in 2020, creating aggressive leasing scenarios. There may be an uptick in demand in secondary and tertiary markets as the sector responds to the integration of 5G and other new technologies.

You must be logged in to post a comment.