CBRE Finds Ongoing Strength in CRE Lending

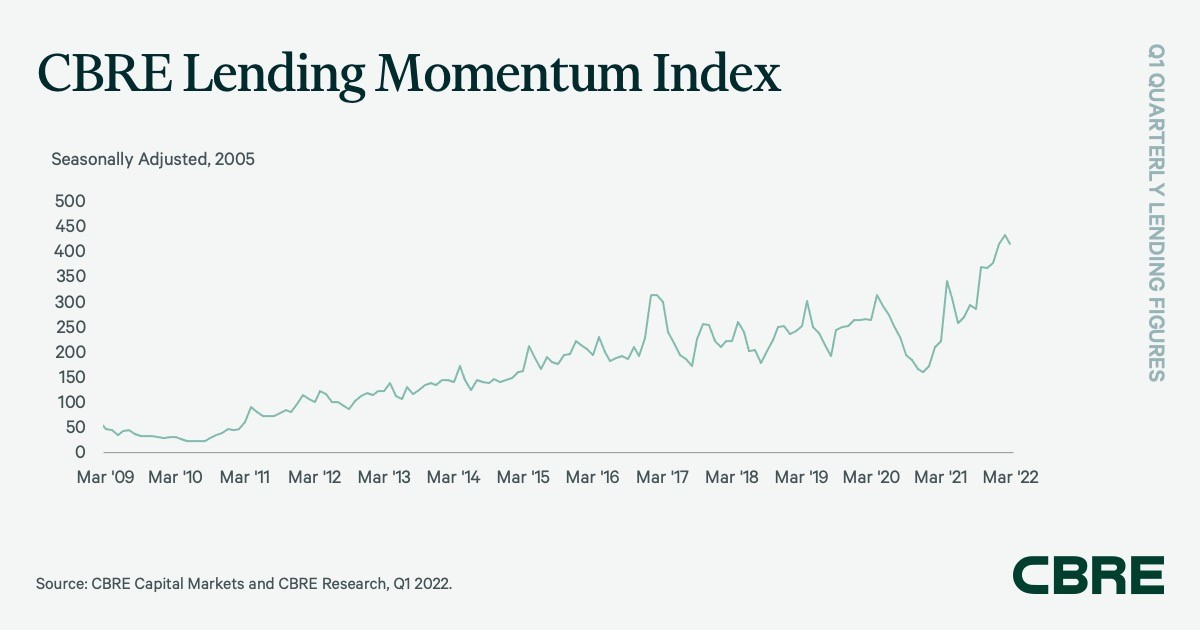

The company’s Lending Momentum Index in the first quarter rose by nearly 70 percent year-over-year.

Even as surging inflation and the war in Europe have come to dominate the headlines, commercial real estate lending activity continued to increase in the first quarter, according to a new report from CBRE.

Lending activity continued to rise in the first quarter of 2022, despite rising prices, increased interest rates and the war in Ukraine, according to Brian Stoffers, global president of Debt & Structured Finance for Capital Markets at CBRE.

He added that, following a strong start to the quarter, some lenders paused during the early onset of the war as credit spreads and loan indexes widened with the uncertainty. But, then, many lenders became very active again, quoting with generally wider spreads, in line with corporate bonds.

The CBRE Lending Momentum Index tracks the pace of CBRE-originated commercial loan closings in the U.S. The index rose by 5.5 percent quarter-over-quarter and 69 percent year-over-year. With these latest increases, the index is now 50 percent above its February 2020 level, just as the pandemic started to hit. The index closed the first quarter of this year at 438; its base value of 100 represents average lending activity for 2005.

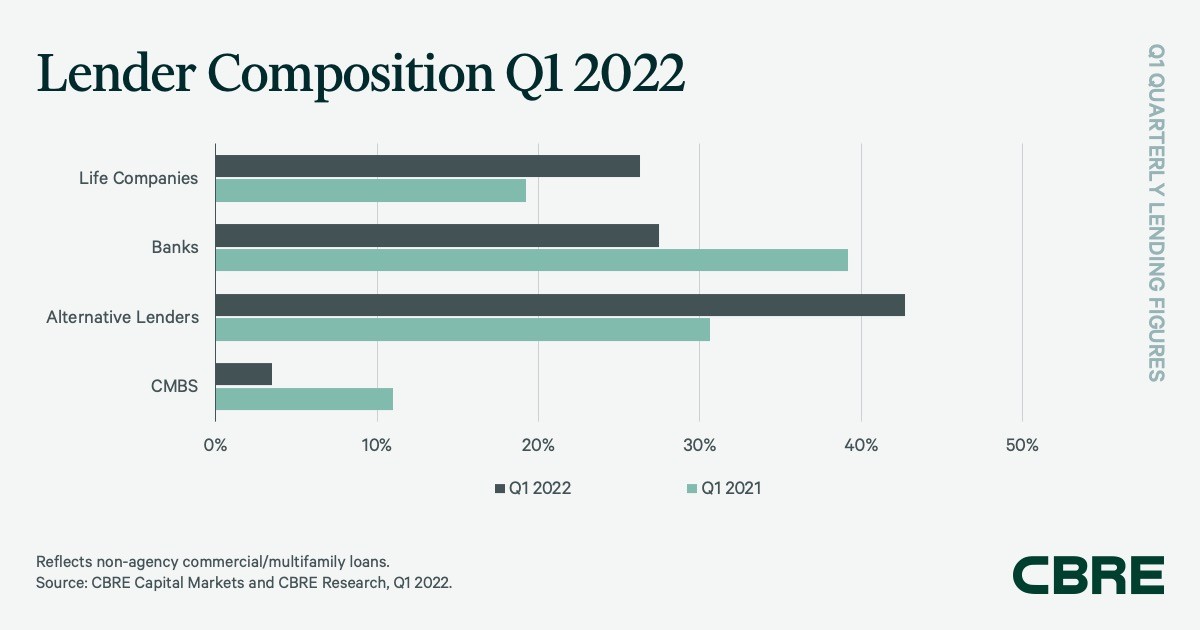

CBRE found that alternative lenders, such as debt funds and mortgage REITs, had the predominant share of non-agency loan closings in the first quarter: 42.7 percent, up sharply from 30.6 percent a year prior. These transactions were primarily floating-rate multifamily bridge loans with an average term to maturity of 43 months.

Banks comprised the second-most-active lending category in the first quarter, at 27.5 percent of loan closings in, down from 39.2 percent a year ago. Bridge and construction loans made up two-thirds of bank financing, with permanent loans making up the rest.

Life companies accounted for 26.3 percent of closed non-agency loans in the first quarter, up from 19.2 percent a year ago. Most of these were permanent fixed-rate loans with an average term to maturity of 108 months.

The securitized side

CMBS conduit loans accounted for the remaining 3.5 percent of non-agency loan volume in the first quarter, a sizable drop from 11 percent a year ago. Industrywide CMBS issuance, however, totaled $20.8 billion, double the amount in the first quarter of 2021.

Many alternative lenders use collateralized loan obligations to term finance their loan portfolios, and these totaled $15.2 billion in issuances in the first quarter, again a sharp rise from 12 months earlier, when they totaled $8.9 billion.

Finally, underwritten cap rates and debt yields edged down in the first quarter, on slightly lower loan-to-value ratios. And the percentage of loans with interest-only terms increased a bit, to 68.3 percent in the first quarter from 62.5 percent in the fourth quarter.

You must be logged in to post a comment.