CBRE Survey Indicates Optimism by Investors

First-mover advantages for 2025 will drive the market.

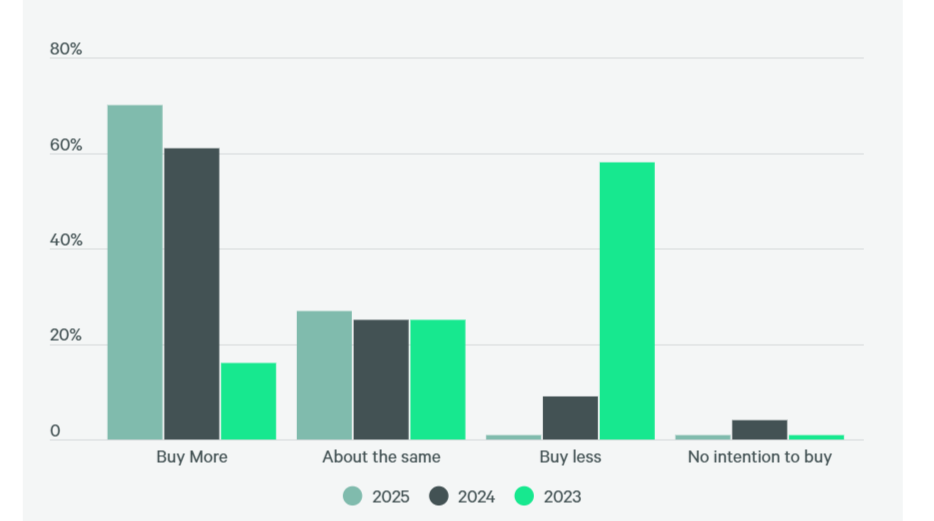

A survey of buyer intentions in 2025 vs 2024 and 2023. Chart and data courtesy of CBRE Research

More capital will be injected into the commercial real estate market this year as pricing is expected to be favorable for investors, according to a new survey from CBRE.

The Investor Intentions Survey showed that interest rate shifts will present challenges, but not enough to bother otherwise optimistic sentiments.

This year, 70 percent of respondents plan to acquire more assets than a year ago and 75 percent said they are even more positive about their own plans. More than half said they are experiencing recovery within their portfolios.

“We are now roughly three years removed from the peak pricing seen in 2022, and property valuations have adjusted to align with the higher interest rate environment,” Kevin Aussef, Americas president of investment properties for CBRE, told Commercial Property Executive.

READ ALSO: A New Dawn for CRE Investing?

“There is a growing consensus that the market has largely stabilized and avoided a significant downturn. On the fundamentals side, the resilience of the US economy is evident in strong leasing activity across most property sectors. Just 18 months ago, there was widespread concern about declining demand and oversupply in many markets, but those fears have largely subsided.”

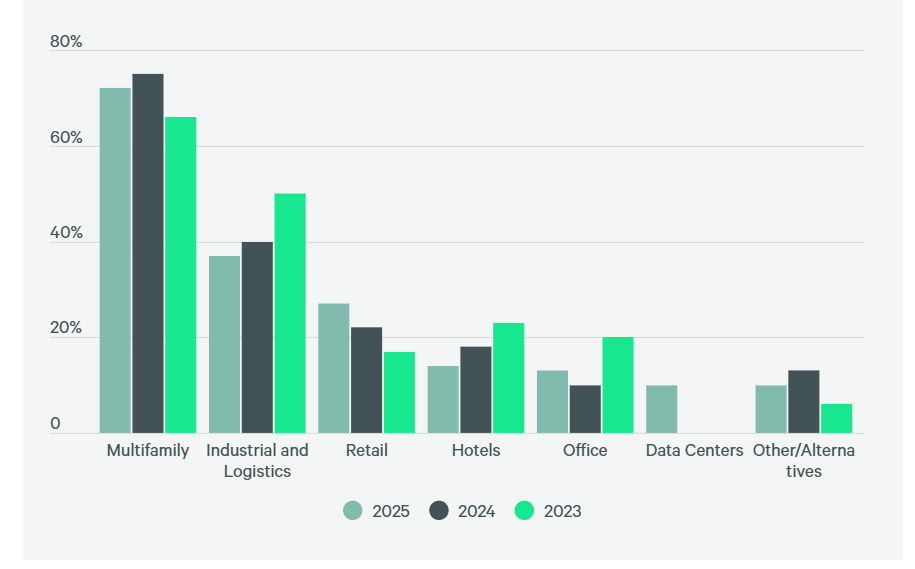

Three-quarters of CBRE respondents said that multifamily remains their top target, followed by industrial and logistics assets at 37 percent, retail at third and office at fourth.

Overseeing CBRE Investment Management are newly appointed co-CEOs Andrew Glanzman and Adam Gallistel.

Sun Belt sees consolidation

Multifamily buyers in Sun Belt markets consolidated into a barbell-like distribution on the risk curve since the rate hikes in 2022, according to Adam Nourafchan, a managing partner at Lunada Rose Partners.

“Core buyers jumped in despite substantial negative leverage with the thesis that either rents would grow or cap rates would drop, while opportunistic buyers were anticipating a wave of distress stemming from aggressive COVID-era bridge loan maturities,” Nourafchan told CPE.

“After nearly three years, cap rates have not dropped, and there has been minimal distress, causing disillusioned investors from both strategies to shift toward a medium-risk approach where they can increase value through a hands-on capital improvement strategy rather than relying on market factors that are out of their control.”

John Felker, Co-CIO of T2 Capital Management, told CPE his firm has seen increased interest in retail properties.

“With higher cap rates on retail properties, the asset class has been more resilient to the run-up in interest rates,” Felker said.

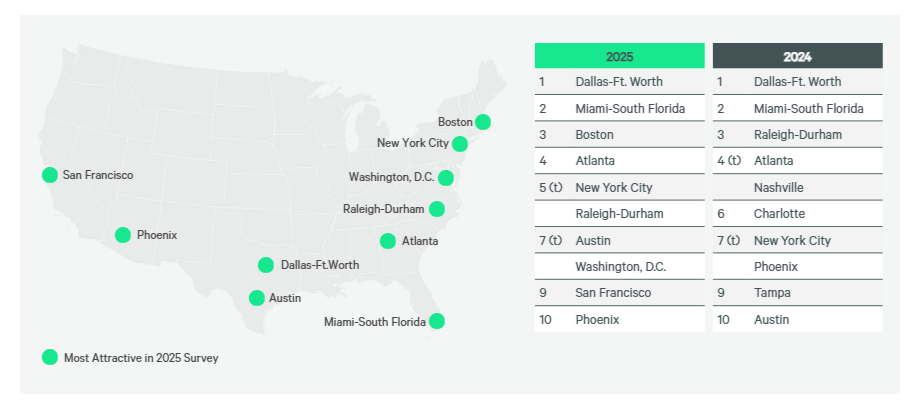

Top investment markets

CBRE said investors are focusing on gateway and high-growth Sun Belt markets, with Dallas taking the top spot, followed by Miami. Boston, Washington, D.C., San Francisco, Atlanta, Raleigh-Durham, Austin and Phoenix are also highly rated.

“Sun Belt markets have been the go-to markets for developers for years now,” Felker said.

“While interest in these markets remains high, concerns about new supply getting absorbed in these growth markets are a significant concern in the near term. Due to the run-up in interest rates and construction costs, the new supply should be down significantly in 2026.”

Boston stands out as a highly appealing market for investors, supported by its strong supply-demand fundamentals and sustained rent growth potential, according to Matt Ranalli, Co-Founder and chief investment officer of Jones Street Investment Partners.

The Northeast/Mid-Atlantic regions have demonstrated remarkable stability over the past 25 years, with an average annual rent growth of roughly 3.2 percent, comparable to faster-growing markets like the Southeast and Southwest but with less volatility and economic sensitivity, he said.

“Chronic housing undersupply in these markets, exacerbated by regulatory burdens, high land and labor costs and NIMBYism, (and) creates a compelling case for multifamily investment, in particular,” Ranalli told CPE.

Millennials and Gen Z are using social media to learn about passive income and smart investing, Benjamin Gordon, managing director at Continental Ventures, told CPE. “They are investing in tangible real estate as a way for them to invest in their futures while baby boomers are cashing out,” he told CPE.

“Real estate will always be a fundamental need, and whether one rents or owns, spending money on a comfortable home will always be important. Even as an exciting wave of investments grows in AI and crypto-currency, people will always need somewhere to live, work, and play.”

Top investor challenges

An uncertain path for interest rates, elevated and volatile long-term interest rates, and higher operating costs are the three top challenges for investors, CBRE showed.

Recession and a wider gap in buyer and seller expectations are less of a worry, CBRE said.

“In mid-2024, there was increasing optimism regarding a drop in interest rates and a resulting increase in transaction volume,” Felker said, “but the move higher in the long end of the yield curve at the end of the year has significantly dampened those expectations.”

You must be logged in to post a comment.