CBRE Tentpole Report: Future-Proofing the Urban Core

Insights into the successes and challenges of re-energizing CRE in city centers.

Outside of creating the nicest amenities, programming and work experiences, the cure for high office vacancy rates, and in turn much of the nation’s struggles with a post-pandemic urban exodus, lies not only in a revision of locations and surroundings, but a recognition and adaptation to larger structural trends within the cities themselves.

Such a prescription can’t come soon enough. According to data from CBRE Econometric Advisors, average downtown office vacancy rates hit a record high of 19.3 percent in the first quarter of this year, while urban apartment vacancy rates have gone up by 60 basis points.

Still, many urban areas have numerous success stories, with mixed-use districts which often include office, multifamily retail and recreational space, posting vastly improved fundamentals in comparison to their counterparts. In a tentpole report and accompanying webinar from CBRE titled Shaping Tomorrow’s Cities: Fostering Resilient and Vibrant Urban Environments, several experts provided a policy and development blueprint for many of the nation’s largest and fastest-growing urban areas and their surroundings, which aims to ensure their long-term livability and appeal.

Shifting sands

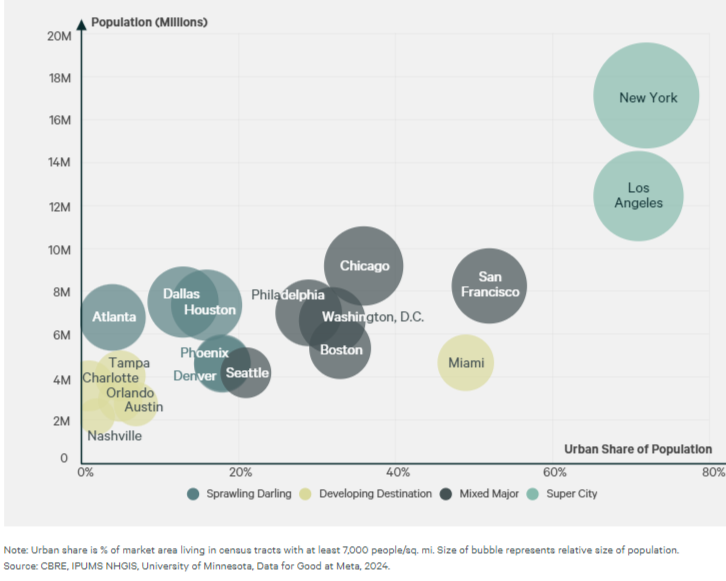

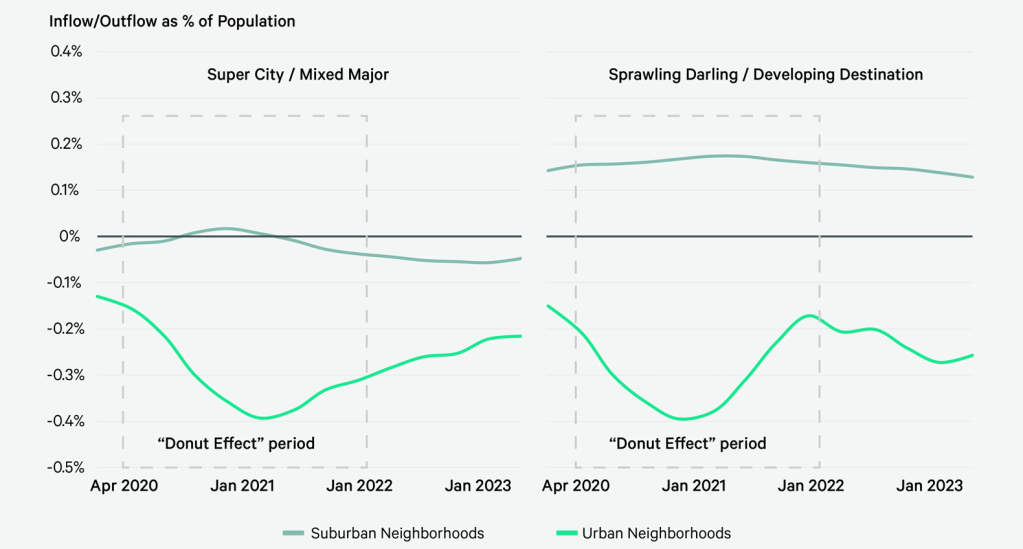

The report, which surveyed 68 mixed-use districts within 19 metros, sectioned the latter within four separate categories that correlate the urban share of the population relative to its total size. These metrics provide a baseline for understanding their economic, geographic and demographic characteristics, and how they inform key fundamentals from resident in-migration to office vacancy. Underpinning all of these results are an aging Millennial population with a preference for living in the suburbs, alongside the omnipresence of hybrid work.

“These trends will continue to challenge the urban core of these markets, because they rely on people continuing to live and work in them in order to keep them vibrant,” explained Julie Whelan, CBRE’s global head of occupier thought leadership.

New York City and Los Angeles, referred to as Super Cities, are unmatched in size, urban populations and commercial footprints, with 70 percent of their respective populations living in areas classified as urban. Mixed Majors such as Chicago, San Francisco, Boston and Philadelphia are older, more established markets with large urban centers and business mainstays, while Sprawling Darlings such as Atlanta, Dallas, Phoenix and Denver have large land areas that have seen substantial population and employment growth, particularly this decade. The smallest, for both size and urban share of population, are Developing Destinations such as Miami; Austin, Texas; Charlotte, N.C.; and Nashville, Tenn.

In contrast to its size and location on the chart’s axes, these cities are, in fact, seeing the most dramatic post-pandemic urban population growth and vibrancy, informed by lower costs of living and more relaxed regulatory environments. The report shows that Developing Destinations have experienced the most substantial downtown recoveries, regaining 81 percent of the activity recorded from March through June of 2023 vs. the same period in 2019. “They have lots of growth around office-using jobs, as well as more commercial development to support this growth,” Whelan said.

The data backs up this forecast, too. “Long-term, if you look at the drivers of demand, Texas, Florida and other Sun Belt markets receive our most favorable job growth and other favorable population growth outlooks,” added Matt Vance, the firm’s head of multifamily research.

Are mixed-use districts and office conversions the cure for high office vacancy?

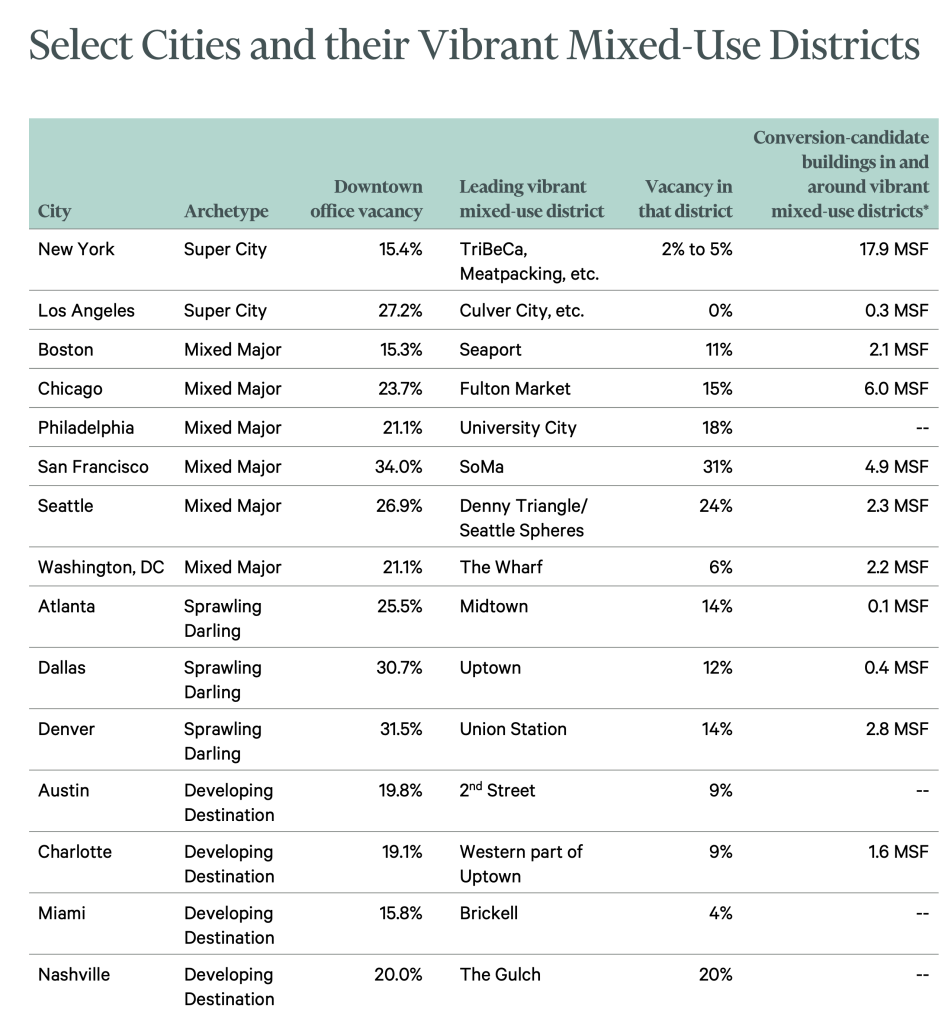

But equally important to seeing where the growth and positive fundamentals are occurring is understanding both how and why. Across the board, from New York City to Nashville, vibrant, commercially diverse mixed-use districts vastly outperform downtown areas, posting average vacancy rates that are several orders of magnitude lower.

For instance, TriBeCa’s and Chelsea’s Meatpacking districts, which host tech companies and diverse retail offerings that line walkable, transit accessible streets post vacancy rates of 2 to 5 percent in comparison to downtown’s 15.4 percent. Even more dramatic are Los Angles’ Culver City district and Miami’s Brickell, which respectively have vacancy rates of 0 percent and 4 percent. Whelan attributes some of these discrepancies to a “bifurcation of the office market.” “Sections of the city that had been built purely for office work are no longer thriving to the degree that they did, because the purpose of office work is shifting,” Whelan added.

READ ALSO: Quality Is the Future of Office, Says KBS Executive

Of course, the ability to build a city section akin to Boston’s Seaport or Uptown Dallas, complete with thousands of multifamily units and layers of retail space from the ground-up is nigh impossible in many of the surveyed markets. Consequently, the report reveals that 25 million square feet of office space is under conversion, 84 percent of which is oriented toward multifamily.

According to the report, these conversions would do little to reduce inventory, while reducing office vacancy rates by as much as 30 percent. Of the surveyed cities, Dallas has the highest conversion pipeline, set to convert 13 percent of its downtown inventory. At the same time, it posts a roughly 30.7 percent vacancy rate.

Within these numbers, authors of the report believe that the best candidates for conversion are more matters of location than the physical building. The report found that there is north of 43 million square feet suitable for conversion within Class B and C office spaces, which it refers to as “zombie buildings:” under-capitalized, yet well-located office properties with high vacancy. The report estimates that the conversion of these properties could add as many as 43,500 new 1,000-square-foot residential units. This could bolster housing affordability, foot traffic and add further vibrancy to already thriving mixed-use districts.

Easier said than done

At the same time, Whelan was cautious about building and converting with reckless abandon. “If you build it, will they come? That’s not necessarily true,” Whelan explained.

For Whelan, the first questions regarding any mixed-use development or office conversion lie within understandings about a city’s economic, demographic and environmental challenges, which can only be met by a mix of public and private collaboration. The report finds six markers for an urban core than can remain prosperous for the foreseeable future. These data points, both material and immaterial, include economic strength and diversity, strong demographic trends, quality of life, resilient infrastructure, effective city governance and a distinct cultural identity.

“A conversion project is not just about the building, but also the location context where it is situated,” explained John Stephens, one of the report’s authors and the firm’s senior director of Americas Consulting. “It’s a matter of what should the identity and feel of a neighborhood become, rather than relying on individual developer efforts,” Stephens concluded. This, coupled with mainstay headwinds such as high interest rates and construction costs, make conversions a form of treatment, but not necessarily a cure for urban vacancies.

You must be logged in to post a comment.