CFO Corner: Digital Reality is Ready for Takeoff

The CRE segment may be a late entrant when it comes to using digital reality technologies, but signals from executives are pointing to robust future adoption plans that could drive more operational efficiencies for the industry, says Deloitte’s Steven Bandolik.

Digital reality is booming, and you don’t have to look far to see its mass-market appeal among consumers, many of whom are enamored of games, films and the latest products featuring the technology.

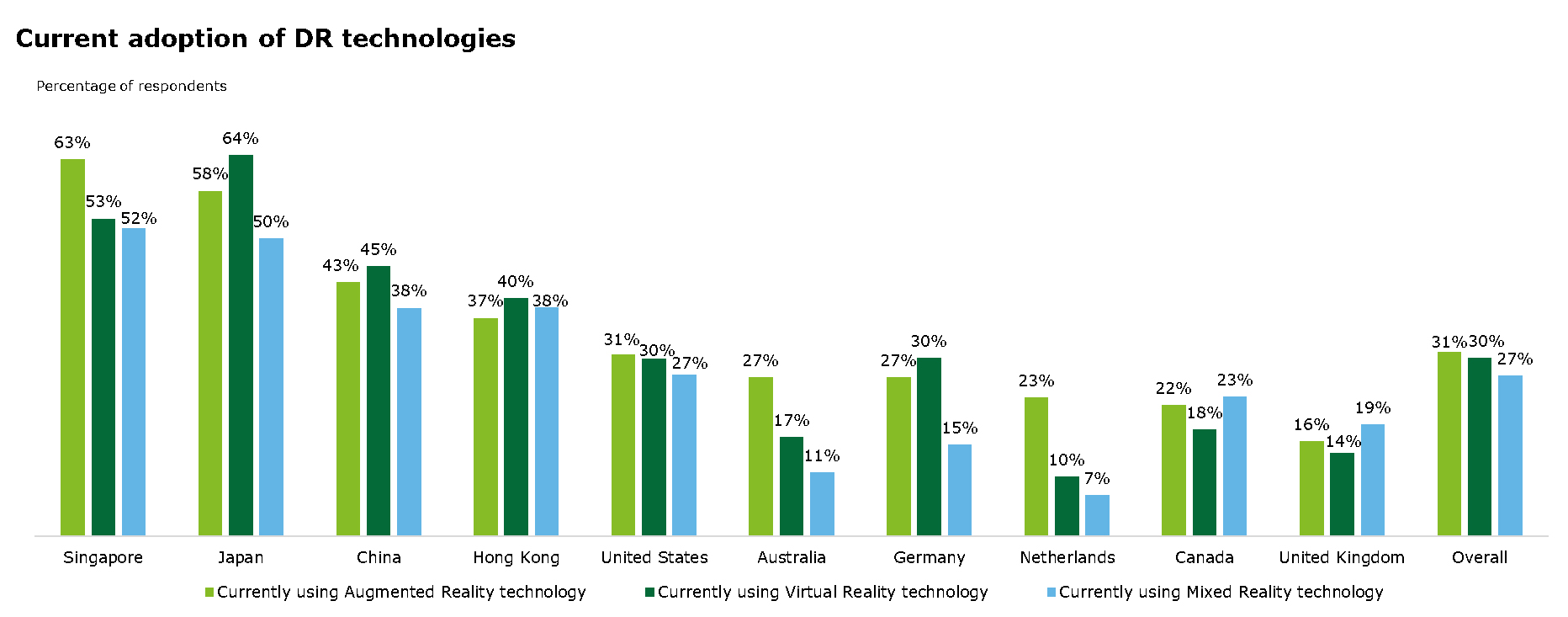

While wildly popular in the retail industry, digital reality (DR)—which encompasses augmented reality (AR), virtual reality (VR), mixed reality, 360-degree videos, and other immersive technologies—is, generally speaking, still in its primordial stage. Just one-third of CRE executives globally currently use any DR technologies, with the highest adoption rates among institutional investors and managers and large brokers, according to our 2020 outlook report. As the chart below indicates, the U.S. lags many Asia-Pacific countries in adopting DR technologies.

DR applications in the industry got their start with residential brokers and agents, who continue to use it for virtual property tours and showcasing space design. Current use spans more CRE segments, but is still mostly relegated to the marketing and sales of existing and future development projects.

Digital reality’s potential value for the CRE industry extends far beyond sales and marketing, however. The technology can be leveraged to drive operational efficiency and attract, retain, and engage tenants during the development phase of a project. The good news is that nearly 60 percent of CRE executives report that their companies plan to use DR in the future, a sign that the technology is primed for takeoff.

New frontiers

In addition to sales and marketing, here are two ways CRE executives can use DR technologies to have a meaningful impact:

-

- DR as a tool for property development: Owners and developers can use prototyping tools and offer potential tenants a futuristic and highly customized experience during pre-development, more so than is possible with paper-based plans and traditional computer-aided design models. For instance, owners and developers can use VR technologies to adjust spaces and finishes based on tenant reactions, monitor progress against plans and suggest modifications, and ultimately sell-in residential, office, industrial, and restaurant properties during the development phase. Considering that 58 percent of executives consider tenant preferences during the pre-development stage, DR technologies could enable more CRE organizations to dig in even deeper on this commitment, especially for early-stage builds.

- DR as a tool for efficiency throughout project development: From the standpoint of operational efficiency, DR technologies can streamline project design by enabling virtual collaboration in a more immersive set-up, while CRE executives can virtually interact with plans to see the impact on building structure and design. Offsite, DR can be used for worker training through pre-construction simulation. And at the job site, it can increase worker precision and accuracy via images of final plans; enable supervisors to virtually monitor onsite activities using a 360-degree field; and, in case of injury, create virtual touch points for paramedics and doctors.

DR technologies have immense potential for CRE firms through all stages of development. That said, the technology is constantly evolving, so its true potential remains unknown and full of possibility. Any new technology brings possible information and privacy risks related to intellectual property, including development plans.

So while it’s important to ask key questions like, “Which DR technologies are likely to be most beneficial for my portfolio?”, CRE executives must also probe the risks of these technologies and ensure that effective policies are in place to maximize the technology’s success.

Steven Bandolik is a managing director with Deloitte Services LP and a senior leader in Deloitte’s real estate practice. He provides advisory services in capital markets (debt and equity), corporate finance, mergers and acquisitions, investments, strategy, restructuring and reorganization, and asset recovery. Bandolik brings more than 30 years of real estate investment, finance, development, and asset/property management experience, both as a leader and as a strategic adviser.

Kevin Marrongelle is a managing director with Deloitte Consulting LLP in Deloitte’s technology transformation practice. Marrongelle provides consulting services in banking and capital markets across global financial services firms, bringing more than 25 years of high-impact transformation experience focused on using technology to achieve desired business outcomes.

You must be logged in to post a comment.