Chicago Office Market Faces a Bumpy Start in 2025

Development stalled while asset values continued to drop, the latest CommercialEdge data shows.

Chicago’s office market ended 2024 with few positive outlooks. New construction was muted, while overall asset values declined. Although office utilization remained low, high-quality space was still in demand, as highlighted by some significant lease deals.

There were some bright spots, however, including the launch of a new framework aimed at fast-tracking office-to-residential conversion projects. As the sector continues to transform, 2025 looks like it might be another challenging year for office, the latest CommercialEdge report suggests.

New construction stalled in 2024

At the end 2024, Chicago’s office market held just 870,000 square feet of office space under construction. This was 0.3 percent of existing stock, 50 basis points below the national figure. Utilization rates leveled off and hybrid work is here to stay, but there are still pockets of demand for high-quality space.

Chicago lagged all its peer markets in terms of office space under construction. Boston (3.4 percent of stock underway) and Miami (1.5 percent) led growth, followed by Los Angeles (0.7 percent) and Manhattan (0.6 percent).

Fulton Street Cos.’ 919 West Fulton remained the largest office building still under construction at the end of the year. In July, general contractor Skender topped out the $300 million project, which encompasses 369,000 square feet. Harrison Street will anchor the asset, having preleased 112,000 square feet.

Developers completed seven projects encompassing slightly more than 1 million square feet of office space in 2024. This amount was down more than 50 percent year-over-year and represented 0.3 percent of existing stock, 30 basis points below the national figure.

The largest office project completed in the metro last year was Sterling Bay’s 360 North Green in the West Loop. The 500,000-square-foot, 25-story building had been nearly fully preleased prior to completion, with Boston Consulting Group on the roster.

Construction starts were few and far in between last year across metro Chicago, as investors and developers are waiting for better economic circumstances. A total of six properties broke ground, encompassing just under 950,000 square feet.

City authorities emboldened office-to-residential projects

Office-to-residential conversions are growing in popularity among owners and investors in the sector, as they present an opportunity to infuse value in underutilized assets. In November last year, Chicago’s Departments of Planning and Development and Transportation sought to create a framework for these projects to take shape and benefit from Tax Increment Financing. Last month, the two departments officially launched this initiative, named A Vision for LaSalle Street, as it is focused on the area between Wacker Drive and Jackson Boulevard.

According to the city’s website, proposed conversions submitted for approval across the city totaled more than $750 million in total investments as of November last year, with nearly $250 million in TIF support already approved. These projects encompass some 1.6 million square feet of unused space, of which a significant share is office.

CommercialEdge’s Conversion Feasibility Index helps developers by ranking buildings across the largest office markets in the U.S., with the aim to identify the most likely candidates for office-to-residential conversion. At the beginning of this year, Chicago had 131 office buildings with a CFI score between 90 and 100, placing them in Tier 1—the highest in terms of conversion potential. These encompassed more than 1.5 million square feet of office space.

In October last year, R2 Cos. and Campari Group secured $28 million in TIF funding for the conversion of the office building at 79 W. Monroe St., in the city’s CBD. The 1913-built property is slated to include 117 residential units, with construction start scheduled sometime this year. This Tier 1 property boasts a perfect 100 CFI score, making it ideal for residential conversion.

Investment volume slightly grew while asset values declined

Investment activity across Chicago’s office market increased in 2024, with $1.1 billion changing hands, up 14.6 percent year-over-year. A total of 74 properties traded last year, encompassing 12.4 million square feet.

Average prices in the metro remained some of the lowest among similar markets. Chicago office buildings traded for an average of $85.13 per square foot in 2024. It was followed by Boston ($249.27), Los Angeles ($281.07), Manhattan ($369.33) and Miami ($400.07).

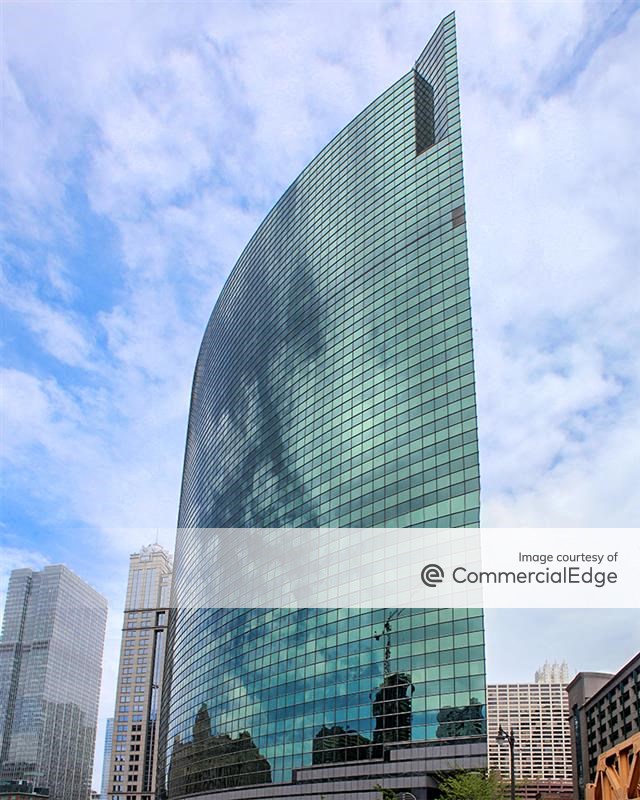

In June, Beacon Capital Partners acquired the office tower at 333 W. Wacker Drive for $125 million, or $144 per square foot. This remained the largest single-asset transaction in the metro last year. Another significant transaction was the $74 million acquisition of the 882,071-square-foot asset at 1400 American Lane by Sigma Plastics Group. At the start of last year, R2 Cos. paid $60 million for the 661,482-square-foot Crain Communication Building, at 150 N. Michigan Ave.

Asset values continued to drop across the metro. These three examples alone changed hands for a combined $259 million last year, which was a 50.9 percent drop in value from their previous total price.

Vacancy failed to improve

Vacancy across Chicago’s office market rose 70 basis points in 2024, to 18.8 percent at the end of the year. This was 100 basis points below the national figure. Some large lease agreements took shape across the metro last year, with high-quality space still in demand, either in newly constructed or established assets.

Chicago lagged all its peer markets in terms of vacancy. Miami’s rate was the lowest (15.2 percent), followed by Los Angeles (16.0 percent), Manhattan (16.6 percent) and Boston (17.0 percent).

In September last year, law firm Smith Gambrell & Russell signed a 57,000-square-foot agreement at 155 N. Wacker Drive, where it will relocate next year. The John Buck Co. is the owner of the 1.2 million-square-foot property.

Another high-profile deal closed in February, when Pinterest agreed to occupy 24,000 square feet at 10 and 120 S. Riverside Plaza, owned by Hines and Ivanhoé Cambridge. The Class A, 1.4 million-square-foot asset underwent a $75 million redevelopment.

Perhaps most indicative of the state of Chicago’s office market was a 100,000-square-foot agreement closed in January last year. Heitman signed a 10-year extension with tenant Mesirow at 353 N. Clark St. This represented a 65,000-square-foot downsizing from the financial services firm’s previous arrangement.

Coworking providers expanded their presence

Chicago’s office market had 6.9 million square feet of shared space in 2024, which represented 2.1 percent of its entire inventory. The metro’s growing coworking segment remained a bright spot, with demand at healthy levels. Chicago lagged some of its peers, but not by a lot. Miami had the most, at 3.8 percent of its office stock as coworking space, followed by Manhattan (2.3 percent), Los Angeles (2.2 percent) and San Francisco (2.2 percent).

In September, flexible workspace provider Expansive signed a deal for the 35th floor of Two Pru, where it aims to open its seventh location in the metro. The space was undergoing a renovation at the time. Expansive partnered with Wanxiang Real Estate Group and Riverside Investments for the new location.

You must be logged in to post a comment.