CMBS Delinquencies Decline As Forbearance Increases: Trepp

The decreasing overall national rate follows significant spikes in May and June.

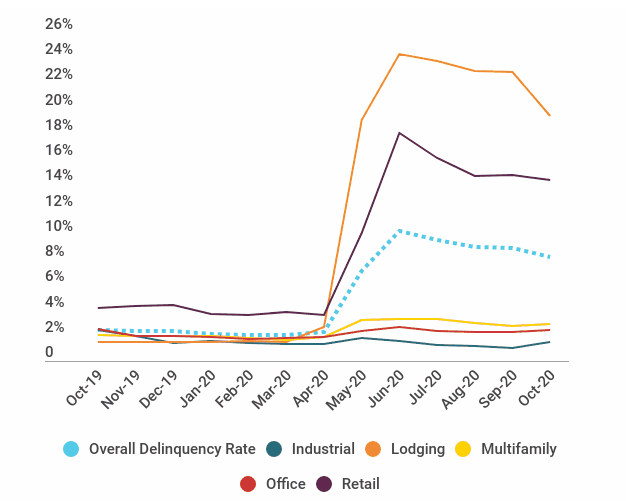

The Trepp CMBS delinquency rate fell for the fourth-consecutive month in October to 8.28 percent. The 64-basis-point drop from September’s rate comes on the heels of large spikes in May and June, but it is not a strong indication of the health of CMBS market.

READ ALSO: CMBS Delinquencies Continue to Drop: Trepp

“The delinquency drop since June has been influenced largely by a significant amount of loan forbearances,” Manus Clancy, senior managing director with Trepp, told Commercial Property Executive. “Without those forbearances, delinquencies would be considerably higher.”

Of the delinquencies, loans that were 30 days delinquent totaled 1 percent, marking a 40-basis-point decrease from September. Sixty-day delinquencies held relatively steady at .78 percent from 0.79 percent, while 90-day delinquencies dropped from 3.81 to 3.73 percent. Foreclosures increased slightly month-over month from 0.72 percent to 0.83 percent.

Sector-level deviations

At the sector level, the hardest-hit property types—lodging and retail—recorded drops in delinquency rates, with lodging seeing the greatest decrease, going from 22.94 percent in September to 19.43 percent in October. Trepp attributes the drop in hotel loan delinquencies to the large number of forbearances granted in the sector. Additionally, retail loan delinquencies declined from 14.76 to 14.33 percent.

The industrial sector logged the largest increase, with the delinquency rate climbing from 1.07 percent to 1.53 percent. However, even with the increase, industrial delinquencies remain extremely low. “The industrial segment is relatively small and can be influenced by a small number of new delinquencies. We believe this is a blip, not the beginning of a trend,” said Clancy. The delinquency rate for multifamily loans increased slightly month-over-month, going from 2.8 to 2.95 percent, and it went on the upswing in the office sector as well, rising from 2.28 to 2.49 percent.

The view ahead

Trepp does not anticipate any major changes to the CMBS delinquency rate as 2020 draws to a close. “We would expect it to be around the current level,” Clancy asserted. “As forbearances end, that will put upward pressure on the number. But we expect a rebounding economy to offset some of that pressure.”

Read the full report by Trepp.

You must be logged in to post a comment.