CMBS Late Payments Starting to Mushroom

The scope of delayed payments is expected to increase for loans secured by certain asset types, according to data released by the CRE Finance Council.

Late payments for CMBS loans backed by hotels and retail properties spiked in April, and market players are bracing for the problem to worsen in coming months.

READ ALSO: Crisis Moves Loan Servicers to Center Stage

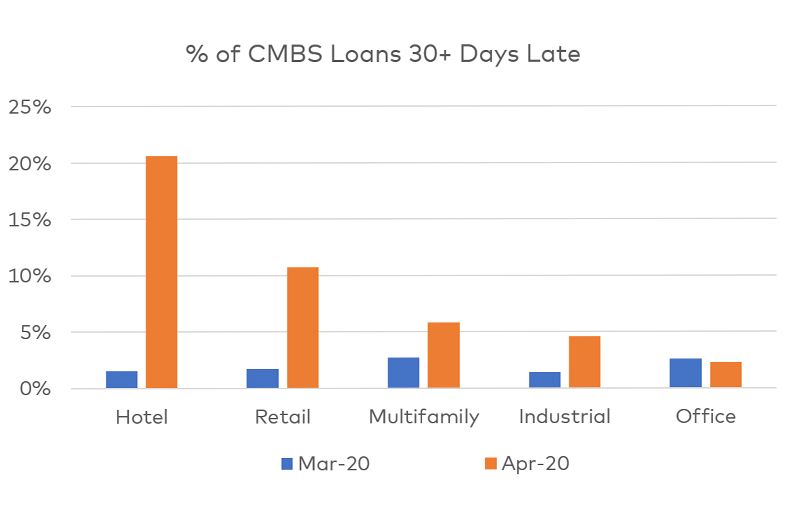

Data released by the CRE Finance Council on Friday found that more than 20 percent of hotel loans and 10 percent of retail loans in CMBS pools were more than 30 days late on mortgage payments as of April, up from less than 2 percent each the previous month.

The percentage of CMBS loans more than 30 days late increased much less sharply for multifamily (to 5.8 percent from 2.7 percent in March) and industrial properties (to 4.6 percent from 1.4 percent in March), according to Trepp. Meanwhile, mortgages more than 30 days late backed by office properties declined slightly in April (to 2.3 percent from 2.6 percent), also according to Trepp.

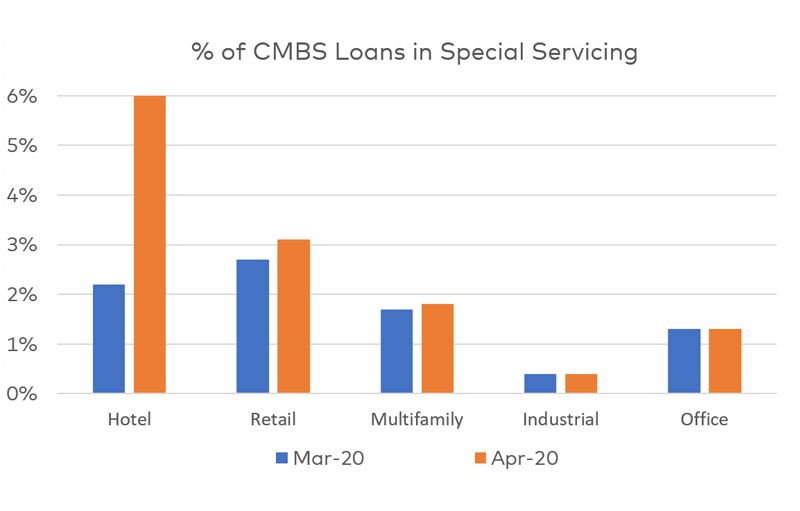

Loans secured by hotels that have been transferred to special servicing nearly tripled in April to 6.0 percent from 2.2 percent in March, according to BofA Research and Intex. Retail properties in special servicing increased to 4.1 percent in April from 3.7 percent the prior month, while the numbers for other property types were flat.

The overall percentage of CMBS loans that have been transferred to special servicing was only 4.0 percent as of April, according to BofA/Intex, while the delinquency rate was 2.8 percent, according to Trepp, but both of those numbers are expected to rise sharply in coming months as closures continue. Many tenants made April loan payments with March income, when the quarantines started. Cash flow is expected to drop in April and May and possibly longer.

The shutdown is particularly difficult for lodging and retail properties. Most hotels in the U.S. have either shut down or are operating at skeletal levels, while more than half of retail outlets nationwide are closed as a result of statewide remain-in-place orders as authorities attempt to stop the spread of Covid-19. Other asset types are not expected to be immune, however. More than 26 million Americans have filed for unemployment over the last four weeks due to business closures, which has created loss of income for properties in just about all property segments.

Feeling the pinch, borrowers have inundated loan servicers with requests to renegotiate terms by, for example, lowering loan coupons, extending the maturity date, and deferring payments by a year or more. “Everybody wants to negotiate forbearance,” one industry insider said.

Although the federal government has mandated that loans originated through government-sponsored enterprises Fannie Mae and Freddie Mac must be afforded 120 days of forbearance, servicers of non-agency CMBS must review each request individually. Some servicers say borrowers are going too far in their requests. For one thing, borrowers must prove that the loss of property income is due only to the impact of the pandemic.

Another issue is that some borrowers are requesting more than a year of forbearance, while servicers say it is far too soon to determine whether properties will experience lost income for that length of time. Requests for lengthy forbearance at this stage “don’t correspond to what we hope is the temporary nature of the environment we are in,” said one servicer. “A lot of these requests lack reasonableness,” said another. A more reasonable option for many servicers is to grant forbearance for 60 to 90 days, and to revisit the economy and impact on property performance at that point to determine how to proceed.

You must be logged in to post a comment.