CMBS Market Update and Forecast for 2020

The second half of 2019 is proving to be much stronger for the CMBS sector. Find out what fueled the boost in our CMBS Market Update and Forecast.

Lower interest rates and a slowdown in multifamily agency lending provided a push to the CMBS market in the second half of 2019 after a very slow start to the year. CMBS experts say the conditions look good for a strong fourth quarter and that strength could carry over into 2020.

“The market in general, it is very safe to say, will outperform expectations for 2019,” said Jon Martin, managing director, Wells Fargo Real Estate Capital Markets. “All of the markets have been really active, much more so than people anticipated during the first part of the year.”

Jamie Woodwell, Vice President of Commercial Research, Mortgage Bankers Association. Photo courtesy of Mortgage Bankers Association

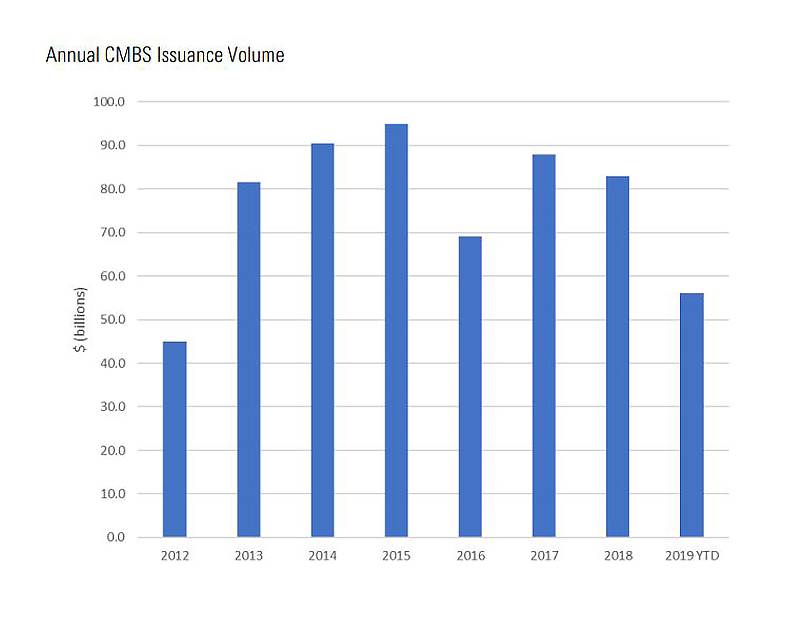

CMBS activity for the first nine months of 2019 was $57.7 billion compared to $58.7 billion for the same period in 2018, according to Commercial Mortgage Alert. Martin anticipates the year-end numbers to exceed $76 billion thanks to expectations for a very busy fourth quarter.

“There are published reports that $20 billion worth of paper is going to be coming to market this [fourth] quarter,” Martin said.

The total for 2018 was between $77 billion and $83 billion, according to various sources. Manus Clancy, senior managing director with Trepp, estimates that last year’s total was about $95 billion, including agency multifamily and commercial real estate collateralized loan obligations activity.

“Through the third quarter, we are right on pace for the pace of last year,” Clancy said.

In addition to megadeals, Martin said there is a “really healthy supply of the standard conduit deals.”

Market took off in spring

The year started off so slow that CMBS issuance was up 58 percent between the first and second quarter of 2019, according to numbers provided by the Mortgage Bankers Association. Also, as a consequence, the first half of the year saw an 11 percent decline compared to the first six months of 2018.

“We tend to focus less on the first quarter change and more on the second quarter compared to last year and fourth quarter year-to-date,” said Jamie Woodwell, the MBA’s vice president of commercial research.

Third quarter originations for commercial and multifamily loans were up across the board, according to the MBA. Woodwell said every major capital source was lending at a pace above last year’s level. The dollar volume of CMBS loan originations increased by 52 percent year-over-year and were up 5 percent year-to-date. Woodwell noted the low interest rate environment should continue to support property values and encourage borrowing into 2020.

“Starting this summer, we did see a real pickup in demand for CMBS,” Woodwell said. “There was a lot of action in August, September and October, but those won’t show up in CMBS issuance [statistics] for a couple of months after they were originated. We will be seeing some of that strength from the summer showing up later this year and going into the fourth quarter.”

Beyond growth numbers

Two things were happening that kicked the CMBS market, which was already improving, into high gear. In late July, the Federal Reserve cut interest rates for the first time since the 2008 financial crisis. Two more rate cuts followed, including in late October, which is expected to be the last of this year.

“When the Fed shifted their policy actions, it proved a boost, a shot in the arm to activity,” Martin said.

Jonathan Hakakha Co-Founder & Managing Director, Quantum Capital Partners. Photo courtesy of Quantum Capital Partners

He noted the Fed’s interest rate reductions resulted in both increased refinancing activity and new transactions, which exceeded even the most optimistic predictions for 2019.

“There has been a really marked decline in rates. For borrowers out there, that is a huge benefit and tailwind for them and their properties. It flows through to other parts of the market,” Woodwell said.

Clancy said Trepp has been hearing anecdotally from issuers that they have been able to compete better.

“What was different is rates fell so low that you were getting to a point where the insurance companies weren’t interested anymore,” Clancy said. “They were saying ‘it really doesn’t meet our benchmarking target.’ CMBS had a little more runway and took advantage of it. I think that will show up in the fourth quarter numbers as well.”

The other big factor in the increased activity in the CMBS conduit market was the fact that Fannie Mae and Freddie Mac slowed their multifamily originations during the summer as they neared their lending caps.

“While agency lending was at a standstill, a lot of big multifamily borrowers moved to CMBS loans. That’s probably what caused the surge in the third quarter,” said Jonathan Hakakha, co-founder & managing director, Quantum Capital Partners in Los Angeles, a commercial mortgage firm with a strong CMBS portfolio.

“When they started tapping the brakes, the conduits started capturing a significant amount [of multifamily transactions],” Martin said of government-sponsored enterprises. “The agencies have since come out with their new guidelines and are fully back in business. But there was a window—a good 60 to maybe 90 days—that CMBS financing for multifamily was actually more attractive than Fannie and Freddie.”

As of Sept. 30, Wells Fargo occupied the fifth position in Commercial Mortgage Alert’s ranking of U.S. CMBS bookrunners for the first nine months of 2019 with $6.4 billion in 17 CMBS transactions, up from about $6 billion and 19 transactions for the same period in 2018. The top six, led by Citigroup with $6.7 billion in 25 deals, all have at least $6 billion in transactions through the end of the third quarter, according to CMA.

Wells Fargo ranked third on CMA’s CMBS agency lead- and co-managers ranking through Sept. 30 with $24.8 billion in 26 deals, down from $27.7 billion with 29 deals through the third quarter of 2018. Credit Suisse, with $30 billion in 39 deals, led the CMA ranking for the first nine months of the year.

CMBS movements

One trend that has become more significant this year is large loans that could have been single-asset single-borrower transactions being split by multiple dealers into conduits. This pushed conduit numbers higher and improved the overall metric of the pool and quality of the conduit transaction, according to Martin.

Despite increased activity from a more conducive rate environment, Steve Jellinek, vice president of credit risk services with DBRS Morningstar, noted that new issue volume has dropped. Through Sept. 27, new issue volume of $56.1 billion was 3.6 percent less than the same period last year, according to the firm’s CMBS market outlook for the fourth quarter. Jellinek cites increasing activity from competitors including mortgage REITs and private debt funds as contributing to fewer CMBS originations.

Jellinek also noted that thanks to more selective underwriting standards under the Dodd-Frank risk retention rules, banks are required to have skin in the game and lenders are shifting to lower-leveraged, higher-quality properties for CMBS loans. Trepp research shows conduit loans through the third quarter of 2019 had an average loan-to-value ratio of 58.9 percent compared to 65.4 percent in 2015, prior to the advent of the Dodd-Frank regulations.

Shlomi Ronen, managing principal & founder with Dekel Capital, said there are fewer players in the CMBS market now because of risk retention rules.

“They don’t have this unlimited capacity that we had pre-crash,” he said. “You have to have a significant balance sheet to originate billions of dollars. You have to have a balance sheet to retain a piece of each securitization.”

Jon Martin, Managing Director, Wells Fargo Real Estate Capital Markets. Photo courtesy of Wells Fargo Real Estate Capital Markets.

Ronen said a CMBS trend that is continuing seems to be better pricing and more aggressive underwriting for loans offering 10-year, interest-only terms. He did note that with rates being so low, rating agencies have tightened up some of their pricing models.

Hakakha said that is a concern with lenders. “Banks are going back and saying you shouldn’t penalize us and our borrowers on good quality loans because interest rates are low. It’s a real battle and everyone is waiting to see how that plays out,” he said.

The rating agencies may be more concerned because of the increasing prevalence of the 10-year, interest-only CMBS loans. However, Hakakha said it provides a competitive edge over banks or life companies.

“If someone wants to undertake a CMBS loan, they want to have one of the best benefits of having a CMBS loan, which is 10 years, interest only. Many people are after returns. The way to get returns is they need to have an interest-only payment,” he said.

What’s on the horizon?

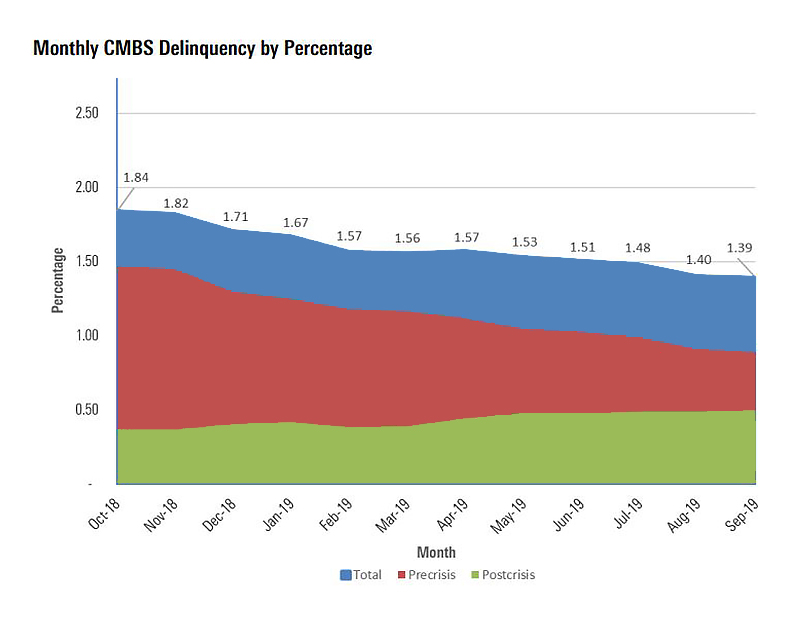

Meanwhile, the delinquency rate continues to set post-crisis lows, according to Jellinek. He said the delinquency rate edged down 1 basis point in September to 1.39 percent thanks to a slight uptick in the volume of loans in the CMBS universe and continued resolution of legacy debt. The balance of delinquent loans dropped from $12.52 billion in August to $12.45 billion in September and down $2.63 billion, or 17.4 percent, from the same time in 2018, according to DBRS Morningtar’s September report.

Steve Jellinek, Vice President of Credit Risk services for DBRS Morningstar. Photo courtesy of DBRS Morningstar

The report notes delinquencies from loans originated from 2010 through 2019 are a small portion of the total—just 0.5 percent—while delinquent post-crisis loans represent 0.9 percent. However, DBRS Morningstar does expect the delinquency rate for the post-crisis or CMBS 2.0 loans to start to increase. Looking ahead to 2020, Jellinek doesn’t see anything alarming.

“We will probably see very little change in the delinquency rate. There’s really nothing on the horizon that makes me nervous,” he said.

As for a small wave of maturities coming due in 2020 through 2023, Jellinek said that’s actually a good thing for the CMBS market, noting they drive new originations. “Maturing loans need to be refinanced,” he said.

“For a property that has an existing loan on it, property values have most likely gone up since it was originated. The rates are most likely lower than when originated. Those two pieces together should open the window for it to refinance pretty nicely,” Woodwell added.

Hakakha is also optimistic about what’s ahead. “I think CMBS activity will stay strong. A lot of people who bought value-add properties between 2013 and 2017 have now completed their business plans and are ready for permanent debt. There is a lot of that.”

You must be logged in to post a comment.