CMBS Scrambles to Comply with New Regulatory Regime

The blizzard of new regulations on commercial mortgage programs took center stage at this week’s CRE Finance Council annual conference.

By Paul Fiorilla, Associate Director of Research, Yardi Matrix

New York—The blizzard of new regulations on commercial mortgage programs that are in the process of taking effect took center stage at this week’s CRE Finance Council annual conference in New York. However, sentiment about which of the new rules may wind up having the biggest impact on the sector appears to be shifting.

For most of the last six months, the top concern of the CMBS market was the “risk-retention” rule mandated by the Dodd-Frank Act that was approved by a host of regulators, including the Federal Reserve and Securities and Exchange Commission. But now some of the concerns about risk-retention are taking a back seat to some of the other regulations dealing with trading and the process of building pools in terms of the impact on pricing and liquidity in the market.

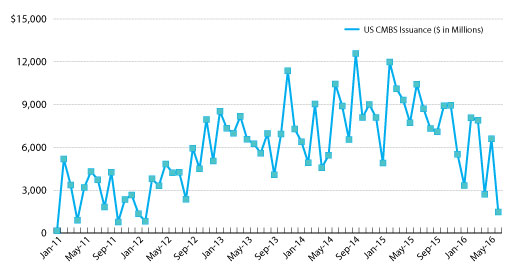

CMBS has struggled so far this year, with issuance down 40 percent through early June, to $30.6 billion in 2016 from $51.9 billion in the same period a year ago. Although the reasons for reduced volume are varied and not entirely the result of the regulatory hurdles, the uncertainty created by the rush to understand and comply with a host of new rules has many in the industry frustrated.

“Once all of the regulations are in place a few years down the road I think we will see that they obstruct the movement of capital, increase volatility, decrease diversification, greatly increase the costs of even plain vanilla financial services products such as cash management and the like,” said Christina Zausner, CREFC’s vice president of industry and policy analysis.

Learning to Live With Risk Retention?

Risk retention requires issuers of securitized products including CMBS to retain a 5 percent strip of the bonds that were issued. The rule could be met by retaining a “horizontal” strip, which encompasses the 5 percent of lowest-rated bonds; a “vertical” strip, which would encompass holding 5 percent of each tranche; or some combination thereof.

CMBS issuers have the option of selling the bottom 5 percent of pools to a qualified “B-piece” buyer, which is largely in keeping with industry custom. Earlier this year there were concerns that it would be difficult to find capital to buy B-pieces because the rules prohibit the owner of the risk-retention strip from selling. There were also concerns that banks would not be willing to hold bonds as part of a vertical strategy.

Now it appears, though, that there will be sufficient B-piece capital to buy the junior bonds, and banks are working with regulators to develop strategies that would enable the 5 percent junior strip to be sliced into different classes and comply with the rules. Plus, most CMBS issuers are developing strategies that would enable them to continue participating in the market via vertical or horizontal structures.

One wrinkle of rule is that loans that meet a prescribed quality standard–based on metrics such as term, interest-only provisions and leverage–would be exempt from risk-retention. However, industry players believe the standard is well too high and treats CMBS unfairly in relation to other product types. The quality standard would exempt only about 4-5 percent of CMBS loans originated to date while exempting about 90 percent of residential loans, said Martin Schuh, CREFC’s vice president of legislative and regulatory strategy. Yet, CMBS historically has suffered far fewer defaults than residential loans.

CREFC and other trade groups including the Mortgage Bankers Association and Real Estate Roundtable are lobbying Congress to have the rules changed. Congressman French Hill (R-Ark) has proposed a bill that would address many of the industry’s concerns, such as flexibility for B-piece buyers and broadening the definition of a qualifying commercial mortgage for risk-retention purposes, but that bill is unlikely to be heard an election year.

Risk-Based Capital Cuts Trading Books

CMBS players have become less optimistic about dealing with the impact of risk-based capital rules that drive what is known as the “fundamental rule of the trading book” that will be implemented through the Bank for International Settlements. The guidelines essentially require banks to follow a standardized formula that would increase the amount of capital that must be set aside for the bonds they hold in their trading books by roughly 20-40 percent.

The rules are an attempt to cut down on the trading that created huge losses in the banking system during the last financial crisis. But the rules also serve to make it more expensive to hold bonds and reduce the willingness of dealers to make markets, which cuts down on liquidity and reduces the value of the bonds.

The way CMBS has historically operated, trading desks at the banks that issued bonds were willing to buy bonds from investors that wanted to sell for any given reason. Investors no longer feel confident that they can find a suitable bid when they want to trade bonds, which makes them less likely to buy. Some market players say that demand for triple-A CMBS, which typically constitutes 75-80 percent of each issue, has dropped significantly in recent months. Instead, traditional triple-A CMBS buyers such as life companies would prefer to originate whole loans, which are even less liquid, but carry higher returns.

While the risk-based capital rules do not go into effect until 2019, most banks have already started to comply with the provisions. The rules open up the market to boutique investment banks, who might be willing to take over a market-making role from the large investment banks that dominated the activity in the past.

Regulation AB II Impact Smaller CMBS Shops

Another regulation that is creating changes in the way CMBS operates is Regulation AB II, published by the SEC, which implements an array of new rules that include more loan-level disclosure, stricter representations and warranties and requires independent asset reviews for deals in which delinquencies rise to a certain level.

Maybe the section of AB II with the biggest impact on CMBS is the one that requires the CEO of the entity depositing loans into the trust to certify that information in the prospectuses is true and the collateral will perform about as expected. Why is this an issue? Well, CMBS conduit pools have historically incorporated loans from multiple originators. Several banks will each contribute a few hundred million dollars of loans to produce a pool of $1 billion or more. Larger transactions are more attractive to investors because they tend to be more liquid and the collateral is more diversified.

But while CEOs may be willing to certify the quality of loans their own banks contribute, some are balking at certifying loans originated by a third party, and thus opening themselves up to potential lawsuits for loans in which they had no control over the origination process. This could prove to be a particular problem for specialty lending firms that have contributed loans to CMBS. Large money-center banks might have faith in the processes enacted by peer institutions, but be less willing to take a risk for lending firms that do not have the same pedigree.

High Costs, More Compliance

It’s hard to say at this point how the CMBS market will shake out, because regulations are still being adjusted, Congress could pass new laws and securitization programs might come up with new strategies and processes. But it’s fairly certain that the cost of lending is going up as a result of the regulatory onslaught, which makes CMBS less competitive in relation to other lenders and is likely to increase prices across the board. It’s also fairly certain that the processes by which the market operates in areas such as trading and the accumulation of collateral will evolve as a result of the new regulatory regime, and the changes will be felt for years to come.

You must be logged in to post a comment.