Cold Storage Investments Heat Up

A new CBRE report looks at the trends spurring investors’ interest but also the challenges they will find in the sector.

Chart courtesy of CBRE

Cold storage is increasingly becoming a hot investment within the industrial and logistics sector as demand grows from both domestic and global investors but it comes with challenges including a lack of available supply, according to a new CBRE report.

The CBRE report, the third and final installment in its Food on Demand series about cold storage, details how trends like the growth expected in online grocery sales have narrowed the gap in cap rates between cold storage and dry storage facilities to 75 basis points, down from 200 basis points in the past three years. CBRE expects the cap rate spread could further narrow in the U.S. market to 25 basis points, similar to the spread in leading Asia Pacific markets.

READ ALSO: How Cool is Cold Storage Today?

Cold storage facilities in the U.S. in the past have only accounted for a small fraction of the overall industrial and logistics real estate volume but Matthew Walaszek, CBRE associate director of industrial & logistics research, noted that investors are seeing cold-storage warehouses as less risk and are willing to access less of a premium return.

Matthew Walaszek, lead author of the report, told Commercial Property Executive certain trends are also behind the growth of investor interest in the cold storage sector. “As dining habits continue to evolve, and as demographic trends drive more direct-to-consumer delivery in grocery shopping, we can expect more institutional investors targeting cold storage assets on the back of these budding trends,” he told CPE. “Given the competitive nature of investing in cold storage, we will likely see more partnerships between investors and specialized developers and/or operators to capitalize on the strong demand for temperature-controlled space”, Walaszek added.

Growing Transaction Volume

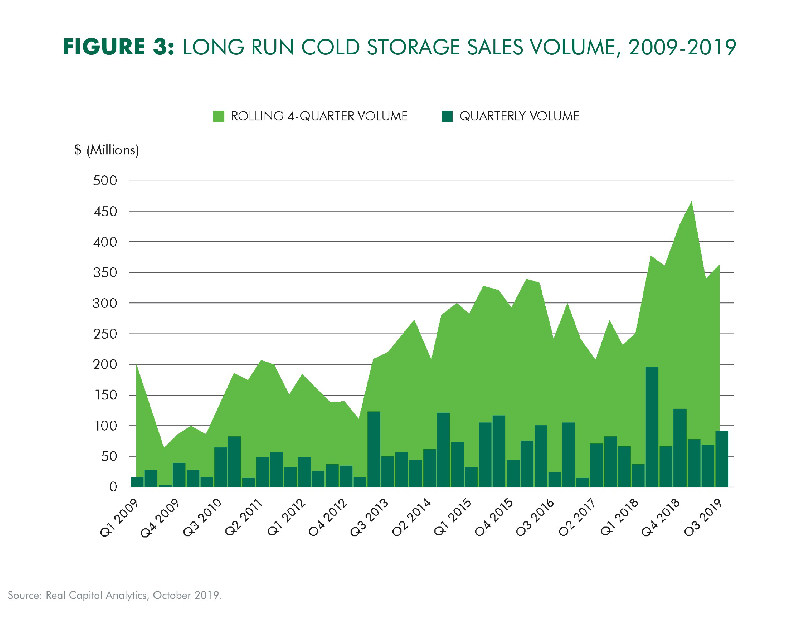

Excluding large portfolio and M&A deals, cold storage transactions have increased at an annual rate of 6.2 percent since 2014 resulting in about $1.6 billion in sales, according to CBRE. That accounts for about 0.4 percent of the overall industrial and logistics investments during the same time period.

Citing statistics from Real Capital Analytics, the report notes volume was up 82.6 percent from 2017 to 2018, when it reached $423 million, mainly due to large acquisitions in Chicago, Los Angeles, Boston, Honolulu, Miami and Indianapolis. Other markets where cold storage investments can be found include Dallas-Fort Worth; St. Louis; Milwaukee; Tampa, Fla.; Cleveland/Akron; Baltimore and Savannah, Ga.

CBRE reports two of the biggest cold storage portfolio sales this year were for $443 million and $194 million and involved properties in Illinois, Texas, Florida, California, Massachusetts, New Jersey and Georgia.

Challenges Detailed

While there are challenges, including high construction and maintenance cost and the need for specialized equipment and knowledge to operate cold storage facilities, the bigger problem is the lack of assets for sale. The U.S. cold storage warehouse inventory totals about 215 million square feet with between 2.2 million and 2.5 million square feet of new supply expected to be coming online, according to CBRE Research. Most of the new supply is build-to-suit and owned by major operators like Americold, Preferred Freezer Services and United States Cold Storage, meaning less new development for interested investors.

The report does note, however, that much of the U.S. cold storage space is outdated and in need of renovations. This means that there could be opportunities to upgrade existing facilities for those investors who want to take on the projects.

Because cold storage facilities require special knowledge to run them, it can be difficult for some investors to capitalize on opportunities. CBRE Research notes there is a small buyer pool—less than 10 percent of the overall industrial and logistics sector buyer pool. But it is growing with new entrants, including institutional investors. Some of the main investors in the cold storage sector so far are Bay Grove Capital (owner of Lineage Logistics), Blackstone and New Market Capital.

The report also notes that new investors with minimal experience in cold storage might be better off having a tenant operator manage the facility, which could lead to opportunities for build-to-suit projects, sale/leasebacks and conversions from dry warehouses to cold storage assets.

You must be logged in to post a comment.