Commercial and Multifamily Mortgage Debt Outstanding Increased in Q1 2024

The amount of commercial mortgage debt outstanding increased in the first quarter of 2024, despite slow mortgage originations activity.

The level of commercial/multifamily mortgage debt outstanding increased by $40.1 billion (0.9 percent) in the first quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report, released last month.

Total commercial/multifamily mortgage debt outstanding rose to $4.70 trillion at the end of the first quarter. Multifamily mortgage debt alone increased $23.7 billion (1.1 percent) to $2.10 trillion from the fourth quarter of 2023.

The amount of commercial mortgage debt outstanding increased in the first quarter of 2024, despite slow mortgage originations activity. Every major capital source increased its holdings of commercial mortgages, as fewer loans than usual were paid off through property sales or refinancings.

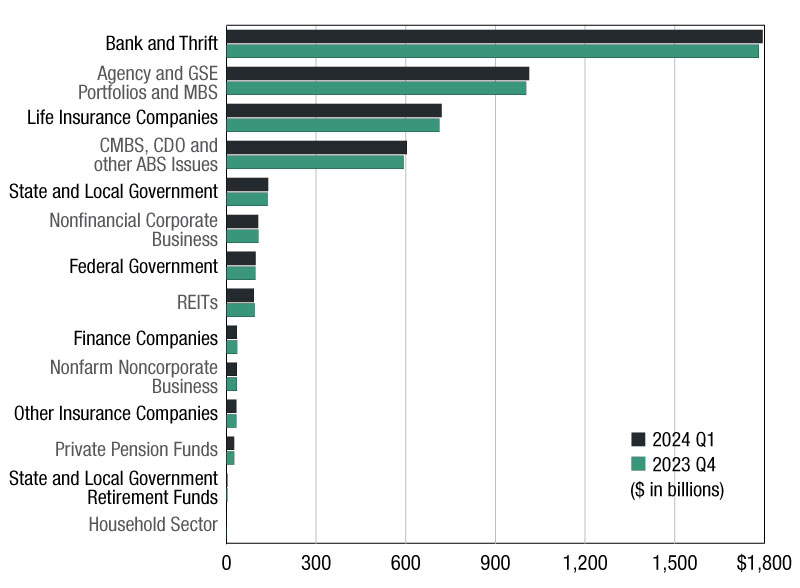

Commercial banks continue to hold the largest share (38 percent) of commercial/multifamily mortgages at $1.8 trillion. Agency and GSE portfolios and MBS are the second-largest holders of commercial/multifamily mortgages (22 percent) at $1.01 trillion. Life insurance companies hold $720 billion (15 percent), and CMBS, CDO and other ABS issues hold $604 billion (13 percent). Many life insurance companies, banks and the GSEs purchase and hold CMBS, CDO and other ABS issues. These loans appear in the report in the “CMBS, CDO and other ABS” category.

Changes in Commercial/Multifamily Debt Outstanding

In the first quarter, bank and thrifts saw the largest gains in dollar terms in their holdings of commercial/multifamily mortgage debt—an increase of $12.8 billion (0.7 percent). CMBS, CDO and other ABS issues increased their holdings by $11.0 billion (1.9 percent), agency and GSE portfolios and MBS increased their holdings by $10.2 billion (1.0 percent), and life insurance companies increased their holdings by $7.0 billion (1.0 percent).

In percentage terms, CMBS, CDO and other ABS issues saw the largest increase – 1.9 percent – in their holdings of commercial/multifamily mortgages. Conversely, state and local government retirement funds saw their holdings decrease 8.3 percent.

You must be logged in to post a comment.