CommercialCafe Report: NYC Office Market Sizzles in 2016

Though it’s no surprise that Manhattan remains the main target for office investment in New York City, other boroughs also managed to attract a good deal of capital in the past year.

By Ioana Neamt

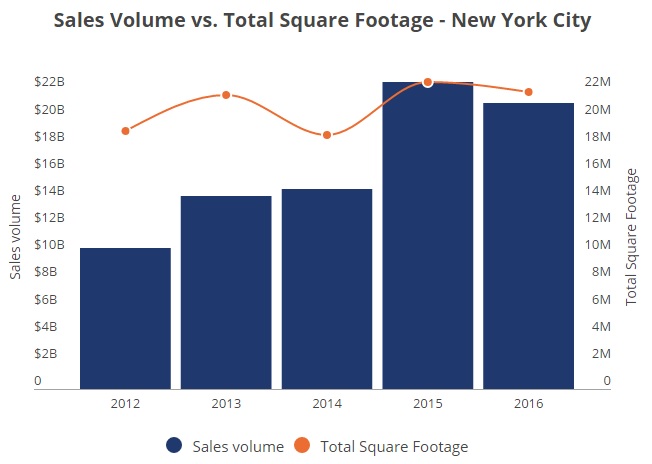

It was the best of times, it was the worst of times—a fitting description for New York City’s commercial real estate market in 2016. Though leasing activity in Manhattan dropped significantly in the midst of political and economic uncertainty, according to data from JLL, this did not put a damper on office sales in NYC. Though activity cooled down from the highs of 2015, investment sales volume remained strong in 2016, surpassing the levels of 2012-2014.

It was the best of times, it was the worst of times—a fitting description for New York City’s commercial real estate market in 2016. Though leasing activity in Manhattan dropped significantly in the midst of political and economic uncertainty, according to data from JLL, this did not put a damper on office sales in NYC. Though activity cooled down from the highs of 2015, investment sales volume remained strong in 2016, surpassing the levels of 2012-2014.

Our study analyzed commercial office transactions of more than $5 million and office buildings and spaces of over 5,000 square feet, from 2012 to 2016, based on Yardi Matrix and PropertyShark sales and proprietary research. The sales included were recorded up until Jan. 25, 2017, and we excluded ownership stake transactions.

Key takeaways:

- Total sales volume in NYC topped $21B in 2016

- The average price per sq. ft. in Manhattan reached a 5-year peak ($1,347)

- June proved busiest month of the year—transaction volume reached $4.4B

- NYC commercial market attracted record foreign capital in 2016

- Largest sale of the year: AXA Equitable Center at 787 7th Ave. traded for $1.9B

- One Brooklyn sale among largest transactions of 2016–Watchtower Building Sold for $340M

- What’s next? Major office projects in the works in NYC

- Download raw report data

The full report is available at Commercial Cafe.

You must be logged in to post a comment.