Commercial Development Confidence Drops Sharply

Despite near-term concerns, the Q2 2020 USG Corporation + U.S. Chamber of Commerce Commercial Construction Index shows the commercial construction industry is poised for recovery.

The coronavirus pandemic hit the commercial construction industry hard during the second quarter, with confidence in new business and revenue expectations both dropping 26 points between the first and the second quarter, according to the USG Corporation + U.S. Chamber of Commerce Commercial Construction Index.

Overall, the index fell from 74 to 56—an 18-point plunge.

READ ALSO: Lowe Adds National Retail Redevelopment Platform

The survey, a quarterly economic index designed to gauge the outlook for, and confidence in, the commercial construction industry, was taken from April 4 to April 27 at the height of shutdown restrictions in the U.S. due to the COVID-19 pandemic. The index comprises three leading indicators—confidence in the market, revenue expectations and backlog—that generate a composite index on a scale of 0 to 100 and serve as an indicator of the construction segment.

Christopher Griffin, president & CEO of USG Corp., said commercial construction often serves as a bellwether for other economic development and recovery. The industry represents 3 million American jobs and $700 billion in spending.

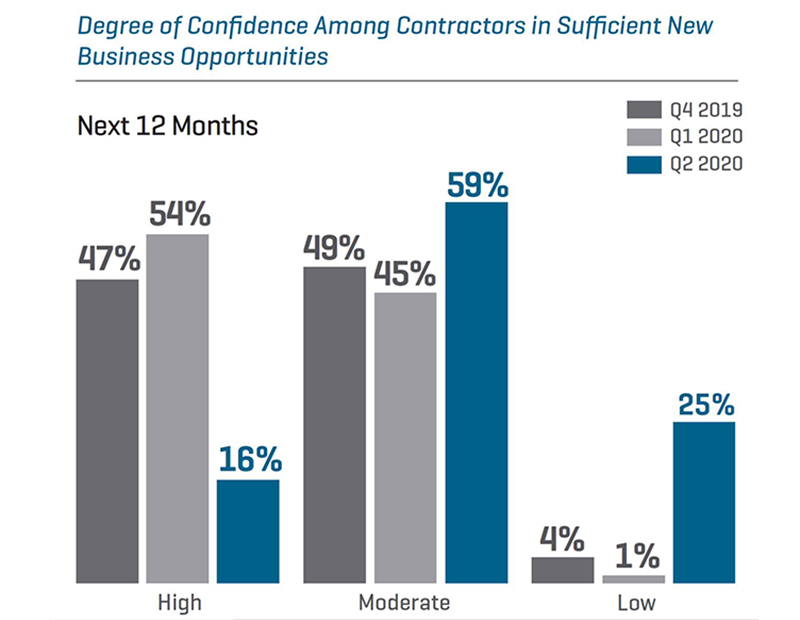

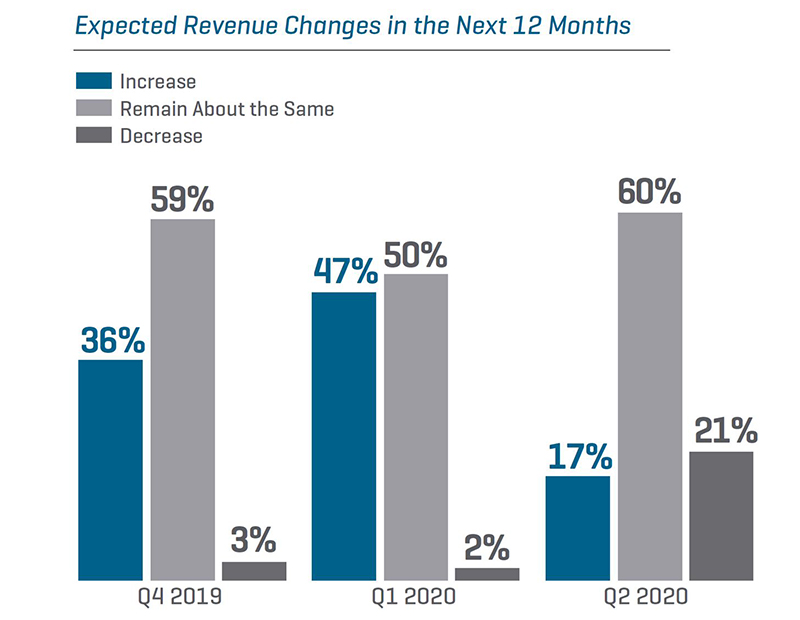

Even though much of the commercial construction industry was deemed essential during the past few months, the loss of new projects and revenue was severe, Griffin noted in a prepared statement. The overall drop in the index was blamed in part on the very low number of contractors (16 percent) expressing high confidence in new business opportunities in the next 12 months, compared to 54 percent in the first quarter. There was also a 30-percentage-point drop in contractors expecting revenues to increase, going from 47 percent in the first quarter to 17 percent in the second quarter. Meanwhile, the percentage of contractors expecting revenues to decrease in the next 12 months rose from 2 percent in the first quarter to 21 percent in the second quarter.

“I was not terribly surprised, although I would say if you look at the top line numbers you say this is remarkably bad. But if you look under the hood a little bit, there’s plenty of reason to be optimistic both in the quarterly report and in the data we’ve seen since then, like the employment data for example,” said Neil Bradley, U.S. Chamber of Commerce executive vice president & chief policy officer.

Bradley and Griffin both noted there are hopeful signs within the survey results. One key indicator, backlog, dropped only three points from 76 to 73 between the first and the second quarter. Contractors reported they still had significant backlog, with 60 percent saying they had at least six months of backlog compared to 69 percent in the first quarter.

“I think the first sign of hope in this is backlogs remained fairly consistent from the first quarter to the second quarter. There is a lot of work to be worked through and done,” Bradley told Commercial Property Executive.

He noted three in four contractors say they have moderate to high confidence that the next year will bring sufficient new business opportunities, and in the next two years, that percentage will rise to 93 percent—but that number is down from 99 percent in the first quarter.

“That was reflective of an incredibly hot economy before COVID-19. Virtually every contractor surveyed was optimistic about the future for the next 12 months,” he said.

One sign of confidence Bradley said is the question of employment. The survey found one in three contractors (32 percent) plan to hire more workers in the next six months, while nearly half (48 percent) believe their workforce will remain the same. Only 15 percent expect to employ fewer people.

Bradley also pointed to the U.S. Bureau of Labor Statistics data that came out on the first Friday of the month as a positive indicator for the industry. “In May, 40 percent of the nonresidential construction jobs that were lost in March and April were restored. And May was still partially shut down,” he said.

Revenue concerns

Compared with the last two quarters, revenue projections for the next two years are far more pessimistic.

“There’s a sense of, how are my customers going to be performing and their ability to pay or are they going to be asking to cancel or defer projects,” Bradley told CPE. “That’s the one, going forward, that will be telling as to a sense of how long the downturn in commercial construction will last.”

Bradley said revenues and access to financing are “pretty closely linked” and should be monitored. The contractors were split on the availability of financing for owners, with nearly half (49 percent) expecting it to remain the same or increase, and 38 percent expecting it to become more difficult, while the remainder is unsure.

Nearly all the contractors reported they were impacted by delays due to the coronavirus and expected those delays to continue through the summer, and 73 percent also expect delays to continue through the fall. But those numbers drop as the year progresses, according to the report. In six months, only 8 percent expect the majority of their projects to be delayed.

“Nearly every industry including the commercial construction industry took a hit with the COVID-19-induced shutdown. They are well poised for a comeback, and the only potential element that will hold back that comeback is broader deterioration in the economy,” Bradley said.

You must be logged in to post a comment.