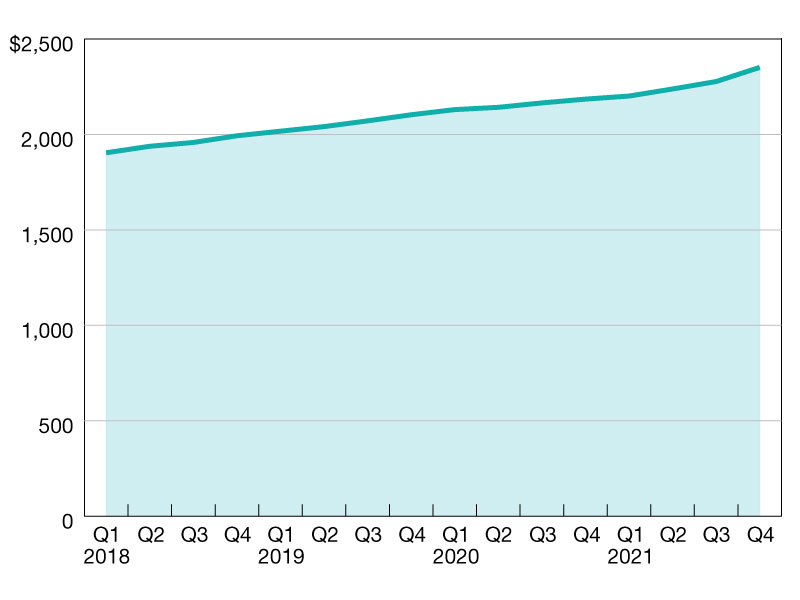

Commercial Mortgage Debt Outstanding Jumps to Record High in Q4

Commercial banks continue to hold the largest share of mortgages at $1.6 trillion, according to MBA’s recent survey.

$ in billions

Strong borrowing and lending backed by commercial properties drove the level of total mortgage debt outstanding to a new high at the end of 2021.

The last three months of the year marked the largest quarterly increase in mortgage debt outstanding on record, as every major capital source increased their holdings. The 7.4 percent annual increase in outstanding debt compares to a 19.5 percent increase in underlying property values.

During fourth-quarter 2021, mortgage debt outstanding was $287 billion (7.4 percent) higher than at the end of 2020, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report. Total mortgage debt outstanding rose by 2.9 percent ($116.0 billion) in fourth-quarter 2021.

Commercial banks continue to hold the largest share (38 percent) of mortgages at $1.6 trillion. Agency and GSE portfolios and MBS are the second largest holders of mortgages at $901 billion (22 percent of the total). Life insurance companies hold $618 billion (15 percent), and CMBS, CDO and other ABS issues hold $609 billion (15 percent).

The early 2022 lending picture for the entire industry is looking solid. For the office and industrial sectors, the final three months of 2021 show evidence of continued strong lending activity this year. Fourth-quarter 2021 originations jumped 122 percent and 113 percent (on an annual basis) for office and industrial properties, respectively.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.