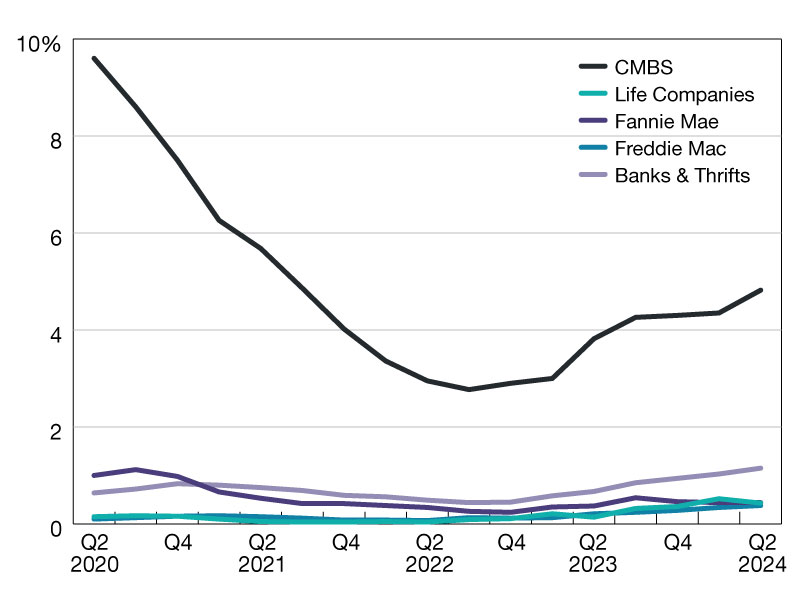

Commercial Mortgage Delinquency Rates Increased in Q2 2024

Based on the Mortgage Bankers Association’s latest commercial delinquency report.

Commercial mortgage delinquencies increased in the second quarter of 2024, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report, released earlier this month.

Delinquency rates increased for bank loans and Freddie Mac loans, as well as those held in CMBS. Rates decreased for loans held by life companies and were unchanged for Fannie Mae.

The greatest focus continues to be on office loans, which make up about $740 billion of the $4.7 trillion of commercial mortgage debt outstanding. The CRE market is large and diverse, with significant differences by property type and subtype, market and submarket, borrower, lender, vintage and more. All of those differences come into play in terms of how an individual loan may perform.

READ ALSO: You Bought an Office Building. Now What?

Based on the unpaid principal balance of loans, delinquency rates for each group at the end of the second quarter of 2024 were as follows:

• Banks and thrifts (90 or more days delinquent or in non-accrual): 1.15 percent, an increase of 0.12 percentage points from the first quarter of 2024;

• Life company portfolios (60 or more days delinquent): 0.43 percent, a decrease of 0.09 percentage points from the first quarter of 2024;

• Fannie Mae (60 or more days delinquent): 0.44 percent, unchanged from the first quarter of 2024;

• Freddie Mac (60 or more days delinquent): 0.38 percent, an increase of 0.04 percentage points from the first quarter of 2024;

• CMBS (30 or more days delinquent or in REO): 4.82 percent, an increase of 0.47 percentage points from the first quarter of 2024.

You must be logged in to post a comment.