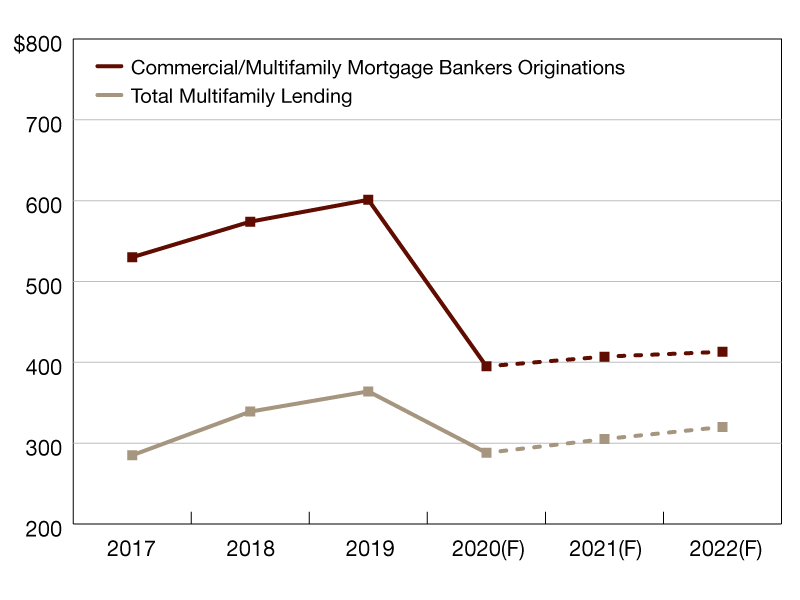

Commercial/Multifamily Lending to Fall 34% in 2020

MBA expects commercial and multifamily mortgage bankers to close $395 billion of loans backed by income-producing properties, a 34 percent decline from 2019's record volume of $601 billion.

MBA Commercial Real Estate Finance (CREF) Forecast

There is one month left in this very challenging year for our personal lives, the economy and especially for certain sectors of commercial real estate.

While the short-term looks somewhat dire, given the rising caseloads and lockdowns in certain parts of the country, the good news is that multiple vaccine candidates will hopefully start to give us and the industry a shot in the arm at some point in early 2021.

To recap this year, MBA expects commercial and multifamily mortgage bankers to close $395 billion of loans backed by income-producing properties, a 34 percent decline from 2019’s record volume of $601 billion.

Total multifamily lending alone, which includes some loans made by small and midsize banks not captured in the overall total, is forecast to fall 21 percent to $288 billion in 2020 from last year’s record total of $364 billion. We do anticipate a slight increase in lending volumes in 2021, with activity rising to $407 billion in commercial/multifamily mortgage bankers originations and $305 billion in total multifamily lending.

There still remains a great deal of uncertainty about the pandemic and its impacts on the economy and commercial real estate, with significant differences across property types and capital sources. The downturn is putting downward pressure on some property incomes, particularly property types most impacted by the pandemic or with shorter lease terms. With low interest rates and investment yields, property values are likely to hold up better, which should help put a floor under sales and originations volumes this year and next.

Consider this: Through the first three quarters of 2020, multifamily sales volume were 41 percent lower than a year earlier, with multifamily originations down just 17 percent. The strong level of refinance activity of multifamily mortgages, particularly into Fannie Mae, Freddie Mac and FHA loans, is lifting overall originations activity from where it might otherwise be, and is driving differences between property types and capital sources. These contrasts are likely to remain pronounced as we head into next year.

Let’s all hope for better times and more market certainty in 2021.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.