Commercial/Multifamily Mortgage Debt Increases

The level of commercial/multifamily mortgage debt outstanding rose by $61.0 billion in the first quarter of 2020, reports MBA’s Jamie Woodwell.

By investor group

The ongoing economic and commercial real estate-related impacts from the COVID-19 pandemic continue to be felt this summer. Rewinding to the first couple of months of 2020, commercial and multifamily lending and borrowing looked very similar to 2019: strong.

According to the Mortgage Bankers Association’s (MBA) most recent Commercial/Multifamily Mortgage Debt Outstanding quarterly report, the level of commercial/multifamily mortgage debt outstanding rose by $61.0 billion (1.7 percent) in the first quarter of 2020. Total commercial/multifamily debt outstanding rose to $3.72 trillion at the end of the first three months of the year, and multifamily mortgage debt alone increased $28.0 billion (1.8 percent) to $1.6 trillion from the fourth quarter of 2019.

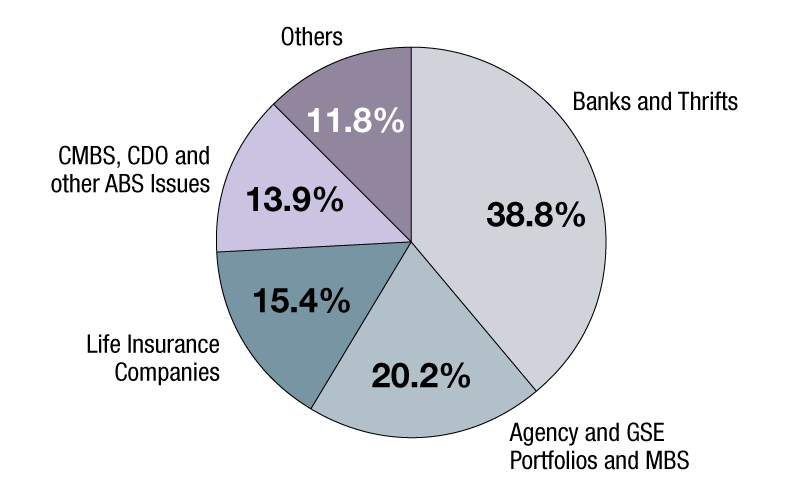

Commercial banks continue to hold the largest share (39 percent) of commercial/multifamily mortgages at $1.4 trillion. Agency and GSE portfolios and MBS are the second largest holders of commercial/multifamily mortgages (20 percent) at $752 billion. Life insurance companies hold $572 billion (15 percent), and CMBS, CDO and other ABS issues hold $516 billion (14 percent). Many life insurance companies, banks and the GSEs purchase and hold CMBS, CDO and other ABS issues. These loans appear in our report in the “CMBS, CDO and other ABS” category.

Rising property values, strong incomes and low interest rates supported increased borrowing and lending. Now, with the COVID-19 pandemic, borrowing and lending has slowed, and some of the tailwinds from earlier this year have reversed.

The coming months are likely to see greater differentiation in debt levels, both by capital source and property type, as investors and lenders assess market conditions. It has certainly been an eventful first half of 2020 for the commercial real estate industry. MBA will be watching to see what the second half will look like.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.