Commercial Real Estate Finding It’s Not Immune to the Coronavirus

Monday’s giant sell-off in the stock market, combined with announcements of increasingly draconian closures of businesses, is moving the market toward a steep cutback in transactions.

Commercial property executives are trying to maintain calm and complete transactions as efforts to stop the spread of the coronavirus intensify, but a business-as-usual approach is growing increasingly difficult as commerce is being shut down across the country.

READ ALSO: Fed Slashes Rates Again as Coronavirus Pressure Mounts

Over the last 7 to 10 days, industry has moved between trying to take advantage of a historic drop in interest rates, to cautiously trying to maintain deal flow, to trying to close existing deals, trying to re-trade those deals and then waiting on the sidelines until there is more clarity.

What appeared a week ago to be a temporary slowdown in business has morphed into a longer lasting and more intense shutdown of activities throughout the country. Schools, public buildings, offices, sporting events, entertainment, restaurants—large chunks of the country have been shut down for weeks, maybe months. The totality of the social distancing quarantines threatens to have an impact on demand for all commercial property types.

What that means for property markets is impossible to gauge with any confidence. Beyond the uncertainty about forecasting the trajectory of a disease—something that is beyond the expertise of real estate executives—is the inability to model the impact of a series of events that is unprecedented in the modern world. What’s more, the situation is changing so rapidly that corporate strategy can change by the hour.

“There’s so much uncertainty, touching so much of the lending universe, I don’t see how transactions can go through right now,” said one industry executive.

Deals grinding to a halt

Reaction through the industry continues to be mixed. Through last week, many lenders were still trying to quote and close deals, and some acquisitions were closing on schedule. However, Monday’s giant sell-off in the stock market, combined with announcements of increasingly draconian closures of businesses, is moving the market toward a steep cutback in transactions.

There’s little unanimity in the market. Some lenders are still quoting new business, although most of those are insisting on loan rate floors or are raising spreads. Other lenders are closing loans that were well down the road to completion, but not taking new applications. Others have decided to put their pencils down for the time being.

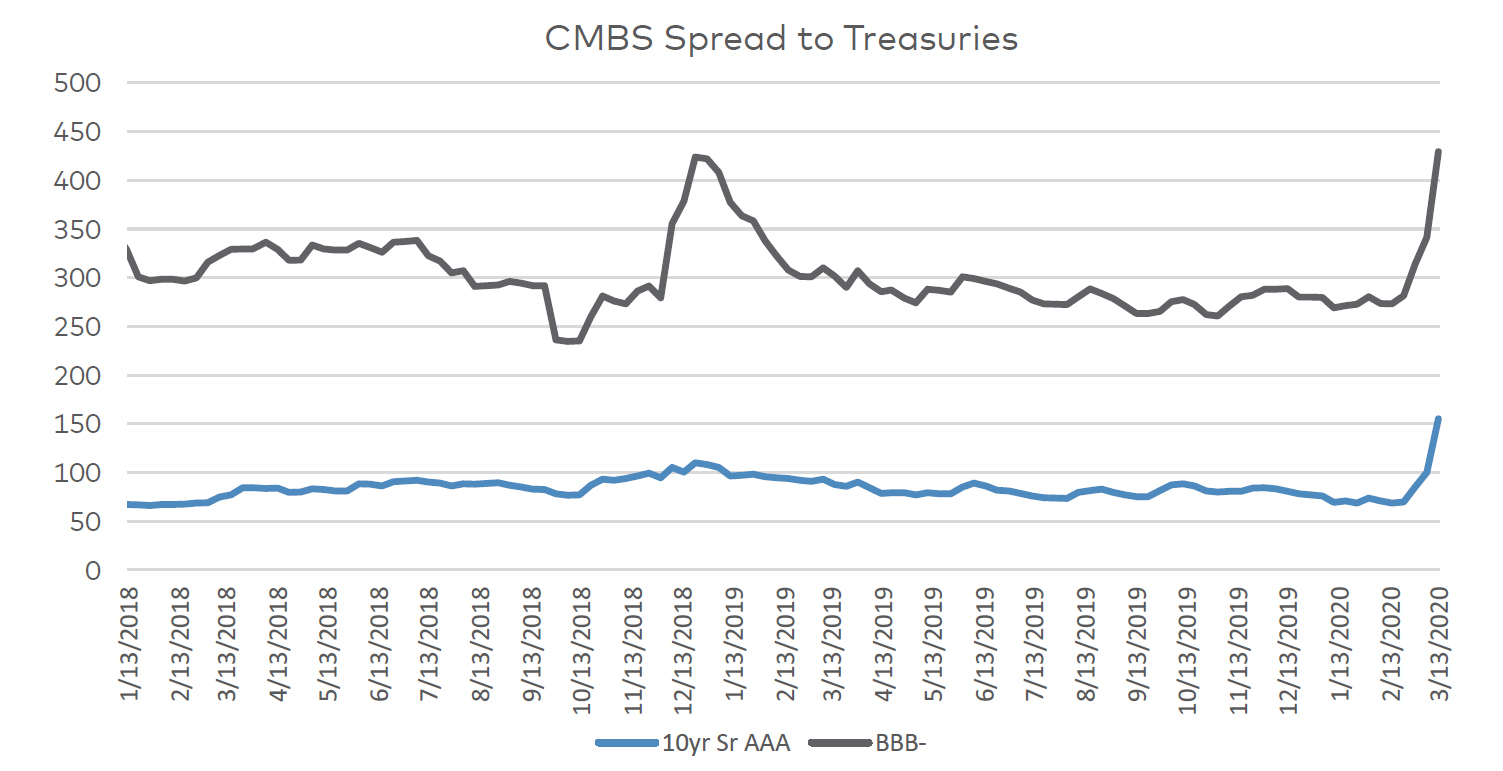

Pricing is uncertain. CMBS bond spreads, for example, have backed up to their widest levels in three years. Between March 6 and 13, spreads of 10-year triple-A bonds widened by 55 basis points, while triple-B-minus CMBS spreads widened by 87 basis points, according to J.P. Morgan and Pricing Direct. Spreads widened further this week, another 60 basis points for triple-A and more than 200 basis points for triple-B-minus. As a result, many CMBS programs widened loan spreads on any transaction that had not yet been closed, even some deals on which the price had been agreed.

Some of those borrowers that were re-traded by other lenders turned to private equity lenders, who have so many loan requests that they in turn also raised spreads. On the multifamily side, Fannie Mae and Freddie Mac reportedly have continued to close deals that were in the works but also set floors that made some borrowers unhappy. For their part, lenders say borrowers should be happy with historically low loan rates as Treasury rates plunge.

The problems with moving forward on deals are many. For one thing, the travel bans have made hard to have property visits and routine meetings between parties. Not to mention that it’s increasingly difficult to model the impact that the closure of businesses will have on property income. What seemed a week ago to be a mere blip suddenly looks more serious and potentially long-lasting. That makes applications harder to complete and means new business is likely to be put on hold.

Property type difference

As the requirements of social distancing become more severe, the potential impact on property demand seems to grow daily. Trying to underwrite income growth under such circumstances is extremely difficult, which in turn leads to a problem setting prices and striking agreements between buyers and sellers and lenders and borrowers.

The difference in REIT performance by property type is an example. As of the end of the day on March 16, lodging REITs were down 46.7 percent over the last month, followed by regional malls (44.6 percent), shopping centers (31.7 percent), office (26.3 percent), industrial (23.4 percent), apartments (21.0 percent) and self-storage (14.8 percent), according to the National Association of REITs.

Properties with short-term leases—hotels in particular—are sure to be hard hit by the coronavirus. All types of business and leisure travel have been cancelled. But the longer the quarantining lasts, the bigger effect it will have on other asset types. “There’s no property type that is not affected or will not be affected,” said an industry executive.

At first blush, multifamily would seem to be more insulated from the business closures, but apartment owners are bracing for a wave of late payments as tenants lose jobs and income and are unable to pay rent. The ultimate depth of the problem may rest on the makeup of the fiscal package that federal government passes. If the government covers unemployment and makes laid-off workers whole, that could mitigate the problem. But the composition of the package is still being negotiated in Congress.

Similarly, malls and retail are likely to be hard hit as people lose income and stay away from crowds. But that could be mitigated to some extent by cash infusions from the government that would put money in consumer pockets. Spending also plays into the demand for logistics facilities. Industrial is also affected by the manufacturing picture in China, where entire regions were shut down due to the coronavirus.

While office leases are mostly long-term, the forced social distancing has led many companies to order employees to work from home, or at least give them the option. Coworking spaces are likely to struggle in the short term. With so many people working from home, the situation is a natural experiment for the growing work-at-home movement. Many companies will get a crash course in whether working at home is possible or desired, which could have an impact on demand for office space in coming years.

With so many uncertainties, maybe the biggest is how quickly the economy will be able to spring back to life once health threat is deemed over. “We’ve come to such a screeching halt in so many ways, we just don’t know how we’re going to get the machine operating again once it’s over,” an industry executive said.

You must be logged in to post a comment.