Conditions Are Ripe for a Lending Boom. Will Discipline Hold?

A deep dive into what’s next for the debt and securitization markets, from Yardi Matrix Research Director Paul Fiorilla.

Low interest rates, increasing transaction volume and pent-up demand for short-term debt on transitional properties have contributed to a surge in mortgage origination in 2021.

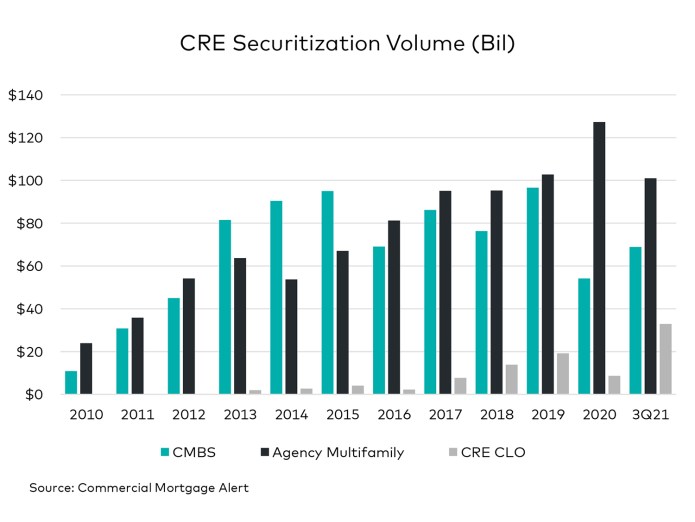

Just over $200 billion of commercial mortgages were securitized during the first three quarters of 2021, according to “Commercial Mortgage Alert.” That includes $101 billion of agency multifamily debt and $32.9 billion of collateralized loan obligations (CLOs), both of which are on track to hit record highs this year, and $68.9 billion of CMBS, which is on track for its most active year since the global financial crisis.

Lending volume is strong across the board, although third-quarter data is not yet available on other major mortgage originators such as banks and life companies. During the second quarter of 2021, commercial mortgage holdings of banks rose by $23.4 billion, while those of life companies increased by $8.7 billion, according to the Mortgage Bankers Association, and lending activity has only intensified since then.

Demand for commercial mortgages has benefited from a confluence of factors, including borrowers wanting to take advantage of rock-bottom interest rates, a rush to finance value-add multifamily properties and pent-up supply as borrowers and lenders make up for the lack of originations last year. Volume is also boosted by the rising number of property transactions and the overall amount of liquidity in commercial real estate as investors seek to deploy capital in a segment that generally has strong fundamentals and bullish prospects in coming years.

“Despite the adverse impact of the COVID Delta variant, commercial and multifamily lending is much less challenging today than a year ago, as asset-level performance continues to normalize for most property types and attractive benchmark and mortgage rates provide borrowers with the opportunity to purchase and finance pandemic-impacted assets at attractive price points,” said Lisa Pendergast, executive director of the CRE Finance Council.

Lots of Capital, Low Rates

Underpinning the red-hot lending market is the wall of capital investors want to park in commercial real estate due to the strong performance and good prospects, especially in multifamily and industrial. That has created an enormous amount of dry powder, as there is more demand for properties than assets available, and has prompted a wave of deal flow. Through mid-year, $214.3 billion of commercial properties were sold, up 29 percent year-over-year and the highest first-half number since before the global financial crisis in 2007, according to the MBA. Multifamily led property types in growth, up 64 percent year-over-year, per the MBA.

Commercial real estate is attractive to investors for many reasons, including low interest rates. With bond yields so low—the 10-year U.S. Treasury rate has moved between 1 percent and 1.5 percent for most of the past year—investors are happy to buy commercial properties at yields in the 4-5 percent range for stable properties and 6-8 percent range for value-add assets. Some of the activity comes from pent-up demand from transactions that likely would have been completed in 2020 but were delayed as a result of the pandemic.

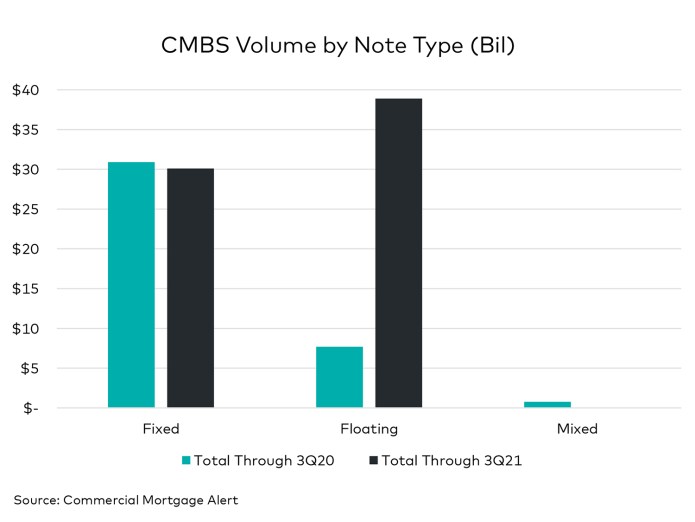

One of the biggest surprises about 2021 has been the dominance of short-term floating-rate debt. With interest rates so low and risk spreads so tight, loan coupons have dipped below 3 percent for well-located properties with stable cash flows and are in the 3-4 percent range for most other assets. Borrowers might normally want to lock in low rates for long periods at fixed coupons, but that has not been the case in 2021.

Some borrowers are choosing variable-rate loans while properties recover from the pandemic. Others, however, are opting to take out short-term floating-rate loans with the expectation that rates will remain low and they can refinance in another year or two with even higher proceeds.

“The underlying trend continues to be that floating-rate financial products are in high demand from both borrowers and fixed-income investors,” said Andrew Foster, an associate vice president of commercial real estate finance at the MBA. “There’s less desire to lock in low rates for a long period when rates have stayed low for so long.”

Multifamily Drives Loan Growth

Much of the growth in lending in 2021 has been driven by multifamily. That can be seen most directly in the volume of loans purchased and securitized by the government-sponsored enterprises (GSEs), which are the most active debt providers to apartments, supplying about 40 percent of total annual volume.

Through three quarters, the GSEs have securitized $101 billion of multifamily loans, putting them on pace to top the yearly high of $127.3 billion, set last year, according to CMA.

Practically the only limit on GSE production is the caps set by the agencies’ overseer, the Federal Housing Finance Agency. Fannie and Freddie have $70 billion annual caps in 2021, although that can and likely will be increased under new leadership appointed this summer by the Biden administration.

Multifamily has also driven origination growth among other lenders, especially commercial real estate CLOs, which encompass pools of short-term loans on non-stabilized properties. The CLO market has been boosted by the proliferation of large private equity firms in the segment. Among the most active CLO issuers this year are MF1 REIT, a joint venture between Berkshire Residential and Limekiln Real Estate, Arbor Realty Trust, Prime Finance, LoanCore Capital, KKR and Blackstone Group.

Owners of transitional multifamily properties that have room for growth in occupancy and rents have been flocking to private equity CLO issuers. Given the booming demand for housing and 10 percent-plus national average multifamily asking rent growth in 2021, it’s a reasonable bet. Through three quarters, 68.5 percent of CRE CLO volume ($22.5 billion) is backed by multifamily, with most of the rest ($5.7 billion, or 17.3 percent) backed by office properties, per CMA. CLO volume has already surpassed the previous annual high-water mark of $19.2 billion, set in 2019, according to CMA.

“Strong multifamily demand, performance and fundamentals are creating ripe conditions for lending, while the ability to efficiently finance bridge loans through matched term, non-recourse debt remains appealing,” Foster said. “Loans on other product types are part of this growth, too, but multifamily’s attractiveness is a big part of CRE CLO growth. The more straightforward post-crisis CRE CLO vehicle utilized to finance pools of transitional assets is also maturing, with broader bases of issuers and investors leading to more and larger transactions.”

Variable-rate deals, mostly of the single-borrower variety, have also dominated CMBS in 2021. Through three quarters, floating-rate bonds account for $38.9 billion, or 56.4 percent, of CMBS, with $30.1 billion (43.6 percent) fixed rate, per CMA. About two-thirds of CMBS ($45.4 billion) issued in 2021 is single-borrower deals.

Both of those numbers are far below historical standards for CMBS, which until recent years was dominated by pools of multi-borrower, fixed-rate (so-called conduit) deals. Investors, however, are skittish about buying conduit paper, as many want to avoid collateral involving retail, hotel or non-trophy office buildings, leaving little room for diversity in mixed-borrower deals. CMBS originators are most competitive right now, bidding for core office buildings and industrial properties, which represent more than half of CMBS issued in 2021. Office accounts for $25.2 billion, or 36.5 percent, of CMBS issued through 3Q21, while industrial accounts for $10 billion, or 14.6 percent, per CMA.

“For single-borrower, single-asset deals, a flight to quality assets, markets and sponsors continues to make these deals a competitive execution and attractive for borrowers and investors even while questions remain about the future of office,” Foster said.

CMBS issuance of $68.9 billion is the highest three-quarter total since 2015, per CMA. Market players say the heavy fourth-quarter pipeline could push the market over $100 billion in 2021 for the first time since $227.6 billion was issued in 2007.

Outlook: Bullish, but Wary

The favorable capital and interest-rate environment, combined with a generally bullish outlook for property demand, portends continued growth in transaction and lending deal flow. “With the Fed expected to tap the brakes in the coming months, expect loan origination volumes to gain even further steam in the interim,” Pendergast said.

However, Pendergast cautioned that investors should remain wary about the possibility of an exogenous event or economic slowdown. “The one development that has real potential to stymie today’s rebound is the increasing potential for stagflation like that seen in the 1970s, when economic growth slowed amidst strong inflationary pressures,” she said. “If COVID taught us anything, it’s that the Black Swan really does exist.”

A big question facing lenders is whether they remain disciplined in the face of “risk-on” market conditions. In past cycles, most recently the run-up to the global financial crisis, fierce competition has prompted lenders to loosen standards that ultimately led to a cycle of defaults. To date, commercial mortgage originators have maintained relatively moderate leverage levels. But discipline could erode as property prices continue to get bid up to new highs and pressure to deploy capital becomes more intense.

You must be logged in to post a comment.