Condor Hospitality Picks Up 3 More Hotels

The REIT takes another step forward in its portfolio repositioning effort with the addition of a 366-key group of Texas properties. The assets traded for almost $60 million.

By Barbra Murray

Condor Hospitality Trust Inc.’s buying binge continues with the signing of a deal to acquire a 366-key portfolio of three Marriott-branded hotels in Texas. The hotel REIT will purchase the assets from Bedford Lodging for a total of $59.6 million.

Completed by the seller between 2015 and 2016, the collection of hotels includes:

- the 124-key Fairfield Inn & Suites El Paso Airport

- the 122-key TownePlace Suites Austin North Tech Ridge

- the 120-key Residence Inn Austin Airport

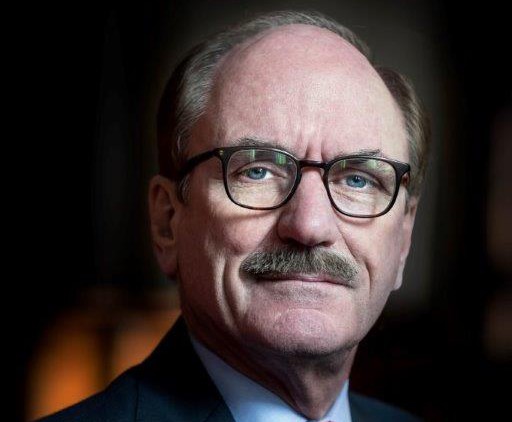

“This acquisition presents a unique opportunity to acquire three high-quality hotels that fit squarely within our investment strategy of investing in newer, premium-branded select-service assets in secondary markets,” Bill Blackham, CEO of Condor Hospitality Trust Inc., said in a prepared statement.

Condor will shell out roughly $16.1 million, $21.8 million and another $21.8 million, respectively, for the Fairfield Inn, TownePlace and Residence Inn, relying on cash, new debt and $150,000 of limited partnership units of the company’s operating partnership to finance the purchase. If all goes as planned, the acquisition of the Fairfield Inn and Residence Inn will close in the third quarter of 2017, and the TownePlace transaction will reach completion in early 2018. Condor sees Aimbridge Hospitality staying onboard to spearhead management of the properties.

A veritable shopping spree

Condor has been aggressive in its program of recycling capital from the disposition of legacy properties to fund purchases of new lodging destinations. Over the last seven quarters, the REIT has committed $261 million to the acquisition of 13 premium-branded hotels, including the three Texas assets it just agreed to buy.

“We continue to assemble an extremely high-quality portfolio of select-service assets located in secondary markets that are poised to outperform due to the expectation for RevPAR growth in excess of the national average, as demonstrated by our 7.7 percent RevPAR year-over-year growth in the first quarter of 2017 for our new investment platform hotels,” Blackham said.

There’s much more to come from Condor. As noted in the company’s investor presentation in June, it has a robust acquisition pipeline of more than $400 million in properties that meet its criteria. In addition to utilizing proceeds from hotel sales to finance new purchases, the company can also turn to its senior secured revolving credit facility, which was expanded from $90 million to $150 million in May of this year.

Image courtesy of Condor Hospitality

You must be logged in to post a comment.