Construction Costs Continue to Rise in 2021

Residential building and home improvements have contributed to an unexpected spike in demand.

The dramatic rise in construction costs over the past year would seem to throw the shape of future development into question.

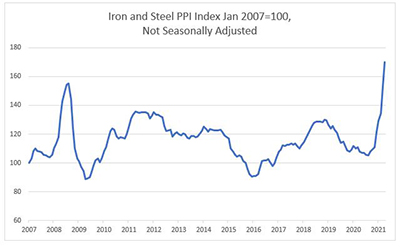

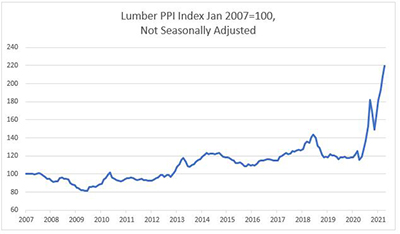

Lumber and steel prices have increased by 90 percent and 58 percent respectively in the past year. While it looks like prices have begun to stabilize, construction costs are still significantly higher than they were a year ago.

Rising materials costs are coincident with a shortage of labor and the rising costs that typically follow such shortages.

But, while the situation might appear dire at first glance, development has not slowed down.

Read Also: How to Unlock Development Value From Institutional Sites

“There have been a lot of deals that just don’t pencil that I think will begin to pencil because there’s an adjustment in the expected return,” said Anna Goodrich, managing director of Development for Continental Realty Advisors.

And the pipeline of future projects is full. “Architectural billings are going up, which is a good sign…that means that projects are being designed and they’re going to go out to bid eventually,” said Robert Mewis, principal engineer for Gordian.

Soaring materials costs are driving up prices

Materials costs have been increasing, in part, due to production delays and logistics issues stemming from the pandemic shutdowns but also due to an unexpected spike in demand. In past recessions, demand for new single-family construction is reduced while the economy recovers.

Things are different this time around with so many people working from home.

“People either got unhappy with their environments and decided they needed a new house, or they started do-it- yourself improvements,” said Goodrich. “Suddenly everybody and their brother decided they needed a new deck or a new kitchen.”

With lumber prices climbing so quickly, developers are looking at alternative construction methods. “A number of people have moved into a structural system of light gauge steel,” said Goodrich, noting that this may be a temporary solution. “What that’s done now is increase the demand for steel, as people move out of wood and into light gauge and creating the next issue, so now we’re going to have expensive wood and expensive steel.”

Lumber and steel tell different stories

The way that lumber and steel are reacting to supply chain disruptions may seem similar at first glance. The recoveries, however, are likely to take a different shape. Both lumber and steel are fungible commodities. But lumber is a natural resource while steel is a manufactured good. Lumber is likely to return to previous prices as production ramps back up. Steel will maintain greater price stickiness as the supply chain has more moving parts.

Over the past 12 months, steel has increased by 58 percent. While that is certainly a dramatic change, it is in line with past recessions. Historically, when this happens there is a correction where the price reverts somewhat but remains above previous levels. The 90 percent spike in lumber prices over the same period is unprecedented. This implies that the increase is more heavily tied to the unique conditions imposed by the Covid-19 pandemic. It is reasonable to conclude that lumber prices are in a bubble that is not likely to last indefinitely.

Ken Simonson, chief economist for Associated General Contractors of America is concerned about the effect rising materials cost is having on his industry.

“The price that a contractor committed to a year ago doesn’t reflect any increase, generally,” he said. “They have to deliver a project at that contract price. But it doesn’t make sense or it’s not even possible to buy all the materials at the time they sign the contract. That design may not have been 100 percent finalized.”

This could potentially spell disaster for a contractor.

“Fortunately, I haven’t heard of a contractor that has actually had to shut their doors,” Simonson said, “but, this is something that has happened in the past when there have been these unanticipated price spikes, and this is the biggest one ever.”

Summertime furthers cost increases

Labor costs have also been increasing but at a slower pace than materials. Mewis believes that labor costs have stayed on trend with the increases of the past few years. He is, however, anticipating a seasonal spike in costs as the summer season begins.

“Everybody wants work done when the weather is good,” he said.

It is reasonable to expect further upward pressure on construction costs over the next few months.

Andrew Kern is senior research analyst and Casey Cobb is research analyst with Yardi Matrix.

You must be logged in to post a comment.