Construction Costs Continue to Rise in 2024

Here’s how much the needle will move this year—and why.

Commercial construction is off to a slow start this year, as developers continue to grapple with myriad factors. A big one is the continuous rise of construction costs, driven mainly by ongoing labor shortages, higher interest rates and supply chain evolution. That, however, is part of the story, but not all of it.

“In today’s market, rising construction costs are causing some developers to pause or even halt projects,” said Nick Zoumas, managing partner with Shoreham Capital, a privately held Florida investment, development and management firm. “Many challenges, including increasing borrowing rates, tighter bank regulations, growing insurance expenses and geopolitical uncertainties are making it difficult to pursue new real estate opportunities.”

Zoumas, whose firm focuses on the East Coast and the Sun Belt, noted that while there may be some relief later this year when it comes to interest rates, these are expected to continue putting pressure on construction costs well into 2025.

Costs concerns outlined

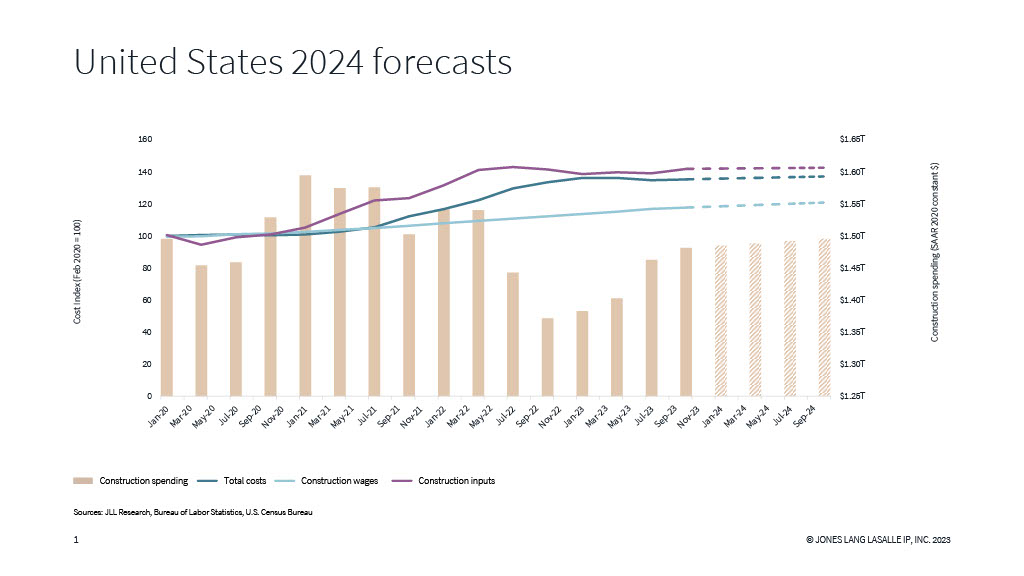

A recent JLL report estimates material costs are expected to increase by 2 to 6 percent this year and employee wages by 3 to 5 percent, with total costs jumping in the 2 to 4 percent range. The report states, “Slowing private sector starts will keep supply chain pressure manageable, but the current pipeline and increase in public-funded construction will prevent price regression.” JLL anticipates some shortages of finished goods to persist, particularly for high-demand electrical components.

Despite the push to do more manufacturing in North America, it will take another 2 to 4 years to accomplish more onshoring of these facilities, reasoned veteran attorney & construction expert Barry LePatner, founder of LePatner & Associates. In the meantime, “We still have the uncertainty of the supply chain,” he said. “There is not an assured supply chain yet like we had before 2020 when the pandemic started.”

LePatner also thinks that supply chain issues, coupled with inflation, create continued volatility in material prices, which he expects to continue through most of 2024.

As of late, there have been concerns around shipping delays caused by aggression in the Red Sea, causing many cargo ships to avoid the area and take a longer route around Africa. Water level issues in the Suez Canal also made headlines. However, LePatner reasoned that those affected European supply chains more than their North American counterparts. Still, global geopolitical issues, trade conflicts, natural disasters and uncertainties stemming from the U.S. elections are pretty significant wild cards.

READ ALSO: 5 Ways to Hold Down Construction Costs

Andrew Volz, research lead of project and development services with JLL, said the increase in data center development in the U.S., combined with an increased push toward more electrification, will continue to increase demand for electrical components.

“These pinch points and price increases are reflecting a lot of this long-term strategic change that we’re seeing within commercial real estate overall,” Volz told Commercial Property Executive.

Why construction costs won’t go down

Zoumas also touched on the impact of rising insurance premiums. “(They) continue to rise nationally due to inflation-driven increases in replacement costs and natural disasters,” he said. “Developers, particularly in high-risk areas, may need to budget for higher insurance costs or explore alternative coverage options.”

Meanwhile, labor costs, driven by an ongoing shortage of skilled construction workers, are expected to persist and construction wages will increase to stay competitive this year, probably in the 3 percent to 5 percent range, according to JLL.

Calling it a significant challenge, LePatner said the construction industry has a shortfall of hundreds of thousands of workers in the U.S., as much as 500,000, according to some estimates.

In a 2024 industry outlook released last month, the Associated General Contractors of America and Sage Construction & Real Estate found 77 percent of construction firms responding to the survey stated they are having a hard time filling some or all salaried or hourly craft positions.

Most firms in the survey said they took steps in 2023 to attract and retain workers, with 63 percent increasing base pay rates more than in 2022. Another 25 percent of firms provided incentives or bonuses and 24 percent increased their portion of benefit contributions and/or improved employee benefits.

“We’re expecting labor costs to increase as folks really continue focusing on retention of quality labor, really focusing on productivity and also investments in tech to boost productivity,” Volz said.

He also added that he expects to see significant investments in technology over the next few years, which should offset some issues. While robots aren’t likely to replace human construction workers—at least not yet—Volz reasoned that there are opportunities in technology such as AI for pre-construction issues like planning and scheduling, as well as safety and training.

Volz also noted there has been increased use of integrated augmented reality and Building Information Modeling (BIM) products “that can really offer a huge upside to the existing labor force.”

Companies responding to the AGC survey stated they were making investments in drones, AI and accounting, document and project management software. Nearly a third said they would be doing more offsite production or planned to in the future.

Construction delays are coming in 2024

While construction costs continue to slowly rise, development is hitting many interwoven roadblocks. The AGC 2024 outlook noted that supply chains, though improving lately, are still far from normal. While construction contractors surveyed generally said demand for many projects types should continue to expand, they continue to face significant challenges, according to prepared remarks by AGC CEO Stephen Sandherr. Reasons for those challenges? More or less the ones already mentioned above.

Nearly two-thirds of respondents in that study said projects have been postponed or cancelled in 2023. About 36 percent of them reported developments were not rescheduled, while 37 percent said they were. Ten percent reported projects scheduled for the first half of this year have already been postponed or cancelled.

Architecture firms were also seeing an impact on their business late last year. The AIA/Deltek Architecture Billings Index remained below 50 for December, indicating soft business conditions at the end of 2023. The ABI survey also noted most firms reported, over the past 6 months, at least some of their projects being significantly delayed, put on hold or cancelled. The report, released in late January, noted that on average, almost 30 percent of projects on a dollar basis had fallen into one of those categories.

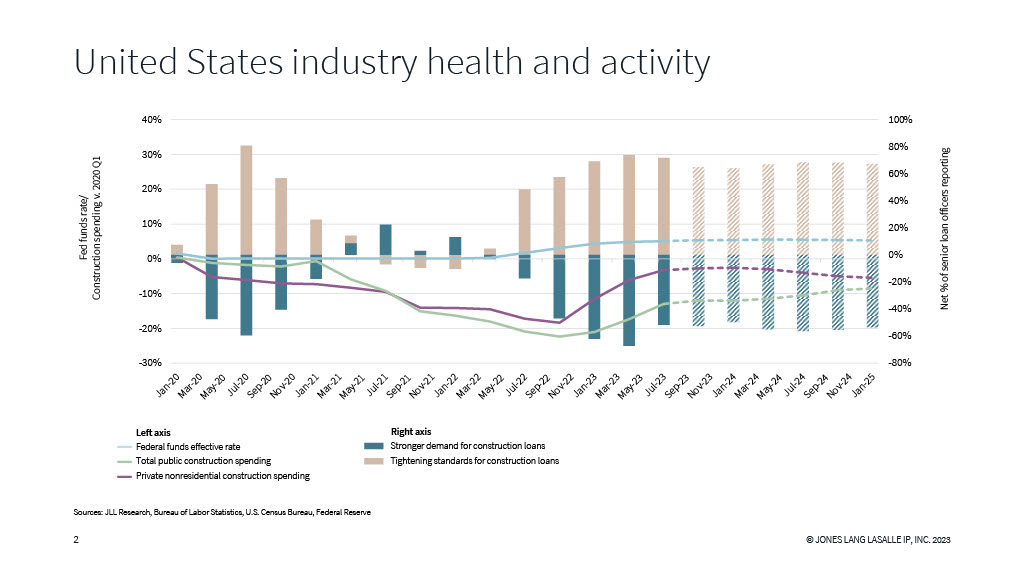

While the Federal Reserve has signaled interest rates may begin dropping later in the year, Volz said his firm has seen construction starts decline a little bit due to the impact of the “higher for longer” interest rate environment. Volz added that it bears watching to see if fewer projects on board will continue to be an issue through the middle of the year.

Sarah Martin, associate director of forecasting for Dodge Construction Network, who also prepares the firm’s Dodge Momentum Index, which measures nonresidential construction planning, reported the DMI rose slightly in January, up 0.1 percent to 184.1 from the revised December reading of 183.9. Over the month, commercial planning fell 1.0 percent and institutional planning rose 2.1 percent. Year-over-year, the DMI was 3 percent lower than in January 2023, with the commercial segment down 12 percent.

“Generally speaking, we view the institutional factor as being a little less sensitive to real time economic fluctuations because of their public funding that allow them to weather the storm better and kind of push those projects into planning,” Martin told CPE.

Martin also noted that while commercial planning pulled back in 2023, it’s still sitting at a historically high level. Data center activity, in terms of the total value of construction starts, rose 140 percent in 2022, another 14 percent in 2023, and is expected to continue expanding in 2024, she added.

Despite less than stellar December and January statistics, Martin and others still reasoned that there are reasons to be optimistic, and that activity will start to pick up sooner rather than later, if only even slightly. LePatner, for example, thinks an increase in the 2 to 4 percent range is possible in 2024.

LePatner added that some of that is likely to come from industrial construction spending because of the large amounts of federal funding included in legislation such as the Infrastructure Investment and Jobs Act and the CHIPS and Science Act, boosting manufacturing and North American onshoring.

You must be logged in to post a comment.