Construction Costs Hit Record High: Report

The jump between February and March was the biggest in 10 years, according to IHS Markit.

Construction and engineering costs in March were the highest they have ever been, following 17 consecutive monthly increases, according to a new report from IHS Markit, now a part of S&P Global and Procurement Executive Group.

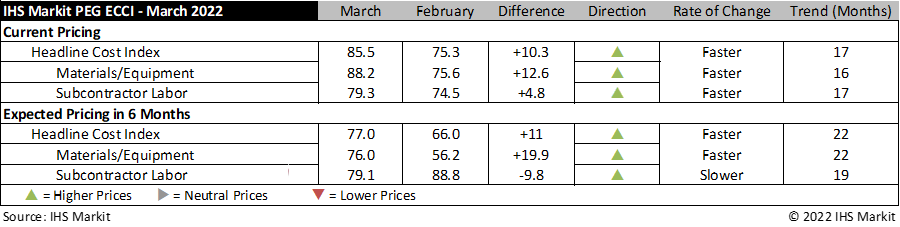

The IHS Markit PEG Engineering and Construction Cost Index increased from 75.3 in February to 85.5 in March, a new peak in the index’s 10-year history. The subcontractor labor index rose 4.8 index points in March to 79.3 from 74.5 in February, and the sub-index for materials and equipment costs climbed 12.6 index points to 88.2.

The ECCI is based on data independently obtained and compiled by IHS Markit from procurement executives representing leading engineering, procurement and construction firms. The index tracks industry specific trends and variations, identifying market turning points for key projects, and is intended to act as a leading indicator for wage and material inflation specific to the construction and engineering industry.

READ ALSO: Office-to-Logistics Conversions Are Challenging. Here’s Why.

Survey responses indicated labor costs increased in all regions of the U.S. and Canada in March. The outlook for the next six months also indicates executives surveyed expect prices to continue rising well into the third quarter as the future construction costs index hit 77 in March, up 11 points from 66 in February.

The six-month expectations index for materials and equipment also saw a double-digit increase during the past month going from 56.2 to 76.0. The only decline in the March survey was the six-month expectations index for sub-contractor labor costs, which dropped 9.8 index points to 79.1.

Material costs jump

Increases in materials also continue to plague the construction industry with many metals prices reaching new price peaks in March. The report found the structural steel index rose from 70.8 in February to 79.2 in March. The structural steel sub-index for carbon steel pipe jumped 20.8 sub-index points to 87.5 in March. Every respondent cited price increases for transformers and electrical equipment, putting the index figure for both categories at 100. The sub-index for copper-based wire and cable prices increased from 79.2 in February to 95.5 in March.

John Mothersole, pricing and purchasing director at S&P Global Market Intelligence, said in a prepared statement the Russian invasion of Ukraine is at least temporarily disrupting trade flows of copper as Russia is a sizable copper producer. He noted Russia represents about 4 percent to 5 percent of the global mine and refined production of copper. Mothersole said copper, which is the most vital input to wire and cable production, hit an all-time high of $10,730 per metric ton earlier this month.

Material costs were also cited as a major cause of overall rising construction costs late last year when JLL released its Construction Outlook H2 2021 report. JLL stated material costs had increased 23.1 percent between August 2020 and August 2021. JLL’s outlook estimated total construction costs, spurred in part by rising materials prices, would increase over the next year between 4 percent and 7 percent. Material costs were not the only source of the rising cost of construction cited by JLL. Labor wages also contributed to the estimate, rising 4.5 percent from August 2020 to August 2021 due to the normalization of unemployment and the scarcity of qualified available labor.

Read the full report by IHS Markit.

You must be logged in to post a comment.