Construction Costs Will Keep Rising. Here’s How Much.

Multiple factors are conspiring to make predictions unusually difficult, says JLL’s latest Construction Outlook.

The U.S. construction industry is firing on all cylinders, buoyed by a post-pandemic revival of demand and a recovering economy.

However, this period of highly vigorous activity has yielded rising construction costs that, according to JLL’s Construction Outlook H2 2021, are just going to continue to rise even higher. Over the next year, the estimated increase in total construction costs is expected to be between 4 percent and 7 percent.

READ ALSO: Why Net Lease Cap Rates Hit New Lows

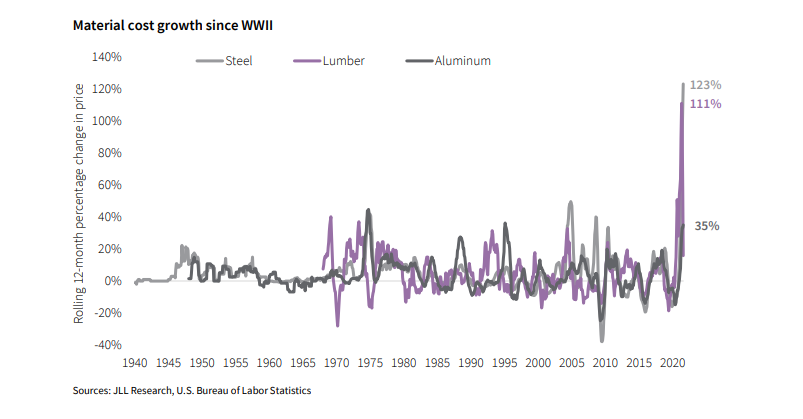

The numbers tell the story. Overall, construction costs for the 12-month period through the end of August 2021 rose by 4.5 percent, with material costs leading the way with a whopping increase of 23.1 percent. As noted in the report, the volatility in construction material prices experienced this year is unprecedented in contemporary history.

“While everyone knows prices have been volatile over the past year, it was remarkable to visualize how severe the price swings have been this year compared to any point over the past 70 years,” Henry D’Esposito, JLL construction research lead, told Commercial Property Executive.

“Not only has it been a record-breaking year for just one commodity but commodity prices are increasing across the board.” The increases in the prices of lumber and steel, for example, are the largest seen since the government began recording the data in 1949. The percentage of the increase in the cost of plastic hasn’t occurred since 1976.

Material costs were not the only source of the rising cost of construction; labor wages also made a contribution, going on the upswing by 4.5 percent from August 2020 to August 2021 due to the normalization of unemployment and the scarcity of qualified available labor.

No discounts in the cards

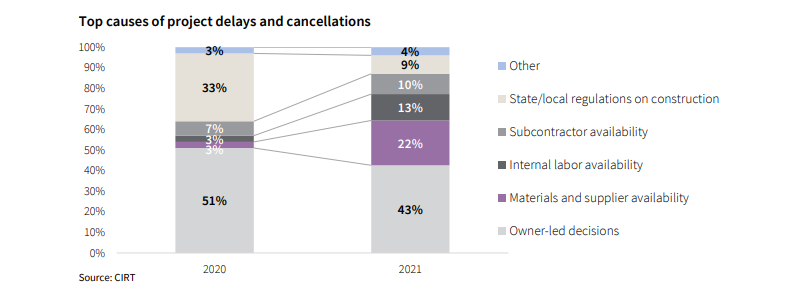

JLL predicts that the next 12 months will offer more of the same, given that the same dynamic is in place: supply chain challenges coupled with domestic labor shortages and potential new waves of COVID-19 infections globally. According to the report, material costs are expected to rise by 5 percent to 11 percent and labor costs could grow by 3 percent to 6 percent over the next 12 months.

But there’s always the potential for an unlikely outcome. “The best-case scenario for construction would be continued demand for new projects combined with stabilization in material costs. If global supply chains can return to a healthier balance by early 2022, it would bring considerable relief to pricing uncertainty and lead times for construction,” D’Esposito said.

“On the other hand, worst-case scenarios hinge on the potential for additional waves of the pandemic. Barring another round of shutdowns in the U.S., which seems unlikely at this point, the worst case would be global disruption leading to more volatility in construction material prices.”

The dreaded I-word

Experts may have predicted the emergence of the current conditions, but not to this extent.

“The construction industry has been in a 12-month period of hyper-construction inflation,” Steve Stouthamer, an executive vice president with Skanska USA Building, told CPE. “Where similar periods have lasted 4 to 8 months, we are already at 12 months and still face challenging months ahead. There’s a perfect storm of events that has conspired to make this period of inflation unique.”

Stouthamer points to the amassed impact of the pandemic along with aggressive growth in distribution, pharmaceuticals, semiconductors/chips and data centers, as well as major weather events and the immense strain on logistics.

While industries like distribution, pharmaceuticals and data centers have proven less vulnerable to cost inflation, others are buckling under the surge. “Sectors such as commercial office development, education and residential cannot sustain these large price increases, so these sectors may need to reevaluate timelines or scope,” Stouthamer said.

On the bright side, while Skanska is adjusting escalation forecasts early during this inflationary period to help its clients from myriad businesses assess the direction of their projects, to date, the company has not seen a trend of projects being suspended or canceled due to cost-escalation impacts.

“History shows that steep periods of construction inflation are followed by similar periods of recessed construction costs, which is attributed to the reality that higher pricing can slow or stall projects, reduce demand and increase supply,” Stouthamer concluded.

Read the full report by JLL.

You must be logged in to post a comment.