Construction Industry Backlog Up

The amount of construction work under contract but not yet completed rose to nine months, according to the Associated Builders and Contractors latest Construction Backlog Indicator, implying expanding demand for construction services, or a shortage of construction labor in a few markets.

By Dees Stribling, Contributing Editor

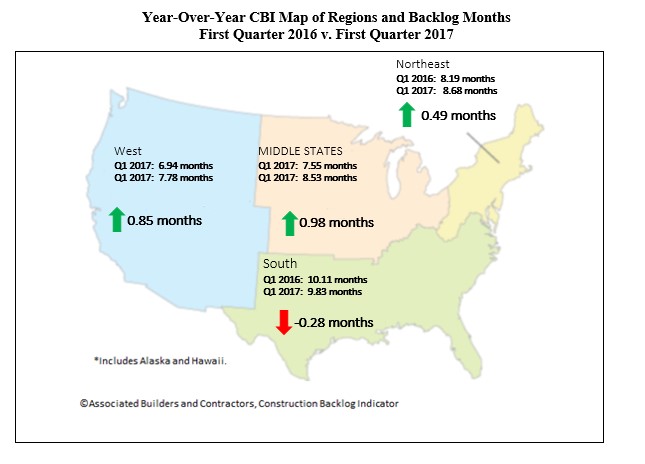

The Associated Builders and Contractors’ Construction Backlog Indicator (CBI) rose to nine months during the first quarter of 2017, up 8.1 percent from the fourth quarter of 2016, the organization recently reported. The indicator is up by 0.4 months, or 4 percent, on a year-over-year basis.

The CBI is a leading economic indicator that reflects the amount of construction work nationwide under contract, but not yet completed. It is measured in months, with a lengthening backlog implying expanding demand for construction services or, in a few markets, a shortage of construction labor.

Surging financial markets helped support construction activity in financial centers like New York, Philadelphia and Boston. Expanding cyber-security and life sciences activity supported markets as geographically diverse as Washington/Baltimore; Austin; Silicon Valley; and Seattle, according to the report. Chicago continues to be a weak spot, registering slow job growth relative to other major U.S. metro areas in recent quarters.

Backlog in the commercial/institutional segment rose by more than 11 percent during the first quarter, and now stands at nearly nine months. Backlog also expanded in the heavy industrial and infrastructure categories during the first three months of the year.

You must be logged in to post a comment.