How the Cost of Building Is Shaping Up for 2024

More price hikes are ahead but so is greater stability, according to JLL.

Calling 2023 a “year of stabilization for the construction industry,” JLL’s 2024 forecast states a strong project pipeline will keep the industry busy in the U.S. during the coming year, despite higher interest rates and slower private starts.

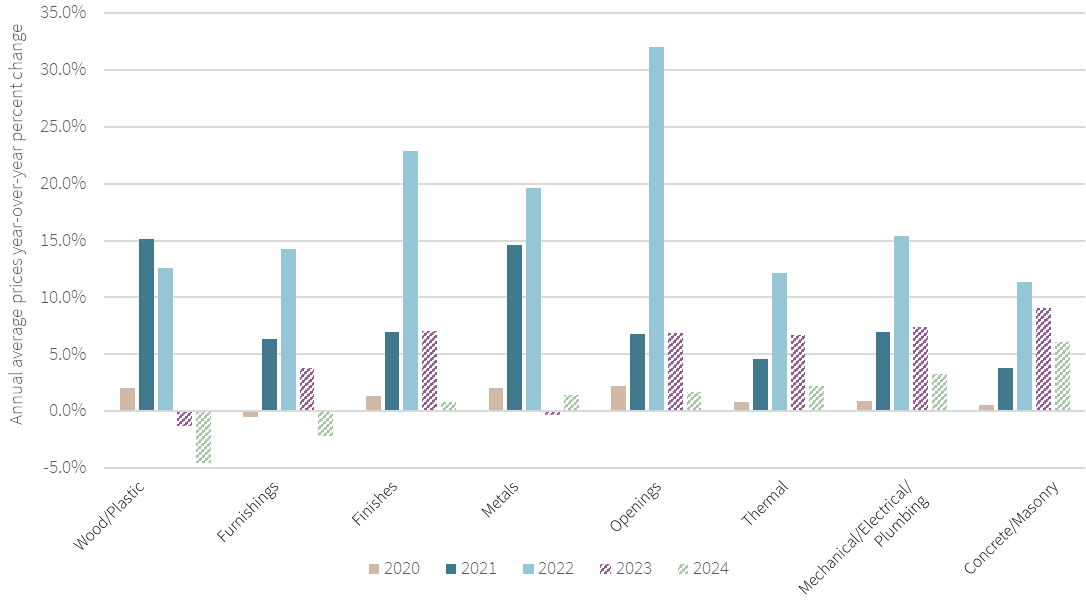

JLL’s forecast for U.S and Canada construction trends notes costs, supply chains and sector-specific needs in the built environment became easier to deal with in 2023, compared to post-pandemic supply chain issues and shortages the previous year. JLL expects total construction costs will see a modest growth—between 2 percent and 4 percent—throughout 2024. There will be shorter lead times and more stable prices for materials, with electrical components being a notable exception. Overall, JLL projects material costs to rise between 2 percent and 6 percent.

Annual average prices for construction materials, year-over-year change. Chart courtesy of JLL Research, Bureau of Labor Statistics

Labor shortages are expected to persist, and construction wages will increase to stay competitive, probably in the 3 percent to 5 percent range. Unfortunately, the report notes that limited labor availability is expected to be an ongoing problem. JLL states the construction labor force is already inadequate and pace of growth will be slow throughout 2024.

READ ALSO: Emerging Trends for CRE in 2024 and Beyond

“Falling productivity levels and shortage will force contractors to prioritize retention and the industry to accelerate investments in tech as well as alternative production strategies,” the report notes.

JLL stated while some AI and robotics may help alleviate some labor constraints, current technologies can’t solve the worker replacement problem that is expected to continue for the foreseeable future.

‘Higher for longer’ impacts

Although the higher interest rates and declining private starts have not slowed construction spending significantly, the JLL report states there may be effects in the second half of 2024 from the so-called “higher for longer” interest rate environment as projects in the current pipeline deliver. JLL cited declining architectural billings, which dropped the most in September since December 2020, as an impact later in the year. However, the JLL report states additional public spending on infrastructure and manufacturing construction is expected to minimize the total spending slowdown.

The increase in public-funded construction should also prevent price regression on materials, according to JLL. Construction of tech-heavy spaces will also keep demand above production capacity, which is expected to impact the high-demand electrical products the most. While supply chains are manageable for now, JLL points out there are numerous potential threats that could create volatility in the supply chain again and push prices up, such as increasingly frequent natural disasters, trade conflicts and geopolitical tensions, which could be heightened during the 2024 election year.

Strategies for success

The construction trends outlook states the global pandemic revealed there are inadequacies in the built environment that can be structural and complex to solve, so JLL offers three core strategies for success for the year ahead for those in the construction industry.

- Know your people: JLL states it’s important to build durable partnerships with those with technical ability and skills to innovate and problem-solve in uncertain times. The report describes retention, upskilling and trust building as critical skills.

- Know your projects: Every project is different and it’s important to anticipate hurdles and know what tools, such as artificial intelligence and building information modeling, should be proactively deployed.

- Know your markets: Understanding market dynamics is more important than ever. Those who will be successful will know how to anticipate macro and micro impacts on people and projects, such as changes in environmental regulations, material costs and shifting preferences.

You must be logged in to post a comment.