Construction Spending to Decline in 2021: AIA

Health care and public safety projects may be exceptions, the American Institute of Architects predicts.

Image by hunt-er via Pixabay.com

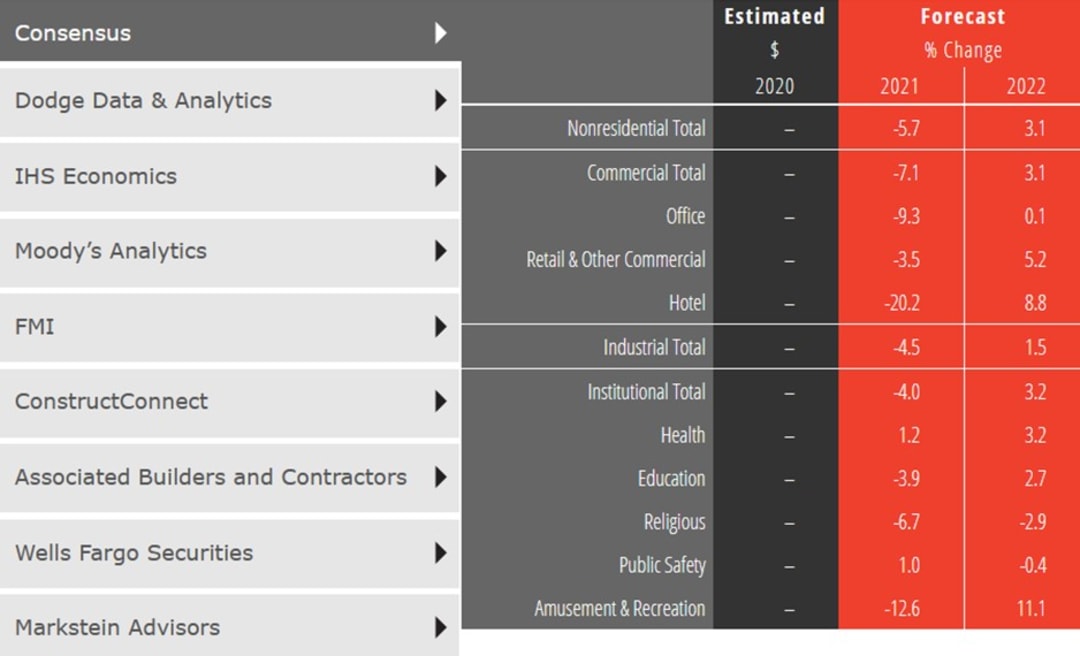

Nonresidential construction is expected to decline by 5.7 percent this year, according to a consensus forecast from the American Institute of Architects.

Sectors like hotels, office and amusement and recreation are being hit the hardest as the U.S. tries to slowly recover from the COVID-19 pandemic. Health care and public safety are the only two major sectors in the AIA Consensus Construction Forecast projected to see slight increases—up 1.2 percent and 1.0 percent, respectively—in construction spending in 2021.

The good news from the AIA Consensus Construction Forecast Panel, comprising leading economic forecasters, is that overall nonresidential construction spending is projected to rise by 3.1 percent in 2022. AIA Chief Economist Kermit Baker said in prepared remarks there will likely be considerable pent-up demand for nonresidential space that will lead to the anticipated 2022 growth.

Baker’s report stated 2020 is expected to end on a better note than predicted in the July Consensus Construction Forecast. He said the panel then projected a high single-digit decline in spending on nonresidential building but the construction industry rebounded in the second half of the year and 2020 figures are expected to likely show only a 2 percent to 3 percent overall decline.

AIA Consensus Construction Forecast. Chart courtesy of The American Institute of Architects

Baker cited two areas of concern for the construction industry. One is the December jobs report showing a loss of jobs instead of the 50,000 that were expected to be added. While the unemployment rate remained at 6.7 percent, it was a sign that the economy is still struggling from the effects of the pandemic. The second indicator is business conditions at architecture firms.

The AIA’s Architecture Billings Index, which measures revenue trends at U.S. architecture firms, recorded a decline starting in March and has continued to see monthly declines. AIA research shows ABI leads nonresidential construction spending by an average 9 to 12 months, leading to the projection for declines in 2021.

By the numbers

The AIA forecast for 2021 states there will be a 5.7 percent decrease in total nonresidential construction spending and a 7.1 percent decline in overall commercial construction spending. The hardest hit sectors will be hotels, with a 20.2 percent projected decline, followed by a 12.6 percent decrease in amusement and recreation, and a 9.3 percent decrease for office construction spending.

Retail and other commercial sectors are projected to decline by 3.5 percent. The total industrial construction spending for 2021 is expected to see a 4.5 percent decrease. Among the institutional sectors, construction spending is projected to decrease 4.0 percent overall, with religious projects seeing a 6.7 percent decrease and education a 3.9 percent reduction.

Looking ahead to 2022, the religious and public safety sectors are the only ones projected to see declines—an estimated 2.9 percent decline for religious and 0.4 percent decrease in construction spending for public safety. In 2022, the overall commercial total spending is projected to increase by 3.1 percent. The amusement and recreation sector is expected to see the biggest gains in 2022—with an 11.1 percent projected boost in construction spending—followed by the hotel sector, with an expected increase of 8.8 percent.

Retail and other commercial entities could see a 5.2 percent increase in construction spending, while total industrial is projected to increase by 1.5 percent. Health care and education are expected to see construction spending increases of 3.2 percent and 2.7 percent, respectively. The office sector is projected to have a slight increase of 0.1 percent in construction spending.

More positive takeaways

Baker points to several potential silver linings. The first is the healthy residential construction market, which saw homebuilding and home improvement activity in 2020 climb above 2019 levels. They are both projected to have healthy growth in 2021, and Baker writes that should help cushion the projected building downturn.

He also notes the retrofit market is expected to be strong in 2021, as many existing commercial and institutional facilities need significant medications for post-COVID-19 returns to commercial buildings, schools and other institutions. Much of that activity is excluded from the projected construction spending figures from the AIA forecast panel. There is also expected to be pent-up demand for travel that could translate into increased activity for leisure and hospitality properties.

Read the full report by The American Institute of Architects.

You must be logged in to post a comment.