Sharp Decline for Construction Starts

A sudden drop in manufacturing projects led to a major decline for the nonresidential sector.

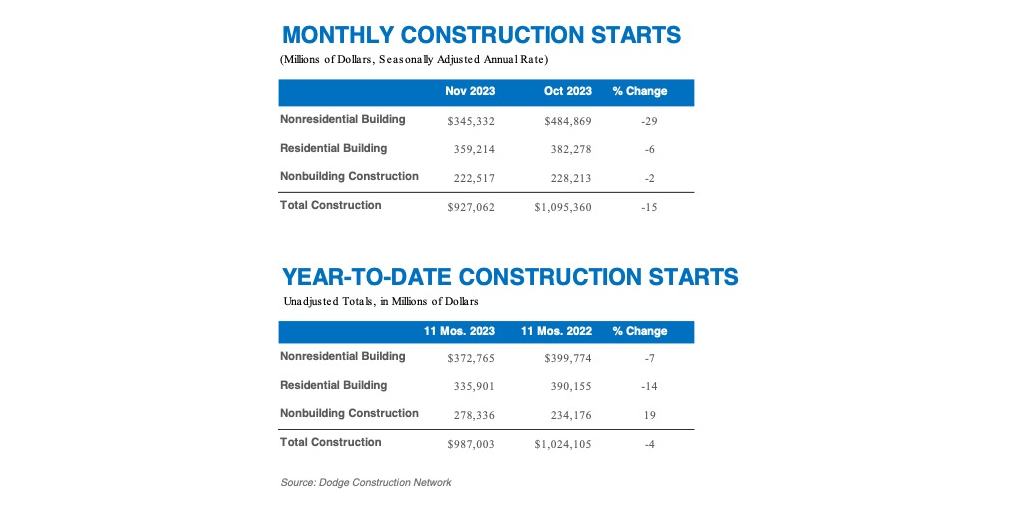

Construction starts have dropped 15 percent in November to a seasonally adjusted annual rate of $927 billion, according to the latest report from Dodge Construction Network.

The nonresidential, residential and nonbuilding sectors all saw a dip in construction starts, but the nonresidential side saw the largest impact with a 29 percent plummet. Compared to the October report, construction starts lost a lot more momentum in November.

Construction starts in the U.S. continued to drop in November. Table courtesy of Dodge Construction Network

When looking at the year-to-date numbers, total construction starts were down 4 percent compared to the same time period last year. More specifically, residential starts saw a 14 percent decrease and nonresidential saw a 7 percent decline, while nonbuilding starts saw a 19 percent increase in year-to-date statistics.

READ ALSO: Revitalizing Vacant Offices Through Housing Conversions

Looking at the 29 percent drop for nonresidential building starts, the Dodge report shows that manufacturing starts fell a staggering 74 percent after a strong October. The report also found a 19 percent decline with commercial project starts, with only office buildings seeing a slight uptick. Despite the overall downward momentum, institutional construction starts rose 7 percent due to an active health-care sector.

According to the Dodge report, the largest nonresidential projects to break ground in November include the $1.9 billion Children’s Hospital of Philadelphia Inpatient Tower in Pennsylvania and the $1.6 billion LG Energy Battery Plant in Queen Creek, Ariz.

Weak momentum until mid-2024

While not as severe of a decline as the nonresidential sector, construction starts with both nonbuilding and residential projects also saw a slight downward trend. Nonbuilding construction starts fell 2 percent in November to a seasonally adjusted rate of $223 billion, with the largest project to break ground last month being the $834 million I-405 Brickyard to SR 527 improvements in Bothell, Wash. Residential construction starts dropped 6 percent to a seasonally adjusted rate of $359 billion in November. The largest multifamily project to start construction was the $200 million 55 Broad St. conversion in New York City.

According to Richard Branch, chief economist for the Dodge Construction Network, construction starts are feeling the impact of higher interest rates from the Federal Reserve. Branch added in his prepared statement that construction starts will remain weak until the midpoint of 2024, following an expected rate cut from the Federal Reserve at the beginning of next year.

You must be logged in to post a comment.