Construction Starts Decline in July, Dodge Finds

Dodge Data & Analytics found gains in the nonresidential and residential sectors mirror a general improvement in the economy.

Construction starts for public works projects plummeted 31 percent from June to July, according to a new report from Dodge Data & Analytics.

READ ALSO: CRE Development Is Hampered by COVID-19 Protocols

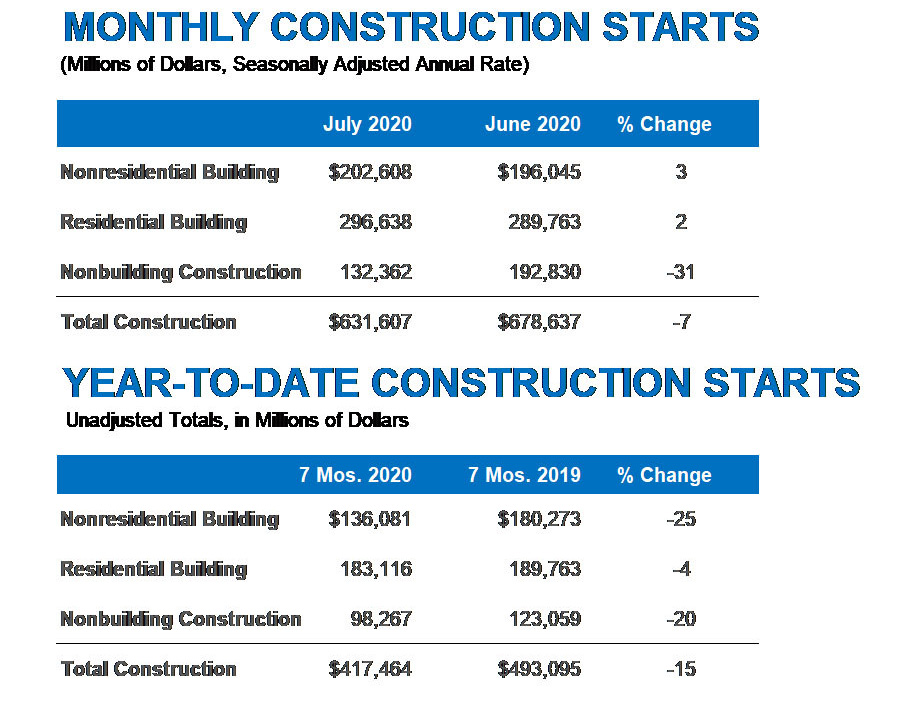

Dodge’s study found that the total number of construction starts decreased 7 percent to a seasonally adjusted annual rate of $631.6 billion in July, compared to the previous month’s $678.6 billion. The drop in the overall count was mostly attributed to the steep decline of 31 percent in nonbuilding construction starts. More specifically, utilities and gas plants saw a 58 percent decrease, public works and the miscellaneous sector fell 27 percent, and the starts for highways and bridges also dropped 25 percent.

On the other hand, nonresidential building starts increased 3 percent to a seasonally adjusted annual rate of $202.6 billion, while residential building starts also saw a slight uptick of 2 percent to $296.6 billion.

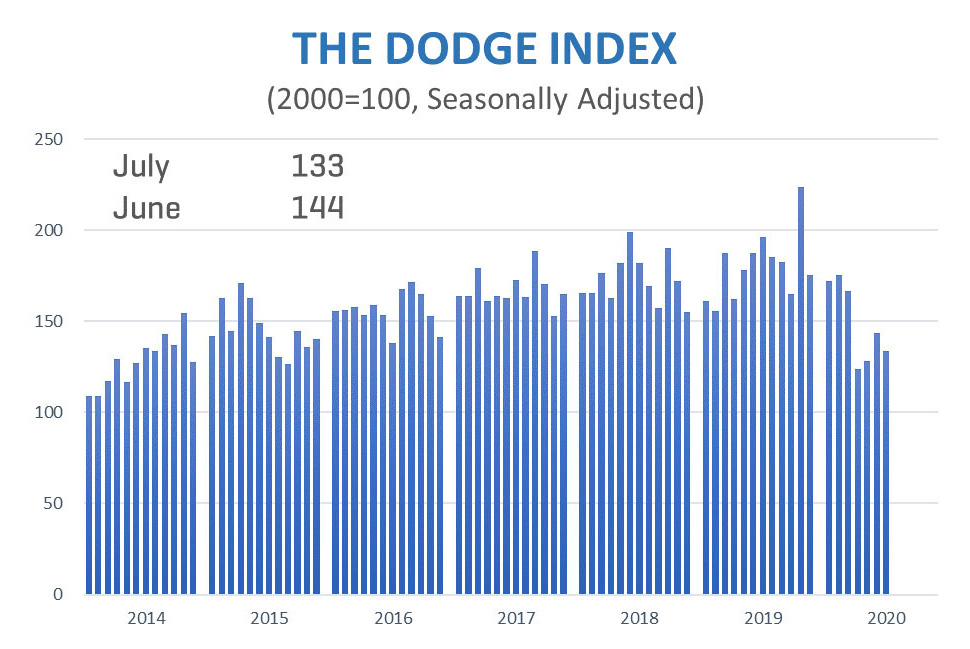

Richard Branch, chief economist for Dodge Data & Analytics, said in prepared remarks that the July decline in construction starts does not directly mean the construction sector is losing momentum on its road to recovery. He added in his statement that the minor gains in the nonresidential and residential construction starts were a more accurate representation of the overall economy’s improvement. The big drop in public works was likely due to a strong spring season where some projects broke ground earlier than expected to take advantage of less traffic on the road due to the COVID-19 shutdown. A recent poll by Building Technologies, on behalf of the American Bankers Association, also showed that the construction sector still had a healthy outlook from its lenders despite the pandemic.

When looking at year-to-date numbers, total construction starts declined 15 percent from $493. One billion in 2019 to $417.5 billion this year. However, the main contributor to the decline went to nonresidential building starts, which saw a 25 percent drop from $180 billion to $136.1 billion during the same time frame last year. Nonbuilding construction starts also performed poorly in the year-to-date statistics, seeing a 20 percent drop, while residential building starts only experienced a four percent decline.

COVID-19 impact on construction

Branch said in prepared remarks that the dip from June to July doesn’t warrant a trend, but the implications of the COVID-19 pandemic could likely affect the rest of the year. Branch also told Commercial Property Executive that the congressional impasse on the extension of enhanced unemployment insurance benefits and small business loans could directly affect the construction industry.

“Consumer spending is the lifeblood of the economy, accounting for roughly two-thirds of all economic output,” Branch told CPE. “The impasse over extending the enhanced unemployment insurance benefits could severely limit the consumer’s ability to meaningfully contribute to the nascent economic recovery.”

Without consumers contributing to the economy, Branch told CPE that this would impact residential, retail and warehouse construction. Additionally, he added that the small business loans significantly benefited the construction sector, which received $65 billion in loan approvals. Without the program, contractors and construction product manufacturers could face bankruptcy, he added.

With COVID-19 spreading in the Southern U.S., Branch also told CPE that the South Central and South Atlantic regions account for more than 40 percent of the country’s construction starts and a slowdown in their construction activity would be reflected in the national statistics.

Read the full report on Dodge Data & Analytics’ website.

You must be logged in to post a comment.