Corporate America’s Solar Leaders

Which commercial real estate owners made the list of the top 10 business customers?

By Anca Gagiuc

Target took first place among corporate users of solar power. (Photo of Staten Island, N.Y., store courtesy of Target)

Solar power is riding a wave of popularity among corporate customers, with the top users adding 325 megawatts of installed capacity last year, according to an assessment by the Solar Energy Industry Association (SEIA), a national trade group. While trailing the record installation of 410 megawatts set in 2012, the tally represents a 2 percent year-over-year increase and a 43 percent jump since 2015, and marks the third-largest year on record.

SEIA’s Solar Means Business 2017 report tracks 2,562 megawatts of commercial projects at nearly 7,400 project sites and represents more than 4,000 companies. The impact translates to a significant increase in the renewable component of the companies’ power supply, enough to supply 402,000 U.S. households and offset 2.4 million metric tons of carbon dioxide annually.

Solar panel prices have been on a rapid downward trend, while the overall cost of systems is also decreasing, mostly thanks to more efficient panels and lower costs for the rest of the systems. In addition, easy-to-install pre-engineered systems help cut prices by bringing down installation costs.

Despite falling prices, SEIA projects that the pace of growth will likely start to soften this year, for several reasons:

- Incentive regime changes in Massachusetts and California shifts to less favorable time-of-use (TOU) rates for commercial solar customers

- Tariffs on imported solar modules and cells

- Decline in the Investment Tax Credit from 30 percent this year to 10 percent in 2022.

However, the industry also has a stream of opportunities, including the decline in costs for non-module hardware, increased electrifications (EVs) and the Internet of Things. Moreover, a growing number of corporate customers are pledging a transition to 100 percent renewable energy.

“To leading companies across America, deploying solar is a common-sense business decision,” said SEIA president & CEO Abigail Ross Hopper, of the Solar Energy Industries Association (SEIA). “Large corporations have found that going solar not only benefits the environment, but also their bottom-line, satisfying both shareholders and customers alike.”

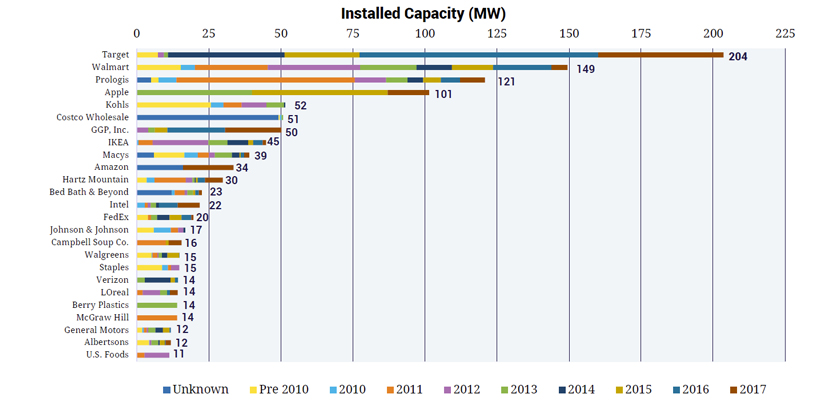

Solar Power’s Top 10 Corporate Customers

(SEIA’s ranking by installed capacity)

10. Amazon.com makes its first appearance in the top 10 with 33.6 megawatts distributed among 14 installations. Meanwhile, the company is also investing in wind power—last fall it began operations at its largest wind facility, Amazon Wind Farm Texas, a 253-megawatt project with more than 100 turbines, which will generate more than 1 million megawatt-hours of energy

9. Macy’s has boosted its solar installed capacity to 38.9 megawatts in 33 installations.

8. IKEA has a solar presence atop nearly 90 percent of its U.S. locations, with a total generation capacity of 44.9 megawatts in 71 installations. Among its solar projects is the 244,000-square-foot rooftop installation in Renton, Wash., a 1.1 MW system with 3,268 panels anticipated to generate about 1.26 million kilowatt-hours of electricity per year.

7. GGP Inc. has 50.2MW of solar power in 44 installations. Since 2011, the retail real estate company has reduced their grid-purchased electricity consumption by more than 277.2 million kilowatt-hours, enough to power all the homes in Napa, Calif., for one year. In addition, it’s been awarded GRESB’s Green Star for four consecutive years.

6. Costco’s portfolio comprises 50.8 megawatts in 158 installations.

5. Kohl’s department stores feature 51.5 megawatts in 85 installations. The company utilizes more than 200,000 rooftop solar panels, which provide energy to 163 of its facilities, up to 50 percent of a store’s needs. Moreover, 88 percent of the chain’s stores are ENERGY STAR-certified.

4. Apple generates 101.4 megawatts in only 5 installations, enough to power their worldwide operations entirely with renewable energy. Furthermore, the company persuaded 23 of its suppliers to commit to powering all their Apple operations with 100 percent renewable energy. Apple’s goal: bringing 4 gigawatts of new clean energy online in their supply chain by 2020.

3. Prologis counts 120.7 megawatts in 52 installations and plans to have 200 megawatts installed by 2020. Since 2011, the company has registered a 27 percent decrease in corporate greenhouse gas emissions.

2. Walmart has 149.4 megawatts in 371 installations, which provide energy for about 28 percent of the company’s portfolio. This means Walmart’s chances of reaching its goal of using 50 percent renewable sources by 2025. In addition, the retailer launched Project Gigaton last year, named for its goal of reducing emissions from the collective value chain by one gigaton by 2030. So far, more than 400 suppliers have signed on and more than 200 of these suppliers reported emission reductions of more than 20 million metric tons.

1. Target takes the top spot by a wide margin with 203.5 megawatts in 425 installations. In 2017, the company added upward of 40 megawatts, a total higher than that of more than 20 states as well as any other US retailer. By 2020, Target aims to grow the number of buildings with rooftop solar panels to 500, at the moment they are at 446. Currently, their solar power-equipped stores generate between 15 and 30 percent of the electricity they need to function. Also by 2020, the company plans to divert 70 percent of its retail waste from landfills through reuse or recycling programs.

Off-site procurement has been a major driver of corporate solar installations in recent years, such as GTM Research—which counts 31 operating off-site corporate projects, plus another 21 in development. The commercial market growth in the past two years is owed to three factors:

- declining prices

- demand from potential International Trade Center expiration and expiring incentives in key state markets

- growth of financing opportunities—PPAs, Contracts for Difference, off-site arrangements, Commercial PACE.

Images courtesy of SEIA

You must be logged in to post a comment.